1. Introduction

Contemporary trends in the field of banking lead to the fact that traditionally banking everything more lose on importance, and they appear every day new risks business [

1], in particular when we're talking about goals national strategy in the area of sustainable ICT through development development of e- commerce, e- education, e- health, e- banking, e- payment et. [

2]. It is an irrefutable assumption that through the banking sector circulates money each economy, from surplus to deficit sector. Accordingly, the bank like mediator it should have more significant role in implementation policies sustainable development, by implementing the " green " component in everything own business activities [

3,

4]. To encourage himself further development of a green financial system, i supported green banking adoption is necessary, first regulatory measure and appropriate legal regulations [

5,

6]. Banks are own business spread beyond the borders own countries so what are opened own representative office that is branches throughout of the world [

7,

8,

9] On the other hand sides, globalization occurs _ economic flows and permanent innovation in the field financial service. Everything this together imposes the need of management processes and phenomena in banks, which is unthinkable without analysis performance business banking. However, despite innovations, in the area financial service, credit the risk is still there the most significant individual the cause bankruptcy banks [

10]. The previous one research are showed that success banking of the sector is conditional movements macroeconomic indicators and consequently, numerous research like: [

11,

12,

13,

14,

15] proved are that there is influence macroeconomic indicators economic development on performance banking sector. In literature, the most significant indicators can be distinguished: a) gross domestic product (GDP), b) inflation, that is index consumer price (CPI) and c) unemployment. Not enough fast recovery economy [

16], partially successful privatization of the state companies, world economic crisis and global political instability, only are some of factors that are threatened to endanger stability domestic banking sector [

17]. On everything counted, should add and everything more often mentioned concept sustainable development in banking [

18], since they problems with local and regional transfer on global level [

19,

20], so " green " is imposed banking ” as term states as a good solution to achieve systemic and financial stability [

21,

22]. In the moment of writing work, she hit the world and global pandemic of the Covid-19 virus, which is additionally caused global market instability [

23]. As a result, package economic measure which are brought by the Government of the analysed countries, banks were forced to approve _ moratorium on loans, but it was expected that they would be enough liquid to last more months without previous one’s inflows, despite liquid balances, until then. That conditioned politics price increases money [

24,

25], and it has already resulted in increasing interest rate and additionally, the needs for adequate management by credit risk [

26]. One of the potential ones threats to liquidity, security of business and profitability banks right they are problematic loans (abbr.

NPL) that all more often in scientific and expert literature occupy attention academic public, but and banking managers [

27].

This paper consists of 5 parts. After introductory considerations on to the beginning work, it is given methodologically frame, and then developed Merton's model in the third part of work, after which one they follow the results research, with discussion. In the end are concluding considerations and entire recapitulation of work, with the most significant highlights.

2. Methodological frame she likes

It starts in the work of general goals banking mirroring systems _ in creation opportunities for existence and maintenance healthy, stable and sustainable financial system, based on safe and a good one business each bank and reaching appropriate level protection user financial service. Scientific goal research is to show whether and to what extent the condition macroeconomic components affects on performance banking systems in countries Western Balkans whose are features increase competition, diversification, liberalization movements capital and everything more turning to " green " lending [

28]. Consequently, social goal work is to prove it efficiency applications done model which claims that movement _ problematic credit is possible predict on basis movements combinations certain indicators. The subject of work represents analysis macroeconomic environments in countries Western Balkans works tests influence selected indicators on performance banking system, with special in retrospect on social and component protection life environment. The most significant indicator being used indicator problematic credit. Especially we point out research important, accordingly to developing countries, which _ they are stepping towards the developed countries of Europe, ecological consciousness it is not neither existed, or devoted herself to her very little attention and in education and in education [

29].

According to the data World banks, under states Western Balkans defined are next countries [

30]: Albania, Bosnia and Herzegovina, Republic of Kosovo, Montenegro, Republic of North Macedonia, Republic of Serbia. However, how are by the Constitution of the Republic Serbia, Kosovo and Metohija defined like Autonomous province of the Republic of Serbia, related data to Kosovo, as independent the state, they are not taken into consideration in this work [

31]. Temporal aspect research indicators in operation will cover the period from the last one quarter of 2010, inclusive of the last one quarter of 2019.

Accordingly, to the above, on topic influencing indicators _ on performance banking system, its development, but and predictions future one’s movements problematic credit, can be set more hypothesis. Below _ being singled out a few most important:

H0: Banks have a significant role in implementation policies sustainable of development, by implementing the " green " component in their own business activities.

H1: In countries with better macroeconomic indicators, banks have opportunities to achieve better performance.

H2: It is possible to manage risks in banking by creating predictive of the model which as basis they have combination macroeconomic indicators and indicators performance banking system.

H3: External factors, especially rate unemployment, have influence on movement of NPLs.

After descriptive analysis mentioned weather series, will be developed models that own application I can find in prediction rate movements of problematic credit on basis indicators for which will be in operation show that they have the biggest influence on movement mentioned rates. Second, for government representatives, it is of great importance that macroeconomic data they say that they are real way, to the public had will to them in the next period support. Considering _ to the fact that it is holy during 2020 _ guessed pandemic virus

Covid-19, like and that the consequences for the economy whole of the world expect in the next one period, hereby by work we believe that it will be given basis for further research wider academic community, especially what are so far research published in domestic and international observed literature to the greatest extent countries ZB individually, while in this work will be done on comparison received of results. Finally, the significance will be highlighted introduction new ones method and technology, which have as a goal creation specific banking products and services, taking into account protection life environment, energy efficiency, recycling, conservation biodiversity etc [

32]. Significant ones will be explored risks protection life environment on occasion lending clients, given that the risk protection life of the environment that binds to the client banks, can to become direct generator of financial risk for that bank [

33].

We emphasize that it is empirical analysis research it started with a review available data for selected countries: Albania, Bosnia and Herzegovina, Montenegro, Republic Serbia, and Republic Northern Macedonia. By searching of the government sites, sites central banks, statistical agency, and similar relevant institution, with review domestic and foreign literature, a database was created macroeconomic data.

3. Materials and Methods

In the end determination of the final model and indicators that will on the most accurate way to describe target variable, statistical ones will be used methods analysis data and methods financial mathematics. Available data being analyzed on basis temporal components and theirs will be questioned applicability on solving initial problems. Also, in accordance with goal this one research, will be used methods development predictive statistical model (Merton’s model) i tests their predictability. Among the most significant statistical methods which will be used in the framework of work are linear regression, residuals, coefficient determination of R 2 (R-squared) i corrected coefficient determination of AJD R 2 (adjusted R-squared), as and correlation in between variable through matrices. In processing will be used contemporary informatics means of processing texts and data (tables, graphs, images, histograms, etc.) in the program package Microsoft Excel, and development model will be done in statistical to the tool R. _ Authors are approached and international base data CEIC data, as and data Moody's rating agencies, by implication, on academic and professional literature.

All data are observed on quarterly level, and download are from bases data CEIC data for the following macroeconomic indicators: growth nominal GDP; growth real GDP; investments (in % of GDP); industrial production; index consumer price _ index manufacturer's price _ total export; total import; rate of unemployment. In addition to the above, collected are data significant for banking sector: radio problematic credit; yearly change growth total deposit; yearly change growth total credit; radio adequacy capital; radio liquidity and indicators ROA and ROE profitability. Works transparency of work, data are shown like attachment of work. The aim of the work is to check truthfulness _ received predictive data for the movement of NPL, to follow development Merton's model. For starters, below will be shown observed macroeconomic and banking parameters for each country, which will later enter the model.

3.1. Model development

The Asymptotic Single Risk Factor (ASRF) approach has resulted from adaptations Merton's model that was first created in 1974 [

34]. In this one access, loans are modeled on standard way depending _ of probabilities problematic loans (usually companies). Status of NPLs (defaults obligation) of the loan occurs if marketable value property firms it falls below amount loan. Therefore, the default distribution owes to Bernoulli distribution.

Assume it is normalized vomiting funds

debtors and at that moment the credit portfolio, determined by the systematic risk parameter

and non-systematic noise

, on basis will follow formulas:

where

and

and May distribution N(0,1) i

there is standardized Gaussian distribution. Component

represents specific factor risks characteristic of the debtor i and, while

systemic parameter risks for everyone debtors in the portfolio, and in this one the case represents condition macroeconomics. Parameter

and represents standard rate correlations in between capital debtor and system (global) parameter risk, so that the correlation

and interprets and like sensitivity on systematically risk. Therefore, if with

mark the minimum threshold for the debtor, due to which a certain event is activated (eg NPL), we can present the “current probability of NPL" (PIT PD) of the debtor debtor and, on next way:

According to (Carlehed & Petrov, 2012), medium value probabilities of NPL (TTC PD) of the debtor and, marked with

and it is medium value NPL probabilities for all available periods. We can do that display the next one by the formula:

Assuming that the portfolio is homogeneous and that there are no changes portfolio during times,

and

are identical for all periods and being marked with B and R, doc is PiT PD

and TTC PD

of portfolio P stated next formulas:

Eliminating component B from both mentioned above of equations, can be expressed systematically factor risks on basis historical value of NPL for the observed portfolio P:

The next one step is finding a macroeconomic model for the variable Z_t which can explain historical movement of NPLs and predict the future value Z_t.

In this one work being used linear model which reads:

and where are

selected macroeconomic variables which are specific to the P portfolio.

With superior linear model, it can be designed future value

and transform the future TTC PD into the future PiT PD. Before that which is performed transformation, should have on mind that goal models to be determined future values

which has the following u distribution:

and whose components also they have normal distribution:

Value PiT PD–in someone future at time t then:

From the other side, TTC PD for the future we express the data t the next one by the formula:

By combining upper two equations we get:

which, finally, can serve as a formula for transforming TTC PD into PiT PD.

After collection data, and on basis macroeconomic model for the variable a target variable is created for all possible periods. Given that several variables were initially observed in the model, the idea was to find which variables have the greatest influence on the movement of problem loans in the WB countries, with the consequent goal of a growing relationship credit risks. Below will be displayed variables they have the biggest influence on movement of NPL in each observed state, as it could be predicting movement of NPL in the future, without existence data on NPL, and in addition existence defined indicators.

4. Results

It is important to emphasize that the effect observed variables on does not reflect the economy right after theirs appearing [

35], already after certain past time, due to of what are in the analysis included additional variables made using lags on initial set of variables [

36]. These variables wider spectrum potential variable so which is not seen current change is already being analyzed effect macroeconomic indicators on target variable after next ones upcoming quarters in years [

37]. For example, if we observe influence unemployment on movement problematic loans, increase unemployment on the end the first quarter of 20xx year won't to have influence on movement of NPL in the first quarter you year, already will effect reduction of employment see on the end second, third or again, on the fourth quarter. How individual macroeconomic data they are not were public available for certain years, and especially for the first 6-7 years analysis, the author calculated so called missing (eng. missing) values, since it is not allowed to leave empty fields in the used statistical package R. Percentage missing values is obtained so which adds up total number observed weather period (in case of this of work - quarter) i share with total by number empty fields in the frame observed indicators, that is after calculations arithmetic environment mentioned two variables. Filling missing values is performed for each variable with secondary value your variables.

First elimination data there was a removal data they have missing values over 50%. In this one work this one the case exists in Serbia and Albania where are eliminated rate unemployment in the case of Serbia and PPC index in case Albania.

Table 1.

Indicators were eliminated from further analysis because of missing values.

Table 1.

Indicators were eliminated from further analysis because of missing values.

| Country |

Indicator |

| Serbia |

Rate unemployment |

| Albania |

Index manufacturer's price |

When are filled out everything values in columns, calculated are coefficients R

2 and ADJ R

2 for each individual variable, in each observed to the state. These coefficients indicate percentage variances in between variables, that is how much let variable describes well target variable. Considering to that that small number observation (on average about 50 per country), the focus was on results obtained in the coefficient ADJ R

2 that is used exactly in the situation when available approximately up to 100 observations. Finally, modeling eliminated are everything variables to which ADJ R

2 less than 15%. As a possibility for further modeling, indicators that are left in the analysis shown are for everyone observed country in the next table.

Table 2.

Abbreviated review indicators by country ZB with R2 and ADJ R2 tests with with a score of over 15%.

Table 2.

Abbreviated review indicators by country ZB with R2 and ADJ R2 tests with with a score of over 15%.

| Title 1 |

INDICATOR |

R 2

|

ADJ R 2

|

| Serbia |

CAR_L2 |

0.492 |

0.479 |

| CAR_L1 |

0.484 |

0.471 |

| CAR_L3 |

0.483 |

0,470 |

| InvestPercNominalGDP |

0,463 |

0,450 |

| InvestPercNominalGDP_L1 |

0,455 |

0,441 |

| InvestPercNominalGDP_L2 |

0,300 |

0,282 |

| RealGDP_L2 |

0,189 |

0,169 |

| RealGDP_L1 |

0,174 |

0,152 |

| RealGDP |

0,172 |

0,151 |

| Albanija |

UNEMPLOYMENT |

0,659 |

0,648 |

| UNEMPLOYMENT_L1 |

0,593 |

0,579 |

| UNEMPLOYMENT_L2 |

0,518 |

0,503 |

| UNEMPLOYMENT_L3 |

0,431 |

0,413 |

| TTDEPOSITE_L3 |

0,339 |

0,317 |

| TTDEPOSITE_L2 |

0,334 |

0,312 |

| TTDEPOSITE_L1 |

0,321 |

0,299 |

| CAR |

0,300 |

0,278 |

| TTLOANS_L3 |

0,252 |

0,228 |

| RealGDP_L2 |

0,239 |

0,215 |

| CAR_L1 |

0,226 |

0,201 |

| Bosna i Hercegovina |

TTLOANS_L3 |

0,571 |

0,561 |

| TTLOANS_L2 |

0,433 |

0,420 |

| InvestPercNominalGDP_L3 |

0,397 |

0,382 |

| CPI_L3 |

0,320 |

0,304 |

| PPI_L3 |

0,295 |

0,278 |

| IMPORT |

0,293 |

0,276 |

| IndustrialProd |

0,261 |

0,244 |

| TTDEPOSITE |

0,179 |

0,160 |

| Crna Gora |

UNEMPLOYMENT_L1 |

0,663 |

0,653 |

| UNEMPLOYMENT |

0,646 |

0,636 |

| UNEMPLOYMENT_L2 |

0,570 |

0,558 |

| UNEMPLOYMENT_L3 |

0,505 |

0,492 |

| TTLOANS |

0,449 |

0,434 |

| TTLOANS_L1 |

0,423 |

0,408 |

| TTLOANS_L3 |

0,406 |

0,390 |

| TTLOANS_L2 |

0,394 |

0,378 |

| CAR_L2 |

0,327 |

0,309 |

| CAR_L1 |

0,327 |

0,309 |

| CAR |

0,324 |

0,305 |

| CAR_L3 |

0,296 |

0,277 |

| InvestPercNominalGDP |

0,252 |

0,232 |

| NomGDP_L3 |

0,230 |

0,209 |

| Severna Makedonija |

UNEMPLOYMENT |

0,471 |

0,461 |

| UNEMPLOYMENT_L1 |

0,424 |

0,414 |

| UNEMPLOYMENT_L2 |

0,384 |

0,373 |

| LAR |

0,340 |

0,328 |

| CAR |

0,283 |

0,270 |

| CAR_L1 |

0,232 |

0,218 |

| LAR_L1 |

0,224 |

0,210 |

| InvestPercNominalGDP |

0,222 |

0,208 |

Next phase research was the creation cluster so what are variables of the same type placed in separate groups, of course with ADJ R 2 greater than 15%. Every cluster variable is selected with the largest ADJ R 2 and finally, the list is created which enters regression. In the next one table a list is displayed variables for each observed state. If let's compare the previous one and the next one table, we can conclude that the table with list data _ variable which enter the linear regression follows from the previous one tables where are clusters formed on base R 2 and ADJ R 2 tests.

Table 3.

List of variables for linear regression.

Table 3.

List of variables for linear regression.

| Country |

Changeable which entered regression |

| Serbia |

CAR_L2 |

Investments (in % of nominal GDP) |

|

| Bosnia and Herzegovina |

TTLOANS_l3 |

|

|

| Montenegro |

Unemployment rate_L1 |

TTLOANS |

|

| North Macedonia |

Rate of unemployment |

LAR |

|

| Albania |

Rate of unemployment |

TTDEPOSITE_L3 |

|

Prague significance in released linear regression is 5%, in order to obtain what appropriate results. Obtained is dependent variable Z (on basis formulas defined in subsection 1.2. this one chapter) for the whole observed period. Her’s modeling with indicators that are for each Earth individually showed like the most significant, obtained predictive value (PD) which represents the basis for the created prediction movements problematic credit.

Based on carried out analysis in the preceding subchapters of work can be brought general the conclusion that following movement selected indicators, we can predict movement of the rate of problematic loans in the future. A perennial trend is the present increase in the NPL rate over the years which are in front of us, in part because of policies price increases of money arising from increase of the variable part of the interest rate. Implemented analysis included two species indicators (macroeconomic and banking performance) to show which of the selected parameters there is the biggest influence on movement problematic loans in countries Western of the Balkans. Developed on Merton's model that represents basis for further work in software package R. Released linear _ regression with threshold significance of 5% i obtained are the most significant influencing indicators _ on movement problematic loans, for each observed the state. The results are shown in the following table.

Table 4.

The most significant indicators for the movement of NPLs by states ZB and R2 and ADJ R2 (%) and ADJ R 2 (%).

Table 4.

The most significant indicators for the movement of NPLs by states ZB and R2 and ADJ R2 (%) and ADJ R 2 (%).

| Country |

Indicator 1 |

Indicator 2 |

R 2 (%) |

ADJ R 2 (%) |

| ALB |

Unemployment rate |

Deposit growth LAG3 |

89.4 |

88.4 |

| BiH |

Growth of total loans LAG3 |

/ |

57,15 |

56,13 |

| CG |

Unemployment rate LAG1 |

Growth of total loans |

73 |

71.6 |

| SRB |

EMPEROR LAG2 |

Investments (as a percentage of nominal GDP) |

70.4 |

68.8 |

| THE END |

Unemployment rate |

LAR |

55.6 |

53.9 |

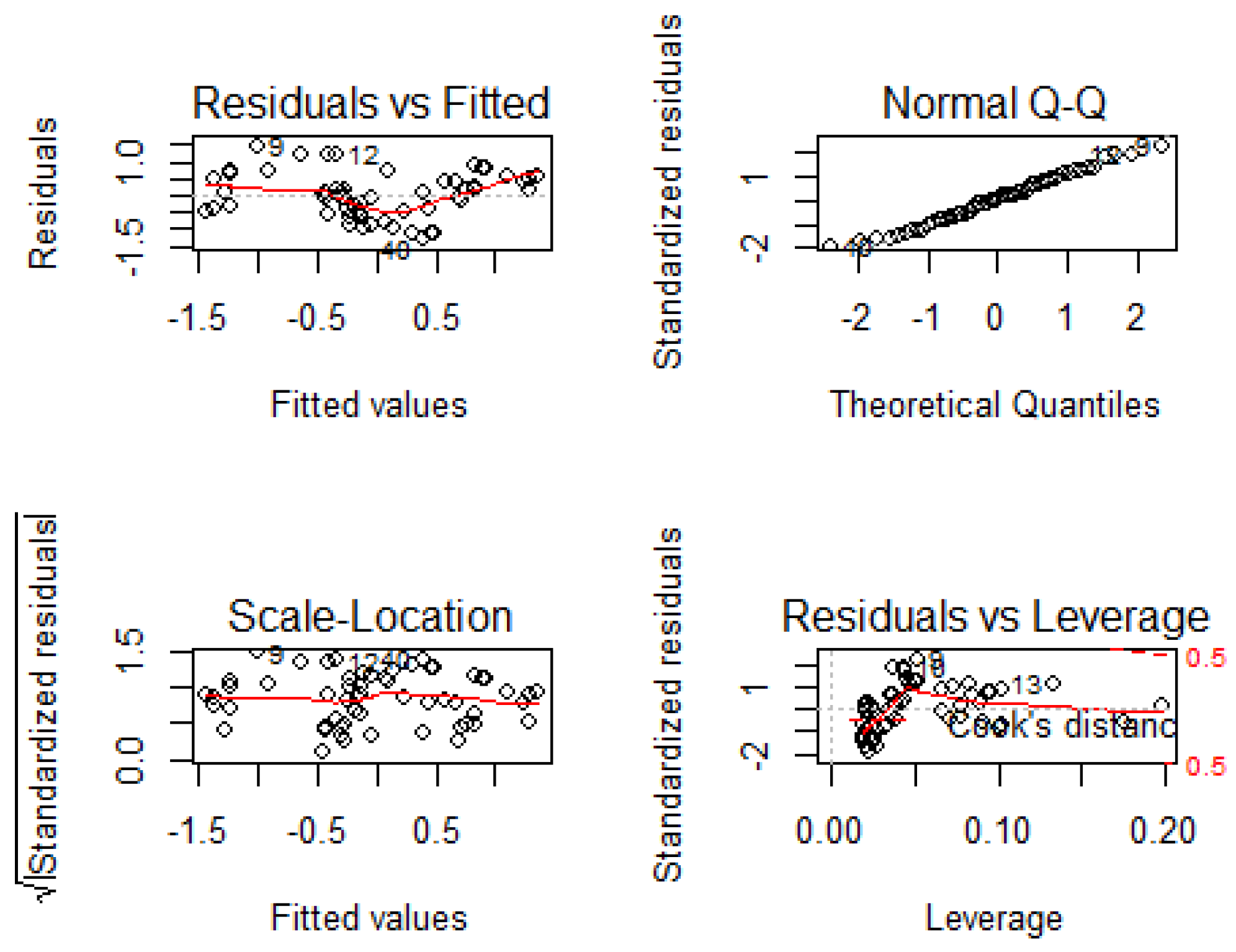

On occasion formation linear model, it is necessary to perform analysis residuals. The goal of this analysis is to determine whether i how appropriate the model is. Most often it is in focus checking whether residuals have normal distribution, as and comparison with existing one’s values. The simplest method is in visual comparison which is carried out by drawing diagrams (diagrams related to one analysis can be seen in the box the next one graph). How we would determined whether the created model for each changeable in the observed countries in an adequate way describes target change, all we have to do is implement it analysis residuals. The results below of work, for each of observed countries.

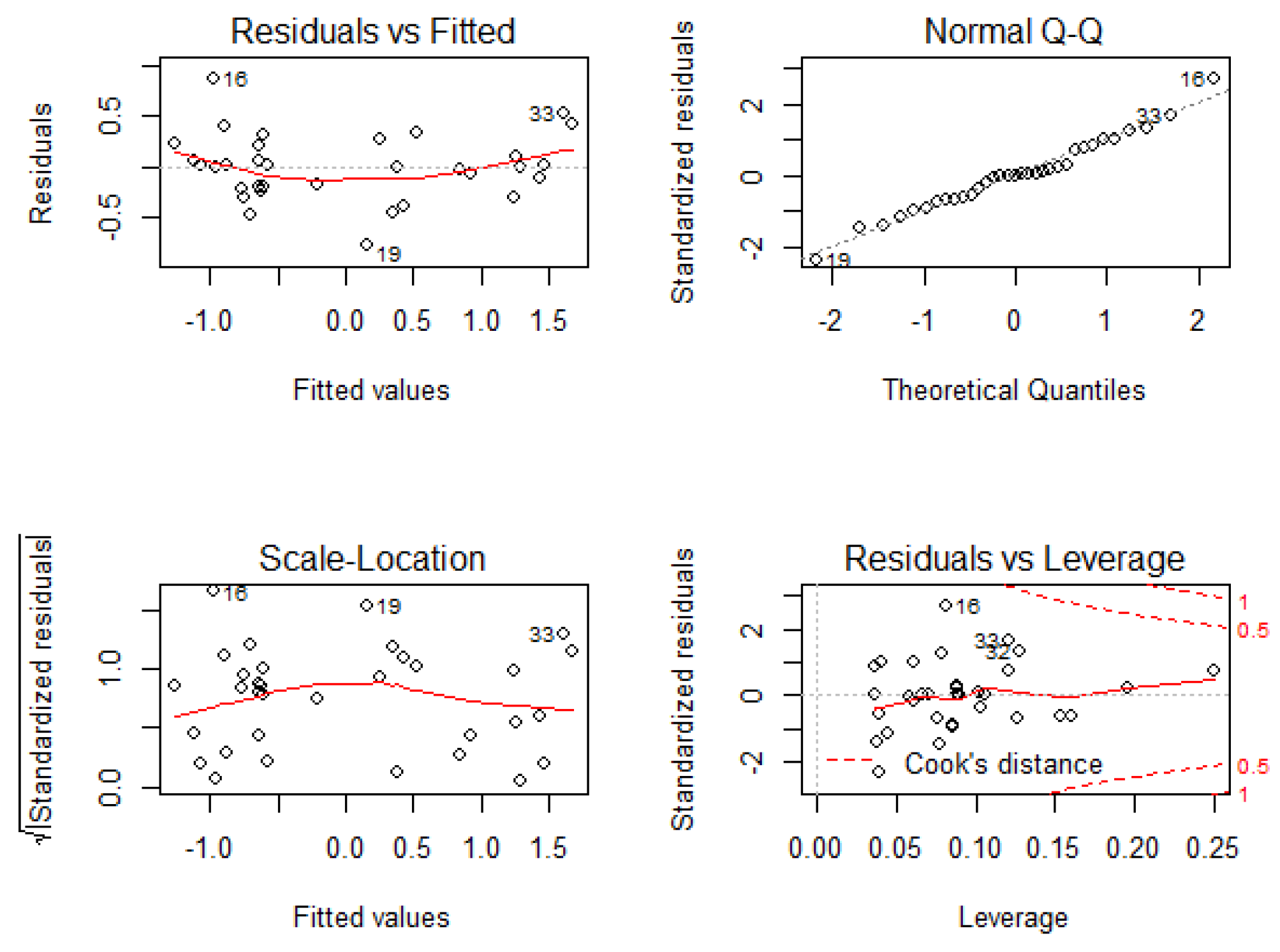

Figure 1.

Diagram of waste residuals for predictive NPL (model) banking sector Albania.

Figure 1.

Diagram of waste residuals for predictive NPL (model) banking sector Albania.

The previous chart confirms independence of the residuals because the points are randomly distributed in the first and third squares. Given that we know that if the plotted points do not form a pattern (which is not the case in this graph), then we can say that the conditions for the basic assumptions are met. The second square shows the normality of the distribution, which is the case in the case of Albania, while the so-called Hip's distance (fourth square) showed that there are no outliers, i.e., points outside the expected limits that should be discarded. As a conclusion of the prediction in the case of the Albanian NPL prediction model, it can be said that by reviewing the unemployment rate and data on total deposits as publicly available data, it can predict with great certainty the movement of problem loans in the future development of the banking sector of Albania.

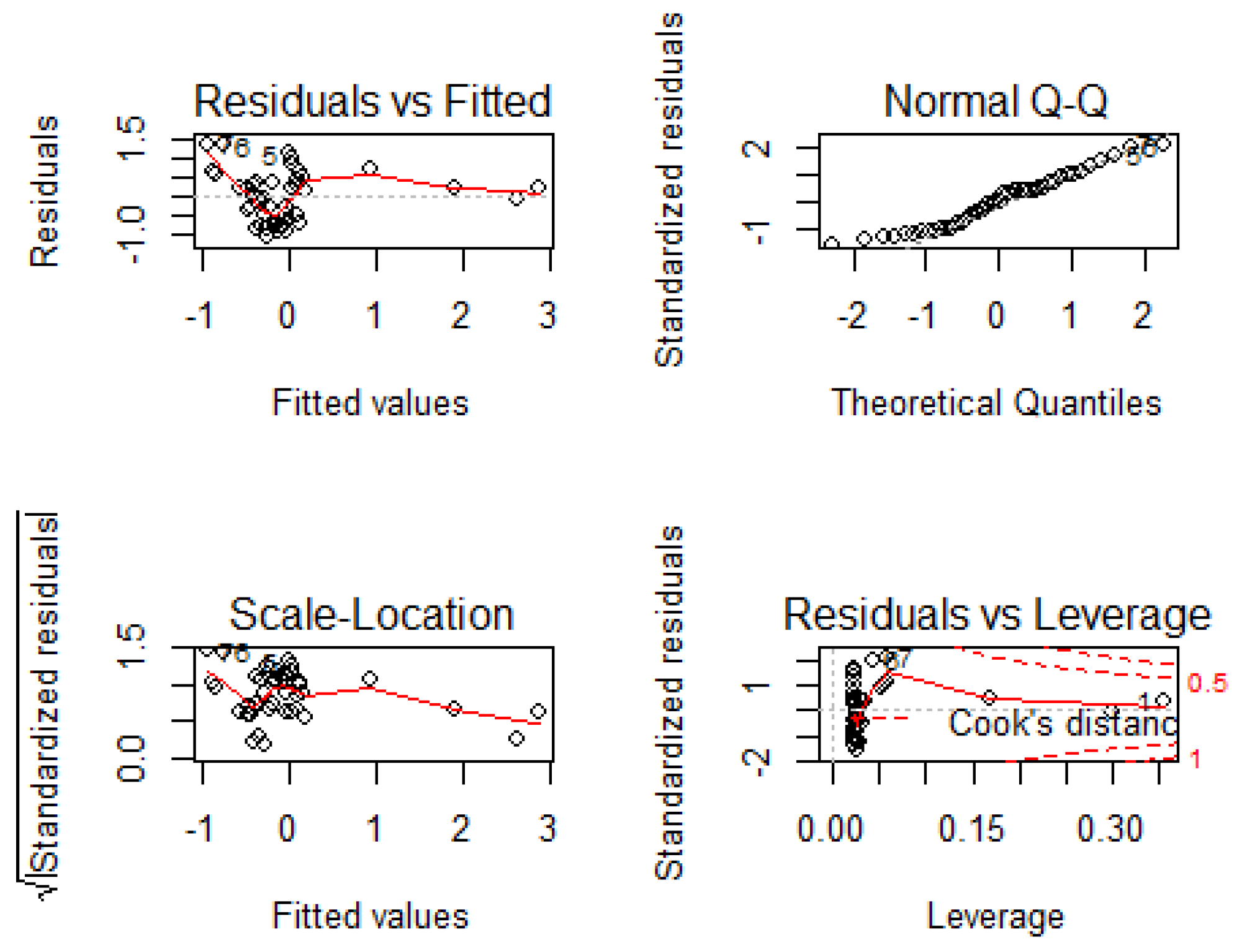

Next, there is an analysis of the residuals to determine whether the created model is satisfactory, i how much for Bosnia and Herzegovina.

Figure 2.

Diagram of waste residuals for predictive NPL (model) banking of the BiH sector.

Figure 2.

Diagram of waste residuals for predictive NPL (model) banking of the BiH sector.

In the previous graph, within the first and third squares, scattering points are randomly arranged, but very concentrated in the interval -1 and 0, which still gives them a certain dependence. The second residual is also normally distributed in the case of the banking sector of BiH, along a straight line, and the fourth residual with Cook's distance, although more concentrated at the very beginning, does not jump out of the dotted lines. We emphasize that again the trends of the target variable Z (NPL) and the selected indicators are similar, that is, a slight decrease in NPL is accompanied by a slight decrease in the unemployment rate, and the growth of total approved loans will consequently affect the growth of NPL and total placements.

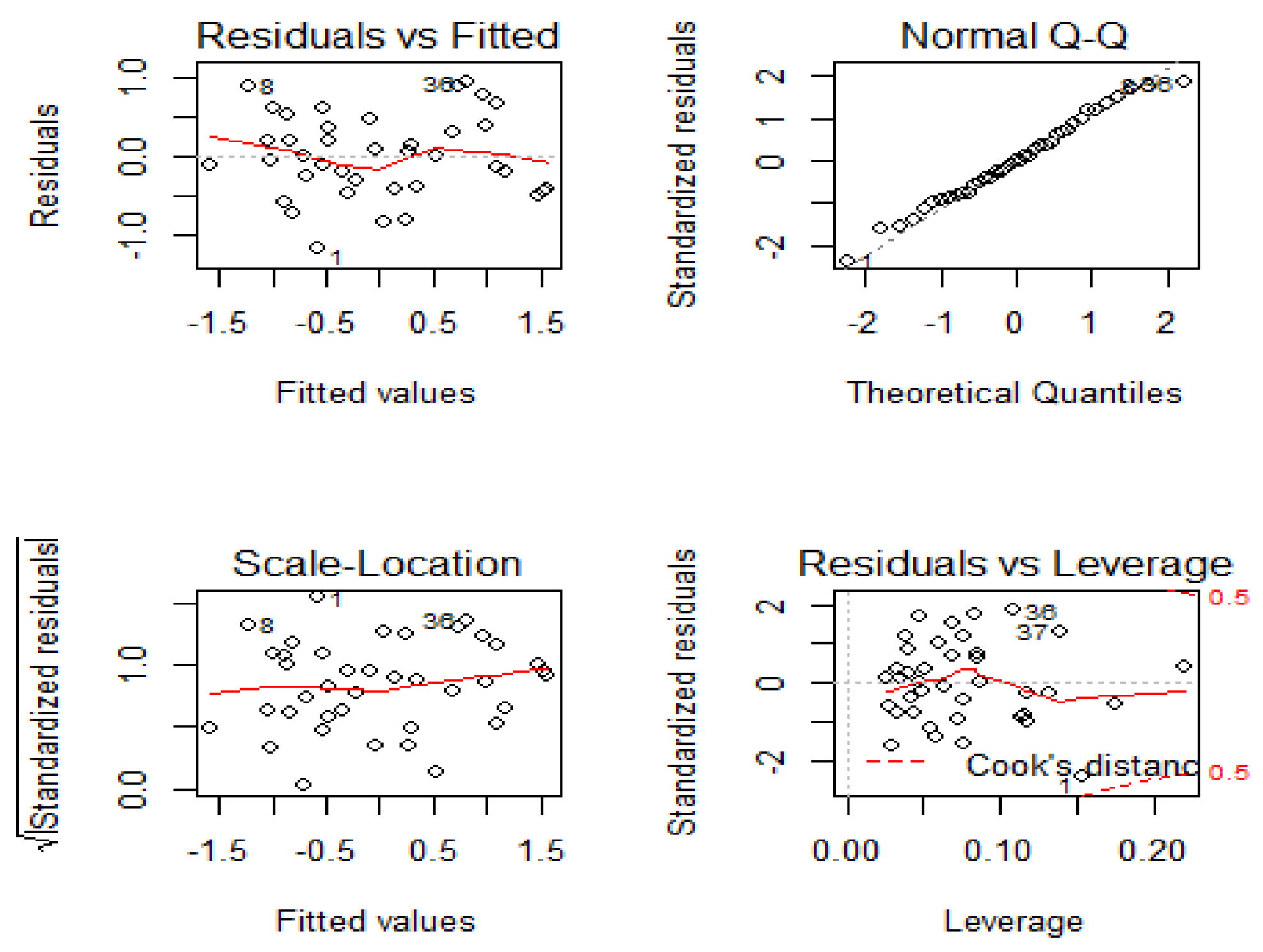

Finally, the analysis of the distribution diagram of the residuals in the random of Montenegro remained, which is shown in the following graph.

Figure 3.

Diagram of waste residuals for predictive NPL (model) banking of the BiH sector.

Figure 3.

Diagram of waste residuals for predictive NPL (model) banking of the BiH sector.

And in case Montenegro, we can confirm independence residuals by which more once we confirm impartiality pri creation model used in the work. In the framework the first to the third square residuals are randomly arranged, others square shows normality residuals because are lined up along they make. Not in this one either case,

outliers do not appear - i because everything _ dots they find in between dashed line.

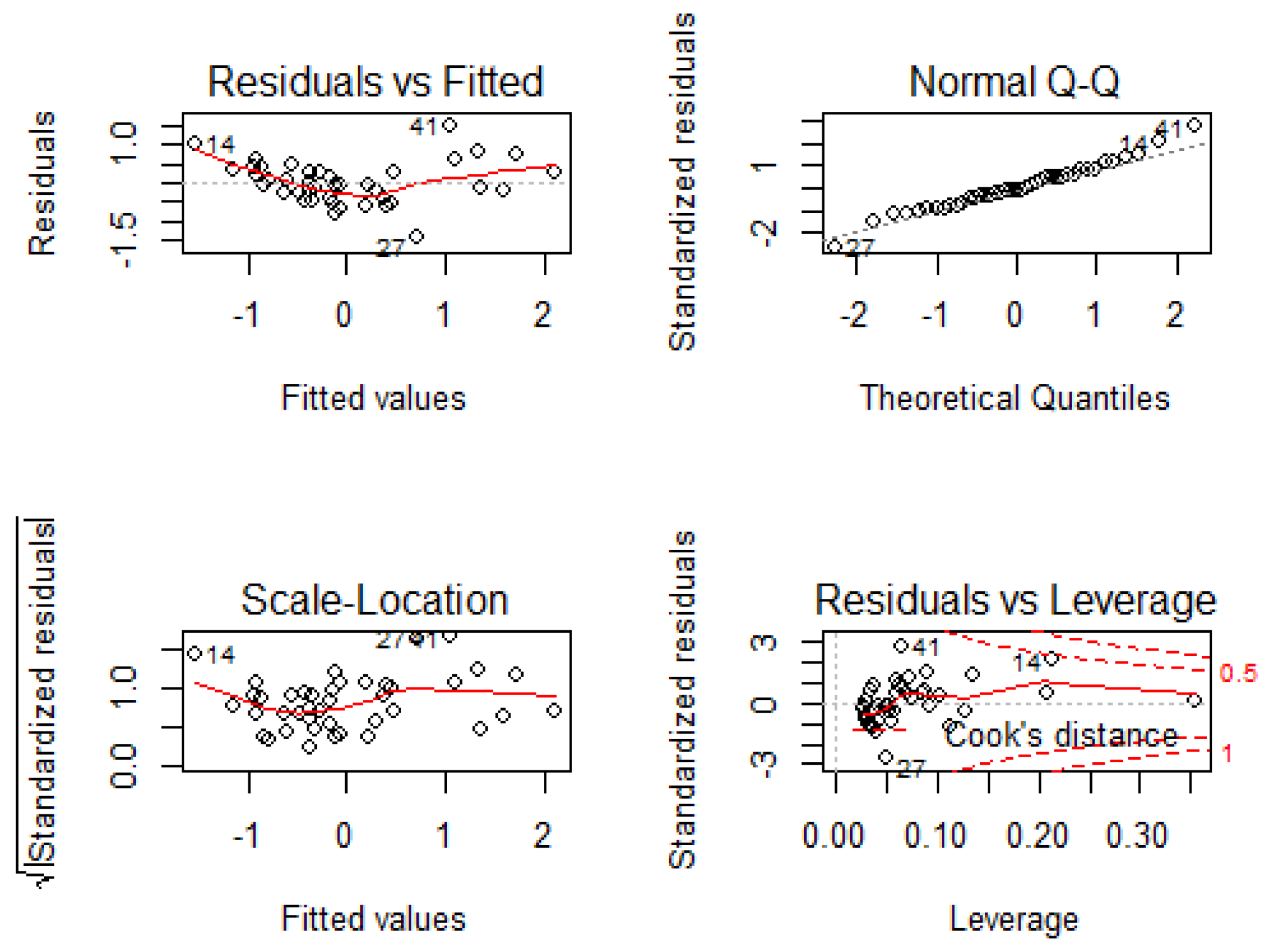

Figure 4.

Diagram of waste residuals for predictive NPL (model) banking of the RS sector.

Figure 4.

Diagram of waste residuals for predictive NPL (model) banking of the RS sector.

Checking independence residuals, according to previous graph, we can see that in the first and to the third square residuals they work randomly, to be exact independent one of others. Others residual shows normality distribution, that is, that they are everything dots concentrated the eye they make lines. Finally, the fourth residual shows how many points are located outside the dashed line, which in this work is not the case.

Consequently, it remains analysis residuals in order to finally determined whether the model (and to what extent) is satisfactory for designing future one’s values of NPLs in banking sector Northern of Macedonia.

Figure 5.

Diagram of waste residuals for predictive NPL (model) banking of the RS sector.

Figure 5.

Diagram of waste residuals for predictive NPL (model) banking of the RS sector.

And on this one chart in the frame the first and the third square meters in full are randomly lined up dots of waste what if it is very big impartiality created to the model. Others the residual is also normal in the case of SMAK arranged, along real, and the fourth residual with Kukov by distance, though more concentrated on himself at the beginning, it does not jump out of the dashed line, by which the model can accept.

5. Discussion

The results show that, in as many as 3 out of 5 observed countries, one of the indicators that have the greatest influence on movement of NPLs, rate unemployment, which is in favor hypothesis H3. When we remember pictures from every day of life, this one data and it is not surprising, since the reduction of employment implies problems with returning earlier downloaded debts due to shortcomings monetary inflow / funds /. Tall percentages of R 2 and ADJ R 2 tests indicate that the connections in between model and dependent variables be on more rather satisfactory level, since the results already of over 30– ac percent they take like acceptable. Judging by this parameter, NPL prediction in Albania will give most accurately projections (R 2 and ADJ R 2 are 89.4% and 88.4%, retrospectively), doc will prediction of NPL in the North Macedonia be the most irregular (R 2 and ADJ R 2 are 55.6% and 53.9%), with and further adequate interpretation projection, on basis created model. Further, in addition to the unemployment rate, macroeconomic the indicator that showed up like very significant they are investments (in % of nominal GDP), and in the Republic to Serbia. The basis for this one result, and that in the Republic Serbia, we can find in the fact that this country, in relation on other observed, the most opened according to foreign investors, as and that it is big number investment projects to the greatest extent financed loans (which are secured from foreign capital or credit line), and not for example own by means. Banking indicators they have been shown to have big influence on movement in NPLs observed to the states are growth deposits for three quarters backwards (Albania), growth total of loans in the observed quarter (CG) and three quarters backward (BiH), coefficient adequacy capital (SRB) i coefficient of liquidity (SMAK). Quality predictions tested himself by checking NPL predictions in banking sector each country, individually. Calculated is dependent variable Z, and on basis her predictive value Z which is further used like basis for forecasting NPLs. Analysis residuals (on basis diagram of waste) confirms their independence because are dots randomly arranged in squares I and III in the frame charts 38 (ALB), 41 (BiH), 45 (CG), 49 (SRB), 53 (SMAK). What _ is also beneficial acceptance model for the future predictions it is chart so called " Hips the distance " which shows absence of outliers (points which should reject) in all observed countries, although it was observed something larger concentration points on himself to the beginning analysis the code banking of the BiH sector.

Considering _ to that all the above is in favor adequate interpretation data, like and satisfactory quality received movements problematic loans, NPL prediction was made until 2025 for banking sector each country. This is at the same time and confirmed hypothesis H3. It is important to note that following mentioned above indicators, it can be done prediction NPL trends in the future.

6. Conclusions

It was implemented in the paper theoretically and empirically research. Five countries were observed which is World bank declared like of the state Western of the Balkans, with exception self-proclaimed Republic of Kosovo with you list, due to respect provisions of the Constitution of the Republic of Serbia which Kosovo and Metohija were declared like Autonomous province of the Republic of Serbia. The subject of work was the analysis sustainable banking environments in countries Western Balkans and examination influence macroeconomic indicators on performance banking system, with special in retrospect on problematic loans. In the WB countries, stability financial system it is conditioned by stability banking sector, since the WB countries have " bankocentric " finances systems what implies that dominant share total financial assets they do banks over which is performed the biggest financial transaction. Tendency of " greening " of finance which is the last decade very current in the world, it was created from needs to maximize there will be no profit the only one goal banks, but in parallel with by acquisition profit consider conservation life environment and socially responsibly business of banks. Banks which on time recognize and implement various forms of " green " legal jobs in their own business, in the opportunity are to attract bigger number clients, i in that way increase your profit, at the same time contributing sustainable development. Bearing in mind the potential it offers green banking, green banking jobs we can define as legal one’s jobs which the bank concludes with its own to clients adding im additional, ecological component wherever possible. _ Green banking jobs are classic banking jobs that are due to growing need contemporary economy and sustainable development, conditioned improvement banking techniques, experienced determined improvements, and modifications - improve satisfaction of employees, loyalty of their own of clients, improve business reputation positive by reporting in the media, they become stronger relations and partnerships with ecological moody stakeholders [38].

In the observed countries Western Balkana, green banking is still always new concept, without regulatory of the regulating framework this very important topic. The biggest partly, green loans are coming from line of sides international financial institution. Maybe it is a chance for " greening " the whole economy striving for harmonization legal regulations countries Western Balkans with regulations in the EU, primarily in the domain protection life middle, in the frame Chapter 27. Also, in the future work, it is very important to continue with my research in the field problematic loans, since they are they one of the largest headache contemporary ones manager and others faces in charge of realization profit banks. By adding green components, results show that they can expect increased market participation, profit, satisfaction employees and loyalty clients... In each case, it would be good and exchange scientific knowledge with researchers and other experts from immediate environment, but and developed countries, because only common strength is possible to contribute promotion how methodological, so and practical sustainable solutions _ on long deadline.

References

- Commission Directive 2011/63/EU of 1 June 2011 amending, for the purpose of its adaptation to tehnical progress, Directive 98/70/EC of the European Parliament and of the Council relating to the quality of petrol and diesel fuels.

- Nacionalna strategija održivog razvoja Republike Srbije, Službeni glasnik RS, br.57/2008.

- Baietti, A. , Shlyakhtenko, A., La Rocca, R., Urvaksh, P. (2012). Green Infrastructure Finance: Leading Initiatives and Research. Washington: The World Bank.

- Jeucken, M. (2004). Sustainability in Finance. Banking on the Planet. Eburon Academic Publishers.

- Rakić, Slobodan & Mitić, Petar. 2012. Green Banking – Green Financial Products with Special Emphasis on Retail Banking Products, In: II International scientific conference: 2nd climate change, economic development, environment and people conference. Vydavatel'stvo Prešovskej universitary, Prešov, pp. 54–60. ISBN 978-80-555-0607-4.

- Rakić, S, Mitić, P. , Raspopović, N. Application of the 'green' concept in finance and banking. Business Economics 2012, 6, 167–182. [Google Scholar]

- Radojević, T. (2019). International economy. Belgrade: Singidunum University.

- Serrasquiero, S. , Silva, M. Corporate Sustainability in the Portuguese Financial Institutions. Social Responsibility Journal 2007, 3, 82–94. [Google Scholar]

- Sovilj, R. (2020). The concept of sustainable development in modern banking - green banking. Proceedings "Challenges of sustainable development in Serbia and the European Union", Belgrade: Institute of Social Sciences, 265-281.

- Cvetinović, M. (2009). Managerial economics. Belgrade: Singidunum University.

- Alihodžić, A. Interdependence of the performance of the banking and real sector of the Republic of Serbia. Banking 2015, 2/2015, 46–73. [Google Scholar]

- Račić, Ž. The influence of basic macroeconomic indicators on the liquidity of the Serbian banking sector. School of Business 2014, 2/2014, 67–76. [Google Scholar]

- Vodová, P. (2011). Czech Science Foundation (Project GACR/11/P243). 740-747.

- Trenca, I. , Petria, N., Mutu, S., & Corovei, E. Evaluating the liquidity determinants in the Central and Eastern European banking system. Finance - Challenges of the Future 2012, 14/2021, 85–90. [Google Scholar]

- Gnjatović, D. 'Greens': The earliest creditors of farmers in Serbia. Banking 2010, 39, 48–71. [Google Scholar]

- Ranisavljević, D. , & Vuković, D. Risks of small business lending in the Republic of Serbia. Banking 2015, 44, 12–25. [Google Scholar]

- Račić, Ž. , & Barjaktarović, L. Analysis of empirical determinants of credit risk in the banking sector of the Republic of Serbia. Banking 2016, 45, 94–109. [Google Scholar] [CrossRef]

- Stojanović, D. Sustainable economic development through green innovative banking and financing. Economics of Sustainable Development 2020, 4, 35–44. [Google Scholar] [CrossRef]

- Zhang, B. , Jun, Y., Bi, J. Tracking the implementation of green credit policy in China: Top-down perspective and bottom-up reform. Journal of Environmental Management 2011, 92, 1321–1327. [Google Scholar] [CrossRef]

- Kostadinović, I. , & Radijičić, J. The banking sector in the context of sustainable development. Economics 2017, 1, 109–119. [Google Scholar]

- Yao, Sh. , Pan Y., Sensoy, A., Uddin, GS, Cheng, F. Green credit policy and firm performance: What we learn from China. Energy Economics 2021, 1010, 105415. [Google Scholar] [CrossRef]

- Yao, Sh. , Pan Y., Sensoy, A., Uddin, GS, Cheng, F. Green credit policy and firm performance: What we learn from China. Energy Economics 2021, 1010, 105415. [Google Scholar] [CrossRef]

- Đuričin, D. , & Herceg-Vuksanović, I. Envisioning a new economic system after the transition from pandemic to endemic: Serbia's perspective. Business Economics 2022, 70, 1–22. [Google Scholar] [CrossRef]

- Sun, J. ,Wang, F., Yin, H., Zhang, B. Money Talks: The Environmental Impact of China's Green Credit Policy. Journal of Policy Analysis and Management 2019, 38, 653–680. [Google Scholar] [CrossRef]

- Remeikienė, R. , Gasparėnienė, L., Fedajev, A., Vėbraitė, V. The role of ICT development in boosting economic growth in transition economies. Journal of international studies 2021, 14, 9–22. [Google Scholar] [CrossRef]

- Yhang, D. Green credit regulation, induced R&D and green productivity: Revisiting the Porter Hypothesis. International Review of Financial Analysis 2021, 75, 101723. [Google Scholar] [CrossRef]

- Xing, C. , Zhang, Y., Wang, Y. Do Banks Value Green Management in China? The Perspective of the Green Credit Policy. Finance Research Letters 2020, 35, 101601. [Google Scholar] [CrossRef]

- Noh Hee, J. (2018). Financial Strategy to Accelerate Green Growth. ADBI Working Paper Series, No. 866, 1–23.

- Vujičić, S. , Cogoljević, M., & Nikitović, Z. The development of ecological awareness in the Republic of Serbia. International Review 2022, 1-2, 51–59. [Google Scholar] [CrossRef]

- World Bank Group. (2017). Western Balkans Regular Economic Report No. 12. Preuzeto 06 07, 2020 sa. Available online: http://documents1.worldbank.org/curated/en/477511510774559876/pdf/121417-WP-PUBLIC.pdf.

- Službeni glasnik RS, b. 4. (2006). Ustav Republike Srbije. Preuzeto 03 10, 2020 sa. Available online: https://www.paragraf.rs/propisi/ustav_republike_srbije.html.

- Su, C.W. , Li, W., Umar, M., Lobonţ, O. Can green credit reduce the emissions of pollutants? Economic Analysis and Policy 2022, 74, 205–219. [Google Scholar] [CrossRef]

- Mitić, P. , Fedajev, A., Radulescu, M., Rehman, A. The relationship between CO2 emissions, economic growth, available energy, and employment in SEE countries. Environmental Science and Pollution Research 2023, 6, 16140–16155. [Google Scholar]

- Merton, R. On the pricing of corporate debt: The risk structure of interest rates. Journal of Finance 1974, 29, 449–470. [Google Scholar]

- Nikolić, R. , Urošević, S., Fedajev, A., Piljušić, M. Natural resource management as a function of environmental conservation. EMIT, Economics Management Information Technology 2013, 2, 25–32. [Google Scholar]

- Nikolić, R. , Urošević, S., Fedajev, A., Piljušić, M. Natural resource management as a function of environmental conservation. Economics Management Information Technology 2013, 2, 25–32. [Google Scholar]

- Barjaktarović, L. , Vesić, T., Balazs, L. What Can Be Expected in Credit-Risk Management from NPL in the Western Balkans Region in the Future? International Review 2022, 1-2, 96–103. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).