1. Introduction and Motivation

Optimal design of profitable trading algorithms for financial markets constitutes a very challenging and technically sophisticated problem of the modern financial engineering (see [3],[4],[5],[7],[8],[9],[10],[11],[31],[38],[41]). It is well known that the highly fluctuating stock market prices and the corresponding highly frequent changes of the main market indicators make an accurate forecasting nearly to impossible. The same is also true with respect to the forecasting based optimization and trading.

In order to develop the optimal trading algorithm, we consider an idealized stock market characterized by some specific technical assumptions. We examine a market under assumption of "no transaction costs" and also consider "one stock portfolio". We also introduce some further simplifying hypothesises, namely, the assumption of the "zero interest" and the so called "continuous trading" conditions. Let us refer to [7],[8],[9] for the necessary technical details and existing abstractions in the modelling of the real-world stock markets. Our paper deals with the discrete-time dynamics of the financial markets under consideration. This assumption is motivated by the generic stock tick dynamics and also by the discrete-time decision making process. Recall that a tick is a measurement of the minimum upward or downward movement in the price of a security (see e.g., [24],[32] and references therein). The given discrete-time dynamics of the stock market ticks naturally implies a discrete-time process of the trading decision making. We next use the following notation of the stock ticks and consider the corresponding semi-open time-intervals of the trading buckets . The market prices and all the additional market indicators (as volatility and other) as well as the trading decisions are related to the above stock ticks.

In this paper, we study the aforementioned idealized stock market and apply the CE based Proportional-Integral-Derivative (PID) control design to development of an efficient trading algorithm. Recall that the PID control synthesis constitutes one of the most powerful and successful real-world control algorithms (see e.g., [2],[27],[28],[34],[36]). The conventional model-based PID control implements a fundamental idea of the feedback control action and is widely used in various real-world engineering applications (see [2] and references therein). Our main idea is to extend the classic PID based optimal control and decision techniques to a class of the model-free AT problems.

Advanced financial engineering and financial economics constitute a powerful theoretical tool of the modern financial science (see [15],[16],[23],[40]). On the other hand, the modern mathematically rigorous time-series based financial theories can not be directly applied to an algorithmic generation of the profitable trading decisions (see [3],[4],[5],[7],[8] and references therein). This fact is a simple consequence of the highly fluctuating stock prices. This fundamental property of the modern financial markets implies the so-called High-Frequency Trading (HFT) methodology. We refer to [16] for the useful HFT concepts and some related technical details. A successful HFT strategy development is a very sophisticated and challenging task. In this paper, we propose to use some fundamental aspects of the conventional CE for this purpose. More specifically, we propose to apply an optimized PID type control strategy to the trading. This optimization technique involve some novel data-driven PID gains tuning approaches. The CE based approach to the modern AT was originated in [7],[8],[9],[10],[11],[19],[31]. Let us also refer to [3],[4] for some novel PID trading algorithms with a switched structure. The non-regular, highly frequent bid-ask spread behaviour on a stock does not admit a realistic price forecasting model. Hence, instead of modeling them, we propose to react to the stock price variations using the classic model-free PID control. We also combine the conventional PID trading with an advanced statistical characterization of the historical market data sets. We next identify a specific log-normal probability distribution function (pdf) for some concrete market quantities related to the data sets under consideration. Recall that a PID control design incorporates the important PID gains tuning procedure (see [2],[27],[28],[34]). The established log-normal pdf for the market quantities mentioned above can next be used in an optimal PID gains tuning scheme.

Note that various optimization techniques play an important role in the modern financial engineering (see e.g., [4],[5],[14],[22],[26],[29],[30],[33],[42],[43],[44] and references therein). In our case, we examine two different data-driven optimization approaches to the PID gains optimization, namely, the regression based technique and the stochastic optimization framework. The first approach is combined with the well-known Forward Testing methodology [4],[43]. It considers the corresponding In-Sample and Out-of-Sample concepts for a concrete data set. On the other hand, the classic stochastic optimization framework uses the established log-normal distribution of the introduced market quantities and leads to the celebrated Monte Carlo solution technique (see e.g., [22],[39]). The resulting PID trading algorithm with the optimized gains was applied to some concrete real-world examples. We consider a trading application on the Binance BTC / USDT spot market and illustrate the implementability, efficiency and profitability of the proposed algorithm. We also briefly discuss the prototype software for the proposed optimal PID trading algorithm.

The remainder of our paper is organized as follows:

Section 2 contains a formal AT problem statement. This section includes a rigorous mathematical description of the conceptually novel model-free PID trading algorithm. In

Section 3 we perform an advanced statistical analysis of the stock market data. We establish the log-normal probability distribution properties for some specific subsequential market characteristics.

Section 4 deals with the main problem of the PID trading, namely, with the optimal PID gains tuning. We consider the data-driven optimization associated with the historical data and the corresponding backtesting procedure. The generic regression analysis is next applied in the general Forward Testing framework. In this section we also propose an alternative PID gains selection strategy and use a scenario based stochastic optimization problem for this purpose. The resulting stochastic program is solved by the Monte Carlo approach. In

Section 5 we discuss a novel Fourier based frequency domain interpretation of the proposed PID trading strategy. We apply the conventional z-transformation for the constructive characterization of the PID trading scheme in the frequency domain.

Section 6 contains a practically motivated application of the developed PID trading algorithm to a specific stock market, namely, to the Binance BTC / USDT futures stock. This section is also devoted to the prototype software design.

Section 7 summarizes our paper.

2. Model-Free PID Based Trading Algorithm

This section formally describes a novel concept of the model-free PID trading algorithm. Consider a trading on an idealized stock market mentioned above. Let

be an initial deposit (initial investment). We next introduce the current return

The current investment level at a time instant

t is denoted by

. In parallel with the current values introduced above we also consider the cumulative return and the cumulative investment

and

, respectively. The nonlinear discrete-time PID trading strategy can be formalized as follows:

By

and

we denote here the necessary PID gains for the proportional, integral, and derivative terms of the classic PID regulator scheme (see [2],[27],[28]). Let us introduce the vector of these PID gains:

Note that the integral term in (

1) incorporates the "process memory" on a given time interval

. The integral kernel

in (

1) is defined by a suitable "memory loss" function

. We consider here a simple exponential function

with

. Note that the proposed scheme (

1) is similar to the classic PID control design (see e.g., [28],[34]). The nonlinear function

in

1 constitutes a specific "control saturation" and can be defined as follows:

Here

are prescribed maximal and minimal current investment levels, respectively. The above "saturated" investment model constitutes a formal mathematical condition and serves as a natural restriction for the investment volume.

Assuming the investment decision

in (

2) and taking into consideration the stock price

, we next calculate the current return

:

If we use the CE analogy, we conclude that the proposed investment level

in (

1) plays a role of a "control input". Note that the current investment decision

is deployed at a present time instant

t under the condition of a natural unknownness of the market price

to the subsequent time instant

. By

and

we denote here a probability state space with a unknown probability measure. The stock price

is assumed to be a measurable stochastic function. Note that the current return

is calculated an a posteriori value, where

in (

3) denotes a concrete realization of the stochastic price

.

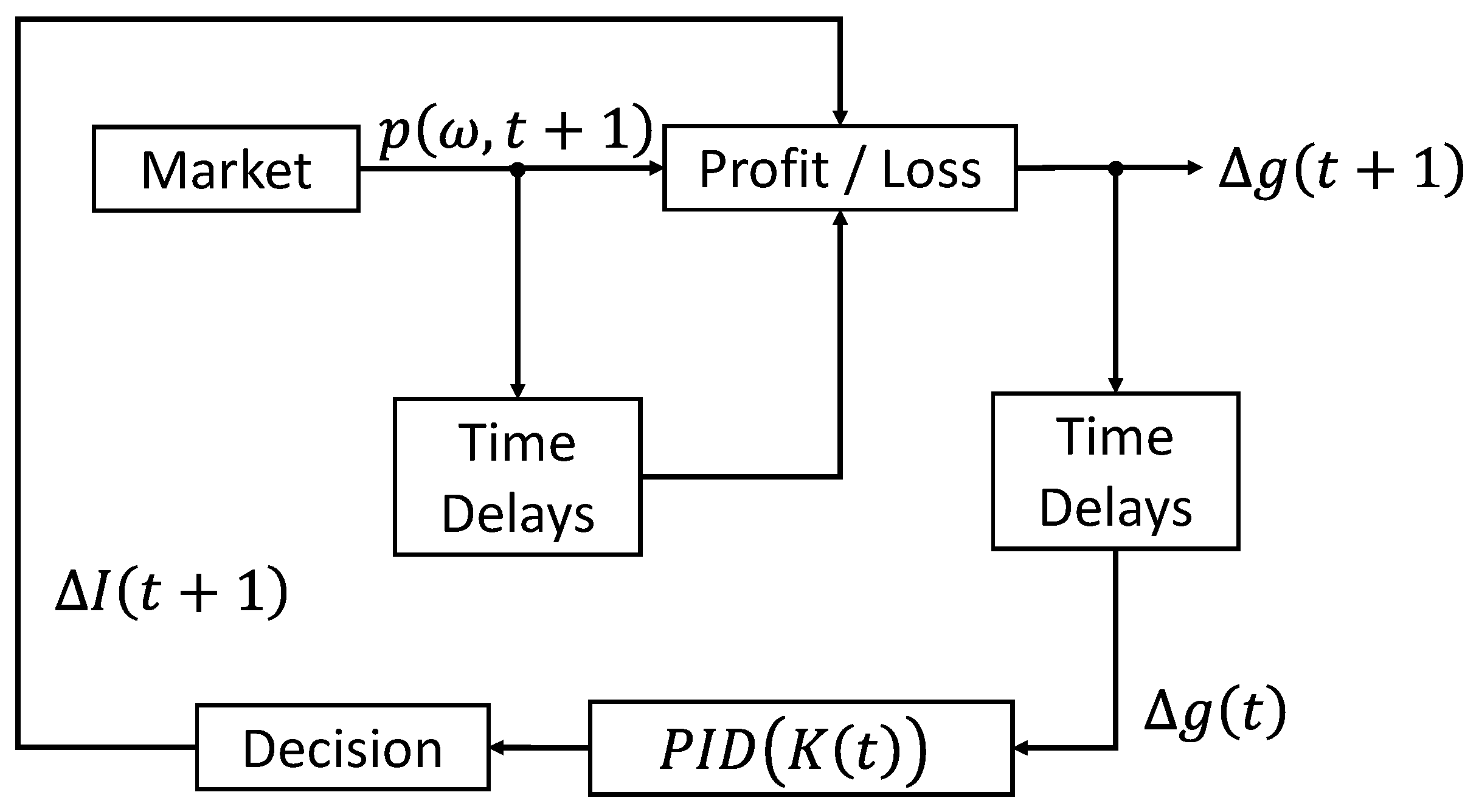

Since we have a clear CE analogy, we also can represent the above PID trading algorithm (

1)-(

3) using the block diagram. The corresponding block scheme of the proposed model-free PID trading strategy (

1)-(

3) is presented in

Figure 1.

Note that the feedback channel in (

1)-(

3) is implemented by the current return

in (

3). In fact, the PID trading algorithm (

1)-(

3) and the corresponding block diagram (

Figure 1) represent the so-called "delayed PID" scheme. We refer to [28] for details.

The general integral formula for

in (

1) can be rewritten in the discrete-time:

Recall that the main CE problem of the conventional PID control approach consists in defining an adequate PID gains tuning rule (see e.g., [27],[28] and references therein). In the generic real-world application fields of the classic PID controllers the tuning techniques are well established [2],[34]. For the conceptually new model-free PID algorithm under consideration, an adequate design of the PID gains tuning schemes constitutes a challenging problem. The suitable PID gains selection strategy immediately determines the trading decision signal by the proposed rule (

4). In fact, the development of an adequate (optimal) PID gains tuning scheme constitutes a key problem for the profitable PID based investment decision.

Let us also note that the model-free character of the proposed PID scheme (

1)-(

3) and (

4) indicates the possibility to apply some suitable Machine Learning (ML) approaches to the corresponding optimal PID gains tuning problem. We refer to [12],[13],[26] for the technical details related to the Reinforcement Learning (RL) approach and to some applications of the ML techniques in the modern AT.

3. Advanced Statistical Description of the Stock Market Data

This section introduces some specific subsequential market characteristics and describes our discovery of the concrete probability distribution functions associated with these new quantities. We study here the PID gains tuning problem and use the obtained statistical information related to the stock market. Let us introduce the following "price/volume" ratio:

Here

is an unknown (stochastic) price at the time instant

and

is an investment volume at the same time instant:

Note that (

6) expresses the entities number of a traded financial instrument (for example, futures trading). The comprehensive (a posteriori) statistical analysis of a wide spectrum of stock instruments demonstrates that the pdf of the above value

constitutes a specific log-normal distribution (see e.g., [18],[20],[35],[44] and references therein). Clearly, the real investment volumes of a hedge fund, a private trader or of a bank are usually a restricted. In the case of the PID trading algorithm (

1)-(

3), the maximal investment volume is formalized by the bounded of

in (

1) and (

6).

The log-normal pdf related to the financial markets has mainly been studied for option prices. In this connection we also refer to the celebrated Black and Scholes model [15]. A useful discussion on this subject can also be found in [40]. Let us also mention the empirical log-normal pdf’s for some volatility involved quotients and other stock market indicators (see e.g., [1],[5],[18],[23]). We next analyze the stationary statistical distribution

of the quantity

from (

5):

Here

denotes a statistical mean,

is a dispersion and

denotes a shifting. Note that (

7) is often called "three-parameters"

log-normal distribution (see e.g., [1],[18]). The concrete parameter values of the log-normal pdf

can be calculated using the backtesting on the historical stock market data. As mentioned above, (

7) constitutes an adequate model distribution for the introduced price/volume ratio

. The quality of this statistic model can be established by application of the Chi-Quadrat test for distributions qualification. We refer to [35] for necessary technical details. For example, one can consider the normalized value

for the above test. Here

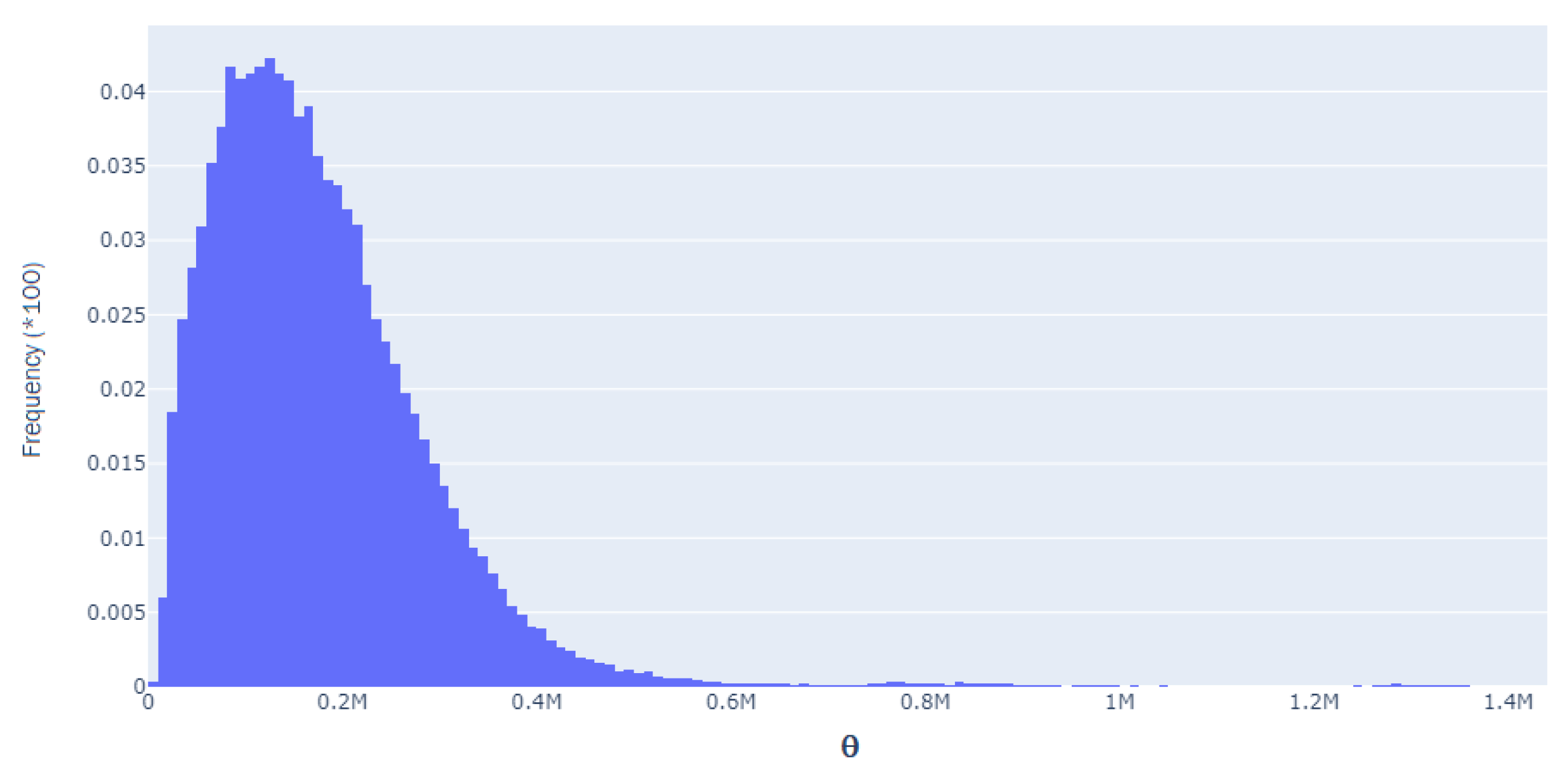

q is the number of degrees of freedom. The concrete stock market histogram for a monthly Binance BTC / USDT price/volume ratio

is depicted in

Figure 2.

In parallel to (

7) we also consider the log-normal pdf for the following price/price ratio:

where

are the stock prices and investment volumes data for the time instants

. The log-normal probability distribution for the value

in (

8) was established in [1]. We denote this pdf by

. We also refer to [5],[16] for the necessary statistical and econometrical details.

We next obtain

and

Expressions (

9)-(

10) make it possible to generate a part of the complete investment decision, namely, the decision about the investment volume

to the time instant

:

Observe that

and

in (

11) are known values. Additionally, the price/volume ration

and the price/price ratio

can effectively be simulated using the corresponding log-normal probability distribution functions. We next can also forecast the value

in (

11) using the corresponding log-normal distribution (see [1],[5],[18]). We assume here that the necessary parameters of the log-normal distributions of the values

and

are previously determined by the generic backtesting technique. For example, for (

7) we need to identify

. This identification procedure is performed using the available statistics in form of a histogram (see e.g.,

Figure 2).

Assuming the investment volume decision (

11), we immediately get a tuning scheme for the PID gains

. Combining (

6) and (

11) we finally obtain

Since the investment decision

is designed by the PID rule (

1)-(

2), the obtained formulae (

12) constitutes a specific tuning restriction for the PID gains

. This novel tuning approach involves the advanced statistical (log-normal) analysis of the financial market behaviour.

4. Data-Driven Optimization Approaches to the PID Gains Tuning

A credible anticipating strategy for the behaviour of stock markets (using a certain amount of historical data) constitutes the main conceptual problem of the algorithmic trading. In the framework of the proposed PID trading algorithm (

1)-(

3), we have to incorporate into the PID methodology an additional optimization procedure for a "best choice" of the PID gains. In this section, we describe two advanced optimization approaches to the optimal PID gains tuning. The resulting PID based strategies (

1)-(

3) with an optimal gain selection are next called optimal PID trading algorithms. Let us note that the "advanced" character of the optimal tuning mentioned above corresponds to the model-free structure of the proposed PID trading scheme. The model-free nature of an optimal PID implementation (

1)-(

3) also indicates the usability of the modern ML and RL approaches for optimal PID gains selection problems. Let us refer to [12],[13],[26] for some technical results and novel ideas.

4.1. Regression Involved Gains Optimization

In this section we use a conventional regression based optimization framework applied to the historical stock data. Our aim is to combine the least square optimization with the generic Forward Testing (FT). Note that the FT technique is a common methodology of the modern AT (see e.g., [23],[26]). It includes the so called In-Sample and Out-of-Sample data subsets of the initially given historical data set. The In-Sample data set is part of historical data on which the optimization is performed. The subset of historical data that has been reserved for a possible validation of the optimized trading algorithm is known as an Out-of-Sample data set.

We now choose a number

as a cardinal number of the In-Sample set and consider the corresponding investment volumes:

Let

denotes a cardinal number of the Out-of-Sample sat such that the complete historical data set under consideration has

elements. Using the given (nonlinear) structure of the PID trading algorithm (

1)-(

3), we next introduce the following main optimization problem

Evidently, (

13) constitutes a specific nonlinear regression determined on the In-Sample data set. Note that problem (

13) involves the previously obtained statistical characterisation (

12). This statistical result for the PID gains constitutes a natural restriction in the minimization problem (

13). The main problem (

13) can be solved by some known numerical optimization methods (see e.g., [3],[21],[29] and references therein). It finally leads to the optimal PID gains selection:

The Out-of-Sample data set can next be used for the validation procedure of optimal solution

obtained using the In-Sample set. This validation is based on the comparison of two values of the same objective functional from (

13), namely, the In-Sample optimal value

and the following Out-of-Sample optimal value

Note that the Out-of-Sample optimal investment

in (

14) is calculated using the optimal gains

(obtained on the In-Sample data set) and the basic expression from (

1). Moreover, the set of investment volumes

in (

14) corresponds to the Out-of-Sample set:

The above optimization problem (

13) will be considered as a consistent (optimal) PID gains selection procedure if

for a sufficiently small prescribed

. Let us note that an alternative validation procedure for the PID gains optimization can involve the celebrated Monte Carlo approach (see e.g., [22],[37]).

We now apply the validated optimal gains vector

for defining the deployed (optimal) investment level

using the PID algorithm (

1)-(

3). The resulting optimal investment volume

for the time instant

has the following expression:

Note that the complete trading decision at the time instant

generated by the proposed algorithm can be formalized using the following "trading signal / volume" pair:

Here

is the signum function. Moreover,

denotes the optimal trading signal and

is the absolute value of the optimal investment volume. The above trading signal / volume pair definitively determines a subsequent

- trading decision in the proposed PID trading framework. The nonlinear optimization approach (

13) implies that the optimal investment decision

constitutes an a priori (optimal) value in the above trading signal / volume pair. The corresponding optimal volume

is in fact an a posteriori value for the subsequent time instant

.

4.2. On the Stochastic Optimal Gains Tuning

The optimal gains selection problem (

13) from the previous section constitutes a data-driven regression based approach. This generic optimization approach involves a constrained nonlinear optimization and uses the given historical stock market data. Additional FT technique discussed in the previous section constitutes in fact an adequate expert driven clustering of the complete historical data set. Note that this separation of the initially given data set is methodologically similar to the main idea of the celebrated Monte Carlo method (see [14],[22],[37] and references therein). Let us recall that the classic Monte Carlo method also contains the so called "training" and "validation" solution steps (see e.g., [14],[17],[42]).

In this section we will formulate the stochastic optimization problem for an adequate gains selection in the proposed PID trading framework (

1)-(

3). The stochastic programming problem we consider is conceptually different to the regression-like problem (

13). It involves the specific statistical description of the stock markets obtained in

Section 3. Using (

11), we next introduce the following minimization problem:

The above optimization problem constitutes a nonlinear stochastic program (see e.g., [14],[42]). Clearly, problem (

15) now contains a probabilistic costs functional

The stochastic program (

15) can be interpreted as a two stage or a multi stage problem. We refer to [14],[32],[45] for the necessary concepts of stochastic programming. However, we consider here the scenarios based Monte Carlo optimization approach (see e.g., [14]). In this section, we study this stochastic problem (

15) only from a conceptual point of view and discuss the corresponding Monte Carlo sampling solution method.

Taking into consideration the mean value approach, we replace (

15) by the following deterministic program:

Here

is the mathematical expectation operator with respect to the (joint) pdf for the pair

of quotients

and

introduced in

Section 3. Note that the log-normal probability distribution functions

and

imply a statistical non-robustness of the mathematical expectation used in (

16). The mean value optimization problem (

16) does not possesses the necessary robustness property (see [25]). This fact can cause the deposit losses when problem (

16) is directly used in the trading. In this situation one can replace the mean value

in problem (

16) by a generic robust statistical characteristic (for example, the median and ctr.).

Let us also note that the auxiliary (deterministic) problem (

16) constitutes a data-driven optimization. These minimization problems incorporates the empiric log-normal probability distribution functions

and

. This fact constitutes a methodological difference between the regression based PID gains optimization (

13)-(

14) and the alternative PID tuning strategy based on the stochastic optimization problem (

15).

The auxiliary problem (

16) provides a possible approach for the numerical treatment of the initial problem (

15). Following the Monte Carlo methodology, we define some probabilistic scenarios

with the corresponding probabilities

associated with the realizations of the stochastic variables ("stochastic events")

The celebrated scenarios based approximating problem for (

16) can now be formalized as follows:

Evidently, the finite sum in (

17)

approximates the mathematical expectation

in the auxiliary problem (

16).

Similar to the FT methodology used in the previous section, we now divide the above

N-dimensional event set

into two subsets and define a suitable

-dimensional training set and an additional

-dimensional validation set

Here

with

The above division of the initially given

N-dimensional scenarios set

makes it possible to consider the basic Monte Carlo approximating problem (

17) on the training set

and then on the full scenarios set

. In the case of an admissible mismatch in the values of the objective functionals of problem (

17) considered on

and on the full set

the optimization procedure is successfully completed. Otherwise, one needs to increase the dimensionality of the historical data set and repeat the above training and validation steps in the Monte Carlo framework.

5. Frequency Domain Representation of the PID Trading Algorithm

A formal frequency domain involved description of the feedback based trading approach can be found in [4]. Let us recall that the Fourier transform and the corresponding frequency domain analysis constitute a generic methodology in the classic CE. We refer to [34] for the corresponding mathematical foundations and some computational details of the Laplace and Fourier transforms in the CE framework.

In this section, we discuss the frequency domain analysis of the proposed PID trading algorithm (

1) - (

3). Let us also observe that the above PID trading algorithm can be interpreted as a specific control design with the time delays. Taking into consideration the main profit formulae (

3), the linear expression

in (

1) can also be considered as an ARMA-like formal model. Note that the main expression for

in the PID formulae (

1) constitutes in fact a nonlinear ARMA process. Let us also observe that the discrete time PID control (

4) can also be considered as a delayed proportional control.

We next apply the celebrated Discrete Signal Processing (DSP) approach and interpret the linear expression for

in (

1) as a linear filter. Application of the z-transform to the discrete PID (

4) implies the following generic form of the causal discrete-time Finite Impulsive Response (FIR) filter (see [35]):

Here

denotes the resulting z-transform of the initially given output signal

. Note that

z is the proper variable in (

18). We next can easily obtain the Frequency Response (FR) function for the above FIR filter (

18). Recall that FR of the filter (

18) is a result of a the formal application of the DTFT (Discrete Time Fourier Transform) to the FIR (

18). Following [35] we next put

where

j in (

18) denotes the imaginary unit. The FR of the PID trading algorithm (

1)-(

3) can now be written as follows:

Here

f denotes the frequency of a dynamic process under consideration. Note that the obtained FR expression (

19) for the proposed PID trading algorithm makes it possible to apply the well developed frequency domain methodology to the PID gains tuning problem. The historical stock market data can be used here for an optimal selection of the above PID gains. Note that a practical calculation of a DTFT is usually performed by the so called Fast Fourier Transform (FFT). This fact is motivated by a considerable number of the efficient FFT codes in the main programming languages.

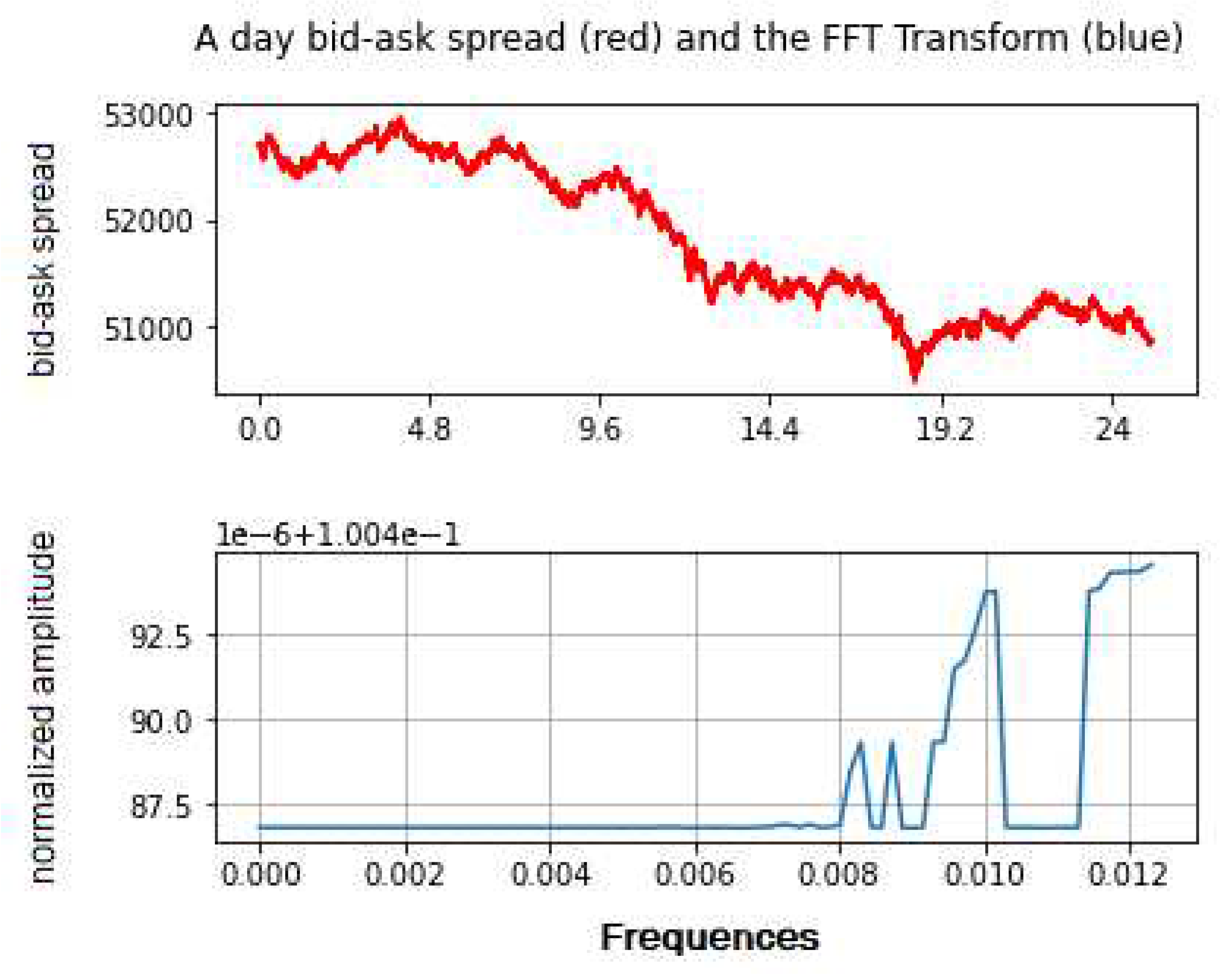

Let us give an illustrative computational example of the FR function. Consider an one day bid-ask spread dynamics of the Binance BTC / USDT exchange and its DTFT (

Figure 3).

In fact, the resulting frequency diagram, namely,

Figure 3 represents a specific "market energy" distribution associated with the corresponding price frequencies. This energetic interpretation of the resulting DTFT is related to the fundamental Parseval´s theorem from the classic Fourier analysis (see e.g., [35]). Motivating from this consideration we introduce the following market energy concept:

where

N is the dimension of an one day data set under consideration and

is the corresponding Frequency response associated with this data set.

The developed optimal PID trading algorithm (

1)-(

3) can also be combined with the several well-known momentum (trading) strategies (see e.g., [31],[32]). For example, a suitable trend following algorithm provides a future promising tool for an optimal FR based PID gains selection procedure. In fact, the frequency domain analysis and the above market energy concept constitutes a natural analytic tool for the HFT algorithmic trading. Finally note that the DTFT naturally represents the frequent character of the market prices and can be used as a new volatility indicator (in parallel to the well-known ATR volatility measure).

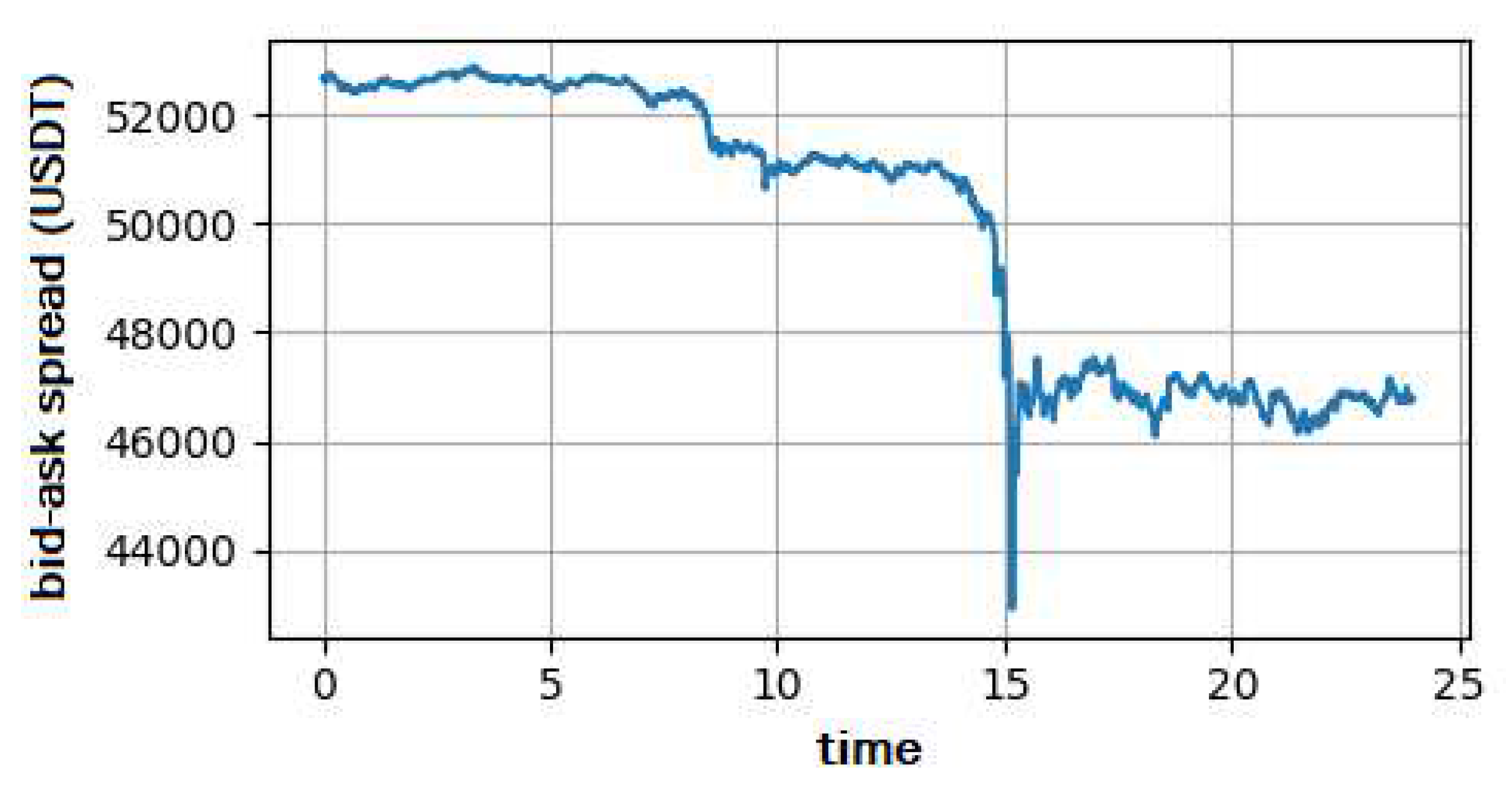

6. On the Implementation of the Optimal PID Trading Algorithm

We now present an application of the developed PID based AT technique to a real-world stock market data. Consider the Binance Bitcoin / USDT futures stock and apply the proposed optimal PID trading algorithm (

1)-(

3). The example of an one-day BTC / USDT futures bid-ask spread dynamics is presented in

Figure 4.

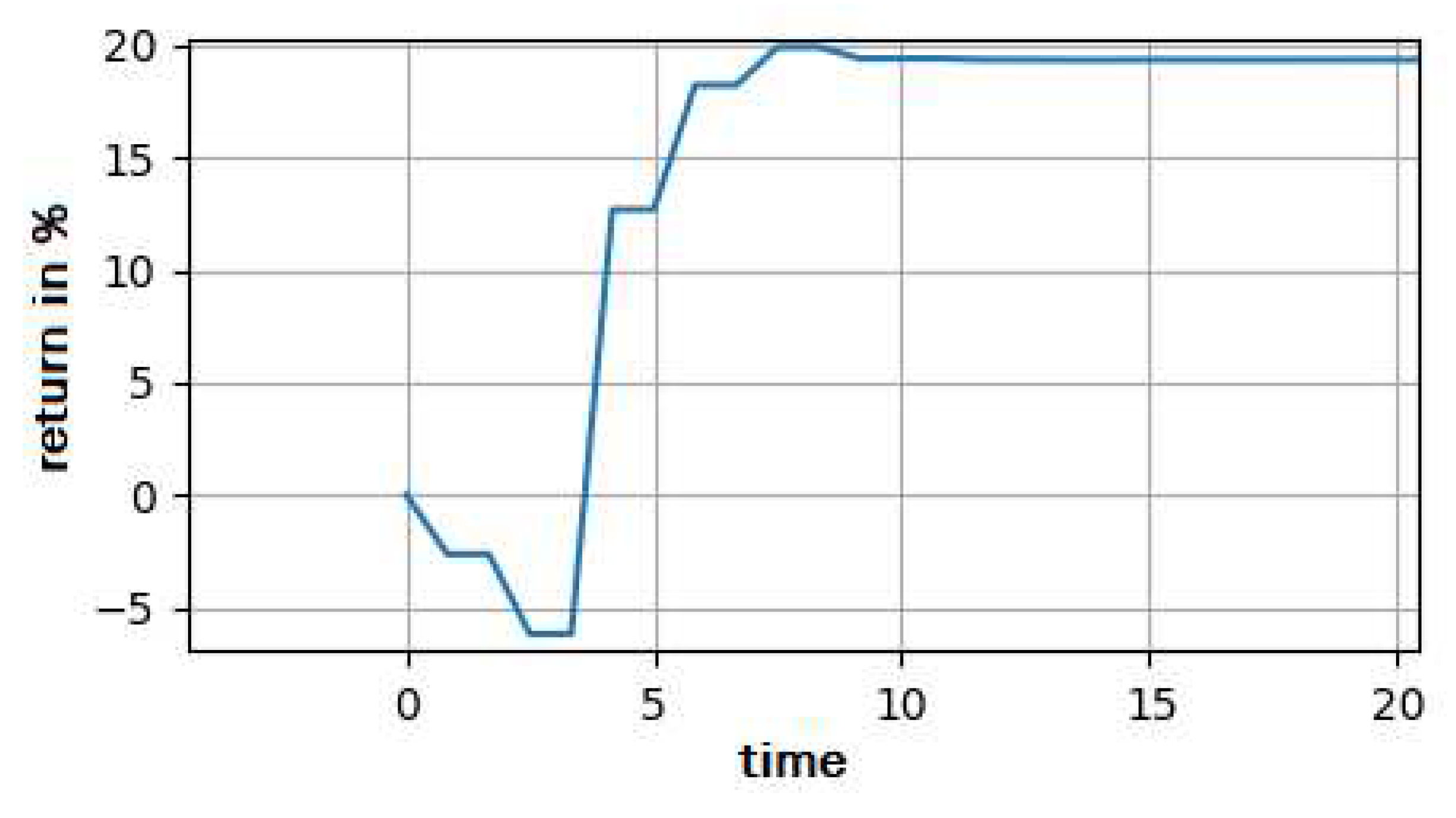

We have applied the developed PID trading algorithm with the optimized gauns to the above one-day price market dynamics. The PID gains optimal tuning procedure for this example was performed using the data-driven optimization discussed in

Section 4.1. The corresponding (globally positive) dynamics of the corresponding return is presented in

Figure 5.

Note that the operation time for every subsequent trading decision of the resulting optimal PID in this example is timely restricted. The stock market under consideration has an obvious high-frequency behaviour. This fact naturally implies some expected difficulties of the common trading algorithms. In particular, this concerns the widely used moving average trading and the general trend following trading strategies.

As one can see, the proposed optimal PID constitutes an adequate strategy for the HFT. The time ticks in the stock example under consideration are significatively dense. The length of the corresponding intervals of trading buckets is equal to 1.728 sec.

Let us also observe the generic "hyperregulation and stabilization" dynamics of the resulting PID trading algorithm with optimized gains (see

Figure 4). This stabilizing dynamics is a characteristic behaviour for the conventional PID controller. We refer to [3],[27],[28],[34] for the corresponding examples and further technical details.

The presented practical example illustrates the implementability and effectiveness of the developed PID trading framework. As we can see the resulting dynamics of the return constitutes a profitable financial behaviour.

7. Concluding Remarks

In this paper, we developed a novel trading algorithm based on the model-free PID control methodology and some advanced statistical characteristics of the stock market. We considered an idealized financial market under the assumption of only one asset. However, the proposed analytic approach and the resulting trading methodology can naturally be extended to the real-time multi-asset trading. It can also be combined with some classical trading strategies (momentum strategies).

The main idea of the proposed PID control approach to the algorithmic trading consists in modern data involved optimization techniques for the PID gains tuning. These data-driven optimization procedures determine an optimal "calibration" (tuning) of the main PID trading parameters. The resulting optimal PID gains finally define the subsequent trading decision (trading signal and trading volume). The optimization procedures we applied involve the conventional FT techniques and the regression analysis. The tuning procedure also involves the backtesting technique. We also shortly discussed a possible application of the classic stochastic optimization and Monte Carlo method in the framework of the optimal PID algorithm.

The given historical stock market data, the statistical properties mentioned above and the data-driven optimization of the PID gains are applied to a practical stock example. The resulting optimal trading PID strategy generated a profitable investment decision of the "buy/sell/hold" type for the stock market orders. The proposed CE based approach to the modern AT involves a combination of some known mathematically rigorous tools. We use the classic feedback control methodology, applied statistics and computational optimization. The model-free character of the proposed PID trading scheme clearly indicates the possibility to apply some modern ML approaches to the PID trading algorithm design (see [12],[13],[26]). We also expect a profitable behaviour of this trading methodology in the High-Frequency Trading.

Note that the developed PID based trading approach can also be involved (as an additional tool) into the several theoretic concepts of the modern financial engineering. For example, it can be studied in the framework of the well established financial time series analysis and Kalman filter techniques (see e.g., [3],[6],[29]). The proposed PID trading algorithm is also compatible with the possible price prediction and trend following techniques (see [24]).

Finally note that the algorithmic trading strategy proposed in our paper constitutes an initial theoretical development. We are mostly concentrated here on the mathematical and algorithmic aspects of the proposed technique. The prototypes of the financial solutions for the stock market proposed in our contribution need a comprehensive computational development, additional simulations, prototyping and further backtesting on the real stock market data.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Antonioua, I.; Ivanova, V.V.; Ivanov, V.V.; Zrelova, P.V. On the log-normal distribution of stock market data. Physica A, 2004, 331, 617–638. [Google Scholar] [CrossRef]

- Azhmyakov, V. A Relaxation Based Approach to Optimal Control of Switched Systems; Elsevier: Oxford, UK, 2019. [Google Scholar]

- Azhmyakov, V.; Arango, J.P.; Bonilla, M.; del Toro, R.J.; Pickl, S. Robust state estimations in controlled ARMA processes with the non-Gaussian noises: applications to the delayed dynamics. IFAC PapersOnline, 2021, 54, 334–339. [Google Scholar] [CrossRef]

- Azhmyakov, V.; Shirokov, I.; Trujillo, L.A.G. Application of a switched PIDD control strategy to the model-free algorithmic trading. IFAC PapersOnline, 2022, 55, 145–150. [Google Scholar] [CrossRef]

- Azhmyakov, V.; Shirokov, I.; Dernov, Y.; Trujillo, L.A.G. On the Proportional-Integral-Derivative based trading algorithm under the condition of the log-normal distribution of stock market data. In Proceedings of the The Sixteenth International Conference on Advanced Engineering Computing and Applications in Sciences (ADVCOMP 2022); pp. 17–21.

- Bahmani, O.; Ford, B. Kalman Filter approach to estimate the demand for international reserves. Applied Economics, 2004, 36, 1655–1668. [Google Scholar] [CrossRef]

- Barmish, B. R. On trading of equities: a robust control paradigm. IFAC Proceedings Volumes, 2008, 41, 1621. [Google Scholar] [CrossRef]

- Barmish, B.R.; Primbs, J.A. On market-neutral stock trading arbitrage via linear feedback. In Proceedings of the American Control Conference, Montreal, Canada, 2012; pp. 3693–3698. [Google Scholar]

- Barmish, B.R.; Primbs, J.A. On a new paradigm for stock trading via a model-free feedback controller. IEEE Transactions on Automatic Control, 2016, 61, 662. [Google Scholar] [CrossRef]

- Baumann, M. H. On stock trading via feedback control when underlying stock returns are discontinuous. IEEE Transactions on Automatic Control, 2017, 62, 2987. [Google Scholar] [CrossRef]

- Bemporad, A.; Gabbriellini, T.; Puglia, L.; Bellucci, L. Scenario-based stochastic model predictive control for dynamic option hedging. In Proceedings of the IEEE Conference on Decision and Control, Atlanta, USA, 2010; pp. 3216–3221. [Google Scholar]

- Bertsekas, D. Reinforcement Learning and Optimal Control; Athena Scientific: Nashua, USA, 2019. [Google Scholar]

- Bertsimas, D.; Lo, A.W. Optimal control of execution costs. Journal of Financial Markets, 1998, 1, 1–50. [Google Scholar] [CrossRef]

- Birge, J.R.; Louveaux, F. Introduction to Stochastic Programming; Springer: New York, USA, 2011. [Google Scholar]

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. Journal of Political Economy, 1973, 81, 637. [Google Scholar] [CrossRef]

- Brooks, C. Introductory Econometcs for Finance; Cambridge University Press: Glasgow, UK, 2015. [Google Scholar]

- Cornuejols, G.; Pena, J.; Tutuncu, R. Optimization Methods in Finance; Cambridge University Press: Cambridge, UK, 2018. [Google Scholar]

- Crow, E.L.; Shimizu, K. (Eds.) Lognormal Distributions, Theory and Applications; Marcel Dekker, Inc.: New York, 1988. [Google Scholar]

- Formentin, S.; Previdi, F.; Maroni, G.; Cantaro, C. Stock trading via feedback control: an extremum seeking approach. In Proceedings of the Mediterranean Conference on Control and Automation, Zadar, Croatia, 2018; pp. 523–528. [Google Scholar]

- Gallager, R.G. Stochastic Processes; Cambridge University Press: NY, USA, 2013. [Google Scholar]

- Gill, P.E.; Murray, W.; Wright, M.H. Practical Optimization; Academic Press: New York, USA, 1981. [Google Scholar]

- Hammel, C.; Paul, W.B. Monte Carlo simulations of a trader-based market model. Physica A, 2002, 313, 640–650. [Google Scholar] [CrossRef]

- Hens, T.; Rieger, M.O. Financial Economics; Springer: Berlin, Germany, 2010. [Google Scholar]

- Huang, S. Online option price forecasting by using unscented Kalman filters and support vector machines. Journal of Expert Systems with Applications 2008, 34, 2819–2825. [Google Scholar] [CrossRef]

- Huber, P.J.; Ronchetti, E.M. Robust Statistics; Wiley: New York, USA, 2005. [Google Scholar]

- Jansen, St. Machine Learning for Algorithmic Trading; Packt: Birmingham, UK, 2020. [Google Scholar]

- Issidori, A. Nonlinear Control Systems; Springer: London, UK, 1995. [Google Scholar]

- Khalil, H. K. Nonlinear Control; Pearson: Boston, USA, 2015. [Google Scholar]

- Lewis, F. L. Optimal Estimation; Wiley: New York, USA, 1986. [Google Scholar]

- Liu, J.; Wright, S.J. Asynchronous stochastic coordinate descent: Parallelism and convergence properties. SIAM Journal on Optimization 2015, 25, 351–376. [Google Scholar] [CrossRef]

- Malekpour, S.; Primbs, J.A.; Barmish, B.R. On stock trading using a PI controller in an idealized market: the robust positive expectation property. In Proceedings of the IEEE Conference on Decision and Control, Florence, Italy, 2013; pp. 1210–1216. [Google Scholar]

- Michaud, R.; Michaud, R. Efficient Asset Management; Oxford University Press: UK, 2008. [Google Scholar]

- Nemirovski, A.; Juditsky, A.; Lan, G.; Shapiro, A. Robust stochastic approximation approach to stochastic programming. SIAM Journal on Optimization, 2009, 19, 1574–1609. [Google Scholar] [CrossRef]

- Poznyak, A. Advanced Mathematical Tools for Automatic Control Engineers: Deterministic Technique; Elsevier: NY, USA, 2008. [Google Scholar]

- Poznyak, A. Advanced Mathematical Tools for Automatic Control Engineers: Stochastic Tools; Elsevier: NY, USA, 2009. [Google Scholar]

- Prakash, J.; Srinivasan, K. Design of nonlinear PID controller and nonlinear model predictive controller for a continuous stirred tank reactor. ISA Transactions, 2009, 48, 273–282. [Google Scholar] [CrossRef] [PubMed]

- Rubinstein, R.Y. Simulation and the Monte Carlo Method; John Wiley Inc.: New York, USA, 1981. [Google Scholar]

- Rudoy, M.B.; Rohrs, C.E. A dynamic programming approach to two-stage mean-variance portfolio selection in cointegrated vector autoregressive systems. In Proceedings of the IEEE Conference on Decision and Control, Cancun, Mexico, 2008; pp. 4280–4285. [Google Scholar]

- Shapiro, A.; Homem-de-Mello, T. On the rate of convergence of optimal solutions of Monte Carlo approximations of stochastic programs. SIAM Journal on Optimization 2000, 11, 70–86. [Google Scholar] [CrossRef]

- Taylor, S. Modeling Financial Time Series; Wiley: Chichester, UK, 1986. [Google Scholar]

- Vo, N.; Slepaczuk, R. Applying hybrid ARIMA-SGARCH in algorithmic investment strategies on S&P500 index. Entropy 2022, 24. [Google Scholar]

- Wets, R.J-B. Stochastic programming. In Optimization, Handbooks in Operations Research and Management Science vol. 1; Nemhauser, G.L., Rinnooy Kan, A.H.G., Todd, M.J., Eds.; North–Holland: Amsterdam, Netherlands, 1990. [Google Scholar]

- Zenios, S.A. Financial Optimization; Cambridge University Press: Cambridge, UK, 1993. [Google Scholar]

- Ziemba, W.T.; Vickson, R.G. Stochastic Optimization Models in Finance; Academic Press: New York, USA, 1975. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).