Submitted:

21 April 2023

Posted:

23 April 2023

You are already at the latest version

Abstract

Keywords:

MSC: 62A88; 91G20; 91G30

1. Introduction

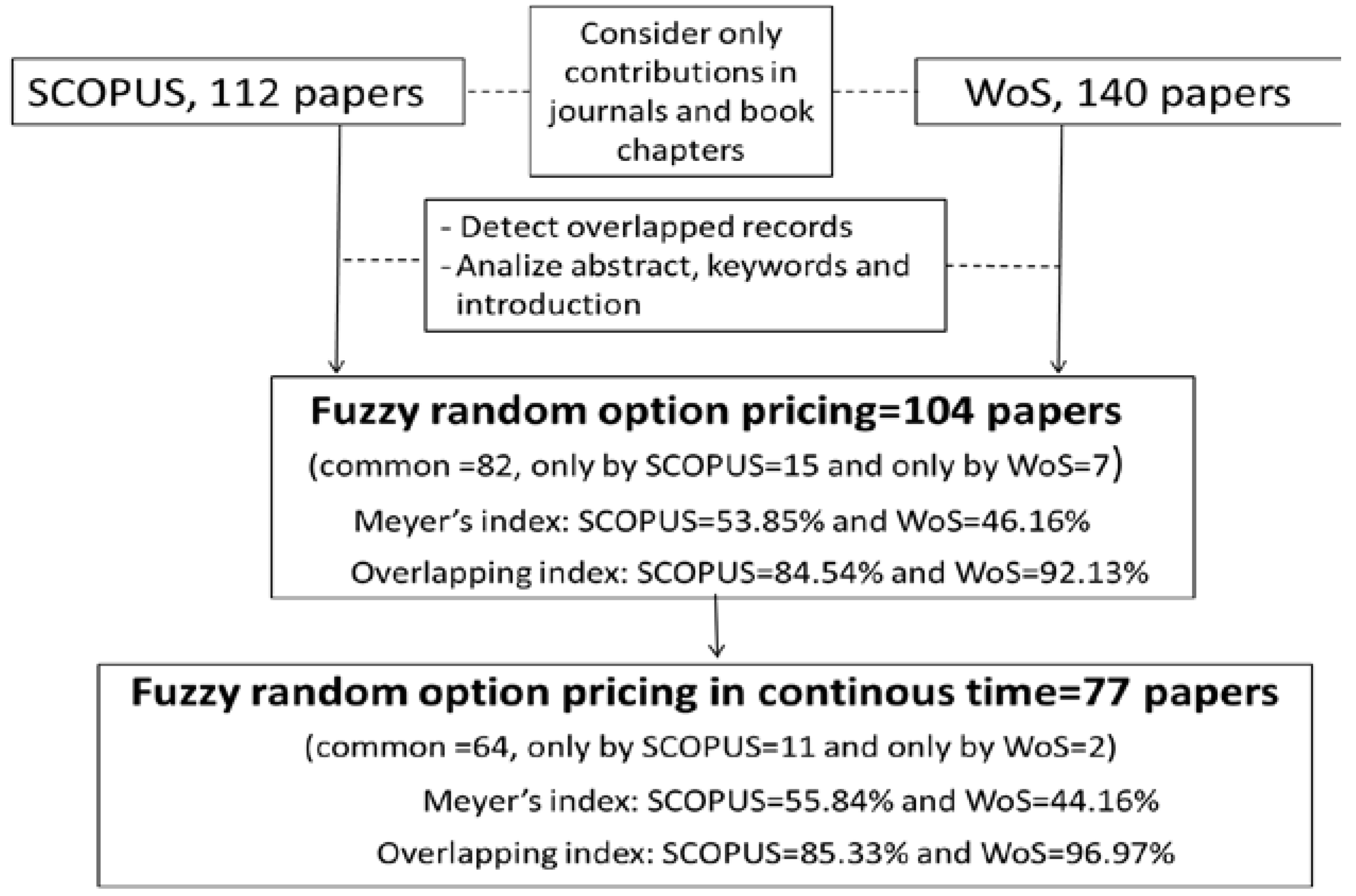

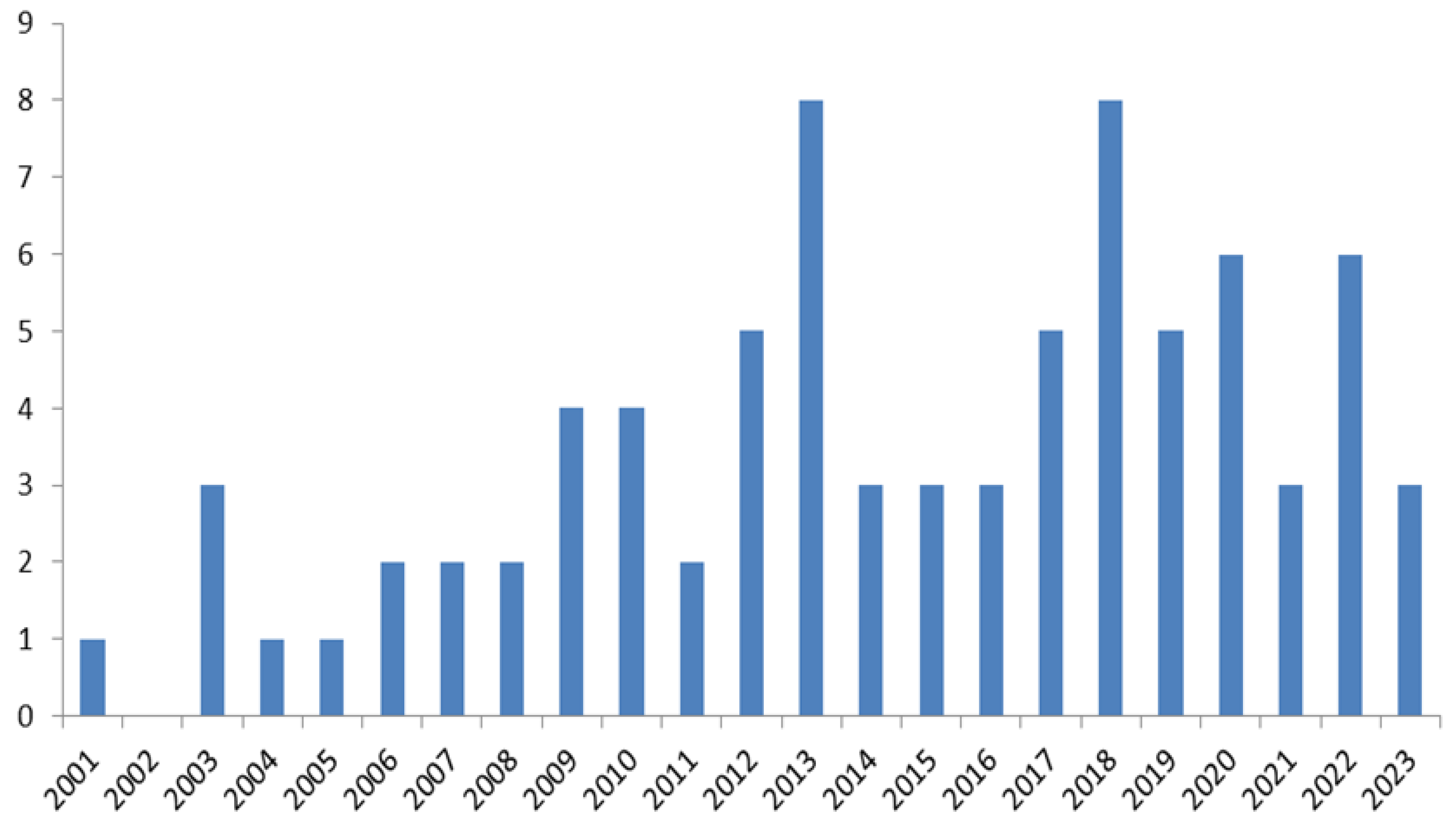

2. Bibliographical Analysis

2.1. Methodology

2.2. Classification

| Year | Authors | Article Title | Source Title | Citations |

|---|---|---|---|---|

| 2003 | Carlsson, C; Fuller, R. [33] | A fuzzy approach to real option valuation | Fuzzy Sets and Systems | 168 |

| 2003 | Yoshida, Y. [70] | The valuation of European options in uncertain environment | European Journal of Operational Research | 119 |

| 2004 | Wu, HC. [63] | Pricing European options based on the fuzzy pattern of Black-Scholes formula | Computers & Operations Research | 105 |

| 2001 | Zmeskal, Z. [74] | Application of the fuzzy-stochastic methodology to appraising the firm value as a European call option | European Journal of Operational Research | 81 |

| 2007 | Wu, HC. [64] | Using fuzzy sets theory and Black-Scholes formula to generate pricing boundaries of European options | Applied Mathematics and Computation | 80 |

| 2009 | Chrysafis, KA.; Papadopoulos, BK. [36] | On theoretical pricing of options with fuzzy estimators | Journal of Computational and Applied Mathematics | 50 |

| 2009 | Thavaneswaran, A.; Appadoo, S. S.; Paseka, A. [56] | Weighted possibilistic moments of fuzzy numbers with applications to GARCH modeling and option pricing | Mathematical and Computer Modelling | 50 |

| 2007 | Thiagarajah, K.; Appadoo, S.S.; Thavaneswaran, A.[57] | Option valuation model with adaptive fuzzy numbers | Computers & Mathematics With Applications | 49 |

| 2005 | Wu, HC [62] | European option pricing under fuzzy environments | International Journal of Intelligent Systems | 36 |

| 2010 | Nowak, P.; Romaniuk, M. [85] |

Computing option price for Levy process with fuzzy parameters | European Journal of Operational Research | 35 |

| 2013 | Thavaneswaran, A.; Appadoo, S. S.; Frank, J. [55] | Binary option pricing using fuzzy numbers | Applied Mathematics Letters | 33 |

| 2015 | Muzzioli, S.; Ruggieri, A.; De Baets, B. [52] | A comparison of fuzzy regression methods for the estimation of the implied volatility smile function | Fuzzy Sets And Systems | 31 |

| 2009 | Xu, W.; Wu, C.; Xu, W.; Li, H. [92] |

A jump-diffusion model for option pricing under fuzzy environments | Insurance Mathematics & Economics | 31 |

| 2014 | Nowak, P.; Romaniuk, M. [87] |

Application of Levy processes and Esscher transformed martingale measures for option pricing in fuzzy framework | Journal of Computational and Applied Mathematics | 29 |

| 2012 | Zhang, LH; Zhang, WG; Xu, WJ; Xiao, WJ [96] |

The double exponential jump diffusion model for pricing European options under fuzzy environments | Economic Modelling | 29 |

| 2017 | Muzzioli, S.; De Baets, B. [20] |

Fuzzy Approaches to Option Price Modeling | IEEE Transactions on Fuzzy Systems | 28 |

| Year | Author | Tittle | Source Tittle | Citations |

|---|---|---|---|---|

| 2003 | Carlsson, C., Fullér, R. [33] | A fuzzy approach to real option valuation | Fuzzy Sets and Systems | 195 |

| 2003 | Yoshida, Y. [70] | The valuation of European options in uncertain environment | European Journal of Operational Research | 122 |

| 2004 | Wu, HC. [63] | Pricing European options based on the fuzzy pattern of Black-Scholes formula | Computers and Operations Research | 112 |

| 2007 | Wu, HC. [64] | Using fuzzy sets theory and Black-Scholes formula to generate pricing boundaries of European options | Applied Mathematics and Computation | 76 |

| 2001 | Zmeškal, Z. [74] | Application of the fuzzy-stochastic methodology to appraising the firm value as a European call option | European Journal of Operational Research | 73 |

| 2009 | Thavaneswaran, A., Appadoo, S.S., Paseka, A. [56] | Weighted possibilistic moments of fuzzy numbers with applications to GARCH modeling and option pricing | Mathematical and Computer Modelling | 55 |

| 2009 | Chrysafis, K.A., Papadopoulos, B.K. [36] | On theoretical pricing of options with fuzzy estimators | Journal of Computational and Applied Mathematics | 51 |

| 2007 | Thiagarajah, K., Appadoo, S.S., Thavaneswaran, A. [57] | Option valuation model with adaptive fuzzy numbers | Computers and Mathematics with Applications | 51 |

| 2005 | Wu, HC., [62] | European option pricing under fuzzy environments | International Journal of Intelligent Systems | 46 |

| 2015 | Muzzioli, S.; Ruggieri, A.; De Baets, B. [52] |

A comparison of fuzzy regression methods for the estimation of the implied volatility smile function | Fuzzy Sets And Systems | 31 |

| 2010 | Nowak, P., Romaniuk, M., [85] |

Computing option price for Levy process with fuzzy parameters | European Journal of Operational Research | 36 |

| 2017 | Muzzioli, S., De Baets, B. [20] | Fuzzy Approaches to Option Price Modeling | IEEE Transactions on Fuzzy Systems | 32 |

| 2009 | Xu, W., Wu, C., Xu, W., Li, H. [92] |

A jump-diffusion model for option pricing under fuzzy environments | Insurance: Mathematics and Economics | 32 |

| 2013 | Thavaneswaran, A., Appadoo, S.S., Frank, J. [55] |

Binary option pricing using fuzzy numbers | Applied Mathematics Letters | 31 |

| 2014 | Nowak, P., Romaniuk, M. [87] |

Application of Levy processes and Esscher transformed martingale measures for option pricing in fuzzy framework | Journal of Computational and Applied Mathematics | 29 |

| 2012 | Zhang, L.-H., Zhang, W.-G., Xu, W.-J., Xiao, W.-L. [96] | The double exponential jump diffusion model for pricing European options under fuzzy environments | Economic Modelling | 29 |

| 2011 | Guerra, M.L., Sorini, L., Stefanini, L. [41] | Option price sensitivities through fuzzy numbers | Computers and Mathematics with Applications | 27 |

| Author | Country | items | Author | Country | items |

|---|---|---|---|---|---|

| Nowak, P. | Poland | 7 | Liu, S. | China | 3 |

| Muzzioli, S. | Italy | 4 | Pawlowski, M. | Poland | 3 |

| Romaniuk, M. | Poland | 4 | Sorini, L. | Italy | 3 |

| Guerra, M.L. | Italy | 4 | Stefanini, L. | Italy | 3 |

| Andres-Sanchez, J. | Spain | 3 | Thavaneswaran, A. | Canada | 3 |

| Appadoo, S.S. | Canada | 3 | Vilani, G. | Italy | 3 |

| de Baets, B. | Belgium | 3 | Wu, H.C. | Taiwan | 3 |

| Figa-Talamanca, G. | Italy | 3 |

3. Fuzzy-Random Extension to Vasicek’s Equilibrium Term Model

3.1. The Equilibrium Model of the Yield Curve by Vasicek

3.2. An Extension of Vasicek’s Yield Curve with Fuzzy Parameters

3.3. Empirical Application of Fuzzy Vasicek’s Model in the Public Debt Bond Market of Euro Area

4. Conclusions and Further Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- A Dotsis, G. (2020). Option pricing methods in the City of London during the late 19th century. Quantitative Finance, 20, 5, 709-719. [CrossRef]

- Zimmermann, H., & Hafner, W. (2007). Amazing discovery: Vincenz Bronzin’s option pricing models. Journal of Banking & Finance, 31, 2, 531-546. [CrossRef]

- Merton, R. C. (1998). Applications of option-pricing theory: twenty-five years later. The American Economic Review, 88, 3, 323-349. http://www.jstor.org/stable/116838.

- Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities, Journal of Political Economy, 81, 3, 637-654. http://www.jstor.org/stable/1831029.

- Merton, R.C. (1973). Theory of rational option pricing. The Bell Journal of Economics and Management Science, 4, Spring, 141-183. [CrossRef]

- Broadie, M., & Detemple, J. B. (2004). Option pricing: Valuation models and applications. Management Science, 50, 9, 1145-1177. [CrossRef]

- Merton, R. C. (1977). An analytic derivation of the cost of deposit insurance and loan guarantees an application of modern option pricing theory. Journal of Banking & Finance, 1, 1, 3-11. [CrossRef]

- Brennan, M. J., & Schwartz, E. S. (1976). The pricing of equity-linked life insurance policies with an asset value guarantee. Journal of Financial Economics, 3,3, 195-213. [CrossRef]

- Trigeorgis, L., & Reuer, J. J. (2017). Real options theory in strategic management. Strategic Management Journal, 38, 1, 42-63. [CrossRef]

- Merton, R. C. (1974). On the pricing of corporate debt: The risk structure of interest rates. The Journal of Finance, 29, 2, 449-470. [CrossRef]

- Chen, R. R. (1996). Understanding and managing interest rate risks (Vol. 1). World Scientific.

- Vasicek, O. (1977). "An equilibrium characterization of the term structure". Journal of Financial Economics. 5 (2): 177–188. CiteSeerX 10.1.1.164.447. [CrossRef]

- Brennan, M. J., & Schwartz, E. S. (1979). “A continuous time approach to the pricing of bonds”. Journal of Banking & Finance, 3(2), 133-155. [CrossRef]

- Dothan, L. U. (1978). On the term structure of interest rates. Journal of Financial Economics, 6(1), 59-69. [CrossRef]

- Cox, J. C., Ingersoll Jr, J. E., & Ross, S. A. (1985). An intertemporal general equilibrium model of asset prices. Econometrica, 53, 2, 363-384. [CrossRef]

- Ho, T. S., & Lee, S. B. (1986). Term structure movements and pricing interest rate contingent claims. The Journal of Finance, 41(5), 1011-1029.

- Black, F., Derman, E., & Toy, W. (1990). A one-factor model of interest rates and its application to treasury bond options. Financial Analysts Journal, 46(1), 33-39. [CrossRef]

- Hull, J., & White, A. (1993). One-factor interest-rate models and the valuation of interest-rate derivative securities. Journal of Financial and Quantitative Analysis, 28(2), 235-254. [CrossRef]

- Andrés-Sánchez, J. (2023). A systematic review of the interactions of fuzzy set theory and option pricing. Expert Systems with Applications, 223, 119868. [CrossRef]

- Muzzioli, S., & De Baets, B. (2016). Fuzzy approaches to option price modelling. IEEE Transactions on Fuzzy Systems, 25, 2, 392-401. [CrossRef]

- Cox, J., Ross, S., & Rubinstein, M. (1979). Option Pricing: A Simplified Approach. Journal of Financial Economics, 7, pp. 229-26. [CrossRef]

- Belle, A. B., & Zhao, Y. (2023). Evidence-based decision-making: On the use of systematicity cases to check the compliance of reviews with reporting guidelines such as PRISMA 2020. Expert Systems with Applications, 119569. [CrossRef]

- Zupic, I., & Čater, T. (2015). Bibliometric methods in management and organization. Organizational Research Methods, 18, 3, 429-472. [CrossRef]

- Andres-Sanchez, J. (2017) An empirical assessment of fuzzy Black and Scholes pricing option model in Spanish stock option market. Journal of Intelligent & Fuzzy Systems, 33, 2509-2521. [CrossRef]

- Andres-Sanchez, J. (2018). Pricing European Options with Triangular Fuzzy Parameters: Assessing Alternative Triangular Approximations in the Spanish Stock Option Market. International Journal of Fuzzy Systems 20, 5, 1624-1643. [CrossRef]

- Anzilli, L., & Villani, G. (2022). Cooperative R&D investment decisions: A fuzzy real option approach. Fuzzy Sets and Systems. [CrossRef]

- Anzilli, L., & Villani, G. (2021). Real R&D options under fuzzy uncertainty in market share and revealed information. Fuzzy Sets and Systems, 434, 117-134. [CrossRef]

- Buckley, J.J., & Eslami, E. (2008). Pricing Options, Forwards and Futures Using Fuzzy Set Theory. Fuzzy Engineering Economics With Applications, 233, 339- 357. [CrossRef]

- Biancardi, M., & Villani, G. (2017) A fuzzy approach for R&D compound option valuation Fuzzy Sets and Systems 310, 108-121. [CrossRef]

- Buckley J.J., & Eslami E., (2008) Pricing stock options using black-scholes and fuzzy sets. New Mathematics and Natural Computation, 4,02, 165-176. [CrossRef]

- Capotorti A., & Figà-Talamanca G. (2020) SMART-or and SMART-and fuzzy average operators: A generalized proposal. Fuzzy Sets and Systems, 395, 1-20. [CrossRef]

- Capotorti, A., & Figa-Talamanca, G. (2013). On an implicit assessment of fuzzy volatility in the Black and Scholes environment. Fuzzy Sets and Systems, 223, 59-71. [CrossRef]

- Carlsson, C., & Fuller, R. (2003). A fuzzy approach to real option valuation. Fuzzy Sets and Systems 139, 2, 297-312. [CrossRef]

- Carlsson, C., Heikkila, M., & Fuller, R. (2010). Fuzzy Real Options Models for Closing/Not Closing a Production Plant. Production Engineering And Management Under Fuzziness (pp. 537-560). Springer, Berlin, Heidelberg.

- Chen, HM., Hu, CF., & Yeh, WC. (2019). Option pricing and the Greeks under Gaussian fuzzy environments. Soft Computing, 23-24, 13351-13374. [CrossRef]

- Chrysafis, KA., & Papadopoulos, BK. (2009). On theoretical pricing of options with fuzzy estimators. Journal of Computational and Applied Mathematics, 223, 2, 552-566. [CrossRef]

- Collan M., Carlsson C., & Majlender P. (2003). Fuzzy Black and Scholes real options pricing. Journal of Decision Systems 12, 3-4, 391-416. [CrossRef]

- Dash, JK., Panda, S., & Panda, GB (2022). A new method to solve fuzzy stochastic finance problem Journal of Economic Studies. 49, 2, 243-258. [CrossRef]

- Gao, H., Ding, X.H., & Li, S.C. (2018). EPC renewable project evaluation: a fuzzy real option pricing model. Energy Sources Part B - Economics Planning and Policy, 13, 9-10, 404-413. [CrossRef]

- Guerra M.L., Sorini L., (2012). Incorporating uncertainty in financial models. Applied Mathematical Sciences, 6,76, 3785-3799.

- Guerra, ML., & Sorini, L., Stefanini, L (2011). Option price sensitivities through fuzzy numbers. Computers & Mathematics with Applications, 61, 3, 515-526. [CrossRef]

- Guerra, ML., Sorini, L., & Stefanini, L. (2017). Value Function Computation in Fuzzy Models by Differential Evolution. International Journal of Fuzzy Systems, 19, 4, 1025-1031. [CrossRef]

- Jafari, H. (2022). Sensitivity of option prices via fuzzy Malliavin calculus. Fuzzy Sets and Systems, 434, 98-116. [CrossRef]

- Kim, Y., & Lee, EB. (2018). Optimal Investment Timing with Investment Propensity Using Fuzzy Real Options Valuation. International Journal of Fuzzy Systems, 20, 6, 1888-1900. [CrossRef]

- Li H., Ware A., Di L., Yuan G., Swishchuk A., & Yuan S. (2018). The application of nonlinear fuzzy parameters PDE method in pricing and hedging European options. Fuzzy Sets and Systems, 331, 14-25. [CrossRef]

- Liu S., Liu E., & Huang L. (2013). Fuzzy random European call option pricing model. Journal of Theoretical and Applied Information Technology, 48, 2, 1003-1013.

- Liu S., Liu E., Huang L., Chai Z., & Chang Y. (2013). American option pricing in fuzzy random environment. International Journal of Applied Mathematics and Statistics, 45, 15, 111-118.

- Liu S., Xu W., Hou J., Zhao M., & Sun Q. (2013). Option valuation based on fuzzy theory in risk management. International Journal of Applied Mathematics and Statistics, 48,18, 414-422.

- Miyake, M., Inoue, H., Shi, J.M., & Shimokawa, T. (2014). A Binary Option Pricing Based on Fuzziness. International Journal Of Information Technology & Decision Making. 13,6,1211-1227. [CrossRef]

- Muzzioli, S., Gambarelli, L., & De Baets, B. (2018). Indices for Financial Market Volatility Obtained Through Fuzzy Regression. International Journal Of Information Technology & Decision Making, 17, 6, 1659-1691. [CrossRef]

- Muzzioli, S., Gambarelli, L., & De Baets, B. (2020). Option implied moments obtained through fuzzy regression. Fuzzy Optimization and Decision Making, 19, 2, 211-238. [CrossRef]

- Muzzioli, S., Ruggieri, A., & De Baets, B. (2015). A comparison of fuzzy regression methods for the estimation of the implied volatility smile function. Fuzzy Sets and Systems, 266, 131-143. [CrossRef]

- Tang W., Cui Q., Zhang F., & Chen Y. (2019). Urban Rail-Transit Project Investment Benefits Based on Compound Real Options and Trapezoid Fuzzy Numbers. Journal of Construction Engineering and Management, 145, 1, 05018016.

- Teran, P. (2006). A note on Yoshida's optimal stopping model for option pricing. European Journal of Operational Research, 170, 2, 672-676. [CrossRef]

- Thavaneswaran, A., Appadoo, S.S., & Frank, J. (2013). Binary option pricing using fuzzy numbers. Applied Mathematics Letters, 26,1,65-72. [CrossRef]

- Thavaneswaran, A., Appadoo, S.S., & Paseka, A. (2009). Weighted possibilistic moments of fuzzy numbers with applications to GARCH modelling and option pricing. Mathematical and Computer Modelling, 49, 1-2, 352-368. [CrossRef]

- Thiagarajah, K., Appadoo, S.S., & Thavaneswaran, A. (2007). Option valuation model with adaptive fuzzy numbers. Computers & Mathematics with Applications, 53, 5, 831-841. [CrossRef]

- Tolga, A. Ç., Kahraman, C., & Demircan, M. L. (2010). A Comparative Fuzzy Real Options Valuation Model using Trinomial Lattice and Black-Scholes Approaches: A Call Center Application. Journal of Multiple-Valued Logic & Soft Computing, 16, 1-2, 135-154.

- Tolga,A.C. (2020). Real options valuation of an IoT based healthcare device with interval Type-2 fuzzy numbers. Socio-Economic Planning Sciences, 69, 100693. [CrossRef]

- Wang, X.D., He, J.M., & Li, S.W. (2014). Compound Option Pricing under Fuzzy Environment. Journal Of Applied Mathematics, 2014, 875319. [CrossRef]

- Wang Q., Hipel K.W., & Kilgour D.M. (2009). Fuzzy real options in brownfield redevelopment evaluation. Journal of Applied Mathematics and Decision Sciences, 2009. 817137. Margrabre. [CrossRef]

- Wu, HC. (2005). European option pricing under fuzzy environments. International Journal of Intelligent Systems, 20, 1, 89-102. [CrossRef]

- Wu, H.C. (2004). Pricing European options based on the fuzzy pattern of Black-Scholes formula. Computers & Operations Research, 31, 7, 1069-1081. [CrossRef]

- Wu, HC. (2007). Using fuzzy sets theory and Black-Scholes formula to generate pricing boundaries of European options. Applied Mathematics and Computation,185,1, 136-146. [CrossRef]

- Wu, SL., Yang, S.G., Wu, Y.F., & Zhu, S.Z. (2020). Interval Pricing Study of Deposit Insurance in China. Discrete Dynamics in Nature and Society, 2020, 1531852. [CrossRef]

- Xu, J.X., Tan, Y.H., Gao, J.G., & Feng, E.M. (2013). Pricing Currency Option Based on the Extension Principle and Defuzzification via Weighting Parameter Identification. Journal of Applied Mathematics, 2013, 623945 . [CrossRef]

- Wu, L., Liu, J.F., Wang, J.T., & Zhuang, Y.M. (2016). Pricing for a basket of LCDS under fuzzy environments. SpringerPlus, 5, 1747. Intuicionistico. Merton. [CrossRef]

- Wu, L., Mei, X.B., & Sun, JG. (2018). A New Default Probability Calculation Formula an Its Application under Uncertain Environments. Discrete Dynamics in Nature and Society, 2018, 3481863. Introduce fuzziness in interests rates: r borroso pero los parámentros CIR son ciertos. Borrosos triangulares. [CrossRef]

- Xu, W.J., Xu, W.D., Li, H.Y., & Zhang, W.G. (2010). A study of Greek letters of currency option under uncertainty environments. Mathematical and Computer Modelling, 51, 5-6, 670-681. [CrossRef]

- Yoshida, Y. (2003). The valuation of European options in uncertain environment. European Journal of Operational Research, 145,1,221-229. [CrossRef]

- Yoshida, Y., Yasuda, M., Nakagami, J.I., & Kurano, M. (2006). A new evaluation of mean value for fuzzy numbers and its application to American put option under uncertainty. Fuzzy Sets and Systems, 157, 19, 2614-2626. [CrossRef]

- Zhang, W.G., Shi, Q.S., & Xiao, W.L. (2011). Fuzzy Pricing of American Options on Stocks with Known Dividends and Its Algorithm. International Journal of Intelligent Systems, 26, 2,169-85. [CrossRef]

- Zhang, W.G., Xiao, W.L., Kong, W.T., & Zhang, Y. (2015). Fuzzy pricing of geometric Asian options and its algorithm. Applied Soft Computing, 28, 360-367. [CrossRef]

- Zmeskal, Z. (2001). Application of the fuzzy-stochastic methodology to appraising the firm value as a European call option. European Journal of Operational Research, 135, 2, 303-310. [CrossRef]

- Bian, L., & Li, Z. (2021). Fuzzy simulation of European option pricing using subfractional Brownian motion. Chaos Solitons & Fractals, 153, 111442. [CrossRef]

- Feng, Z.Y., Cheng, J.T.S., Liu, Y.H., & Jiang, I.M. (2015). Options pricing with time changed Levy processes under imprecise information. Fuzzy Optimization and Decision Making, 65, 8, 2348-2362. [CrossRef]

- Figa-Talamanca, G., Guerra, M.L., & Stefanini, L. (2012). Market Application of the Fuzzy-Stochastic Approach in the Heston Option Pricing Model. Finance a Uver-Czech Journal of Economics and Finance. 62, 2, 162-179. [CrossRef]

- Ghasemalipour, S., & Fathi-Vajargah, B. (2019). Fuzzy simulation of European option pricing using mixed fractional Brownian motion. Soft Computing, 23, 13205–13213. [CrossRef]

- Lia, H., Wareb, A., & Swishchukb, A. (2012). Nonlinear PDE approach for option pricing with stochastic volatility by using fuzzy sets theory. Journal of Theoretical and Applied Information Technology, 45, 2, 508-514. [CrossRef]

- Liu, K., Chen, J., Zhang, J., & Yang, Y. (2023). Application of fuzzy Malliavin calculus in hedging fixed strike lookback option. AIMS Mathematics, 8(4), 9187-9211. [CrossRef]

- Liu, W.Q., & Li, S.H. (2013). European option pricing model in a stochastic and fuzzy environment. Applied Mathematics-a Journal Of Chinese Universities Series B, 28, 3, 321-334. [CrossRef]

- Nowak, P., & Pawlowski, M. (2017). Option Pricing With Application of Levy Processes and the Minimal Variance Equivalent Martingale Measure Under Uncertainty. IEEE Transactions on Fuzzy Systems, 25, 2, 402-416. [CrossRef]

- Nowak, P., & Pawlowski, M. (2019). Pricing European options under uncertainty with application of Levy processes and the minimal L-q equivalent martingale measure. Journal of Computational and Applied Mathematics, 345, 416-433. [CrossRef]

- Nowak, P., & Pawłowski, M. (2023). Application of the Esscher Transform to Pricing Forward Contracts on Energy Markets in a Fuzzy Environment. Entropy, 25(3), 527. ; [CrossRef]

- Nowak, P., & Romaniuk, M. (2010). Computing option price for Levy process with fuzzy parameters. European Journal of Operational Research, 201, 1, 206-210. [CrossRef]

- Nowak, P., & Romaniuk, M. (2013). A fuzzy approach to option pricing in a Levy process setting. International Journal of Applied Mathematics and Computer Science, 23, 3, 613-622. [CrossRef]

- Nowak, P., & Romaniuk, M. (2014). Application of Levy processes and Esscher transformed martingale measures for option pricing in fuzzy framework. Journal of Computational and Applied Mathematics, 263, 129-151. [CrossRef]

- Nowak, P., & Romaniuk, M. (2017). Catastrophe bond pricing for the two-factor Vasicek interest rate model with automatized fuzzy decision making. Soft Computing, 21, 2575-2597. [CrossRef]

- Qin, X.Z., Lin, X.W., & Shang, Q. (2020). Fuzzy pricing of binary option based on the long memory property of financial markets. Journal Of Intelligent & Fuzzy Systems, 38, 4, 4889-4900. [CrossRef]

- Wang, T., Zhao, P.P., & Song, AM. (2022). Power Option Pricing Based on Time-Fractional Model and Triangular Interval Type-2 Fuzzy Numbers. Complexity, 2022, 5670482. [CrossRef]

- Wang, X.D., & He, J.M. (2016). A geometric Levy model for n-fold compound option pricing in a fuzzy framework. Journal of Computational and Applied Mathematics, 306, 248-264. [CrossRef]

- Xu, W.D., Wu, C.F., Xu, W.J., & Li, H.Y. (2009). A jump-diffusion model for option pricing under fuzzy environments. Insurance Mathematics & Economics, 44, 3, 337-344. [CrossRef]

- Zhang, H.M., & Watada, J. (2018). A European call options pricing model using the infinite pure jump levy process in a fuzzy environment. IEEJ Transactions on Electrical and Electronic Engineering, 13, 10, 1468-1482. [CrossRef]

- Zhang, H.M., & Watada, J. (2018). Fuzzy Levy-GJR-GARCH American Option Pricing Model Based on an Infinite Pure Jump Process. IEICE Transactions on Information and Systems, E101D, 7, 1843-1859. [CrossRef]

- Zhang, J.K., Wang, Y.Y., & Zhang, S.M. (2022). A New Homotopy Transformation Method for Solving the Fuzzy Fractional Black-Scholes European Option Pricing Equations under the Concept of Granular Differentiability. Fractal and Fractional, 6, 6, 286. [CrossRef]

- Zhang, L.H., Zhang, W.G., Xu, W.J., & Xiao, W.L. (2012). The double exponential jump diffusion model for pricing European options under fuzzy environments. Economic Modelling, 29, 3, 780-786. [CrossRef]

- Zhang, W.G., Li, Z., Liu, Y.J., & Zhang, Y. (2021). Pricing European Option Under Fuzzy Mixed Fractional Brownian Motion Model with Jumps. Computational Economics, 58, 2, 483-515. [CrossRef]

- Zhao, P.P., Wang, T., Xiang, K.L., Chen, P.M. (2022). N-Fold Compound Option Fuzzy Pricing Based on the Fractional Brownian Motion. International Journal of Fuzzy Systems, 24, 6, 2767-2782. [CrossRef]

- Garman, M. B., & Kohlhagen, S. W. (1983). Foreign currency option values. Journal of International Money and Finance, 2,3, 231-237. [CrossRef]

- A.G.Z. Kemma, A.C.F. Vorst, A pricing method for options based on average asset values, J. Bank. Financ. 4 (1990) 121–168.

- Margrabe, W. (1978) The value of an exchange option to exchange one asset for another, Journal of Finance, 33 ,1, 177–186. [CrossRef]

- Geske, R. The valuation of compound options, Journal of Financial Economics, 7 (1979): 63-81.

- Merton, R. C. (1976). Option pricing when underlying stock returns are discontinuous. Journal of Financial Economics, 3(1-2), 125-144. [CrossRef]

- Heston, S.L. (1993). A closed-form solution for options with stochastic volatility with applications to bond and currency options. The Review of Financial Studies, 6,2, 327-343. [CrossRef]

- Dubois, D., Folloy, L., Mauris, G., & Prade, H. (2004). Probability–possibility transformations, triangular fuzzy sets, and probabilistic inequalities, Reliability Computing, 10, 273–297. [CrossRef]

- Hull, J.C. (2008). Options futures and other derivatives. Pearson Education India.

- Longstaff, F. A., & Schwartz, E. S. (1993). Interest rate volatility and bond prices. Financial Analysts Journal, 49(4), 70-74. [CrossRef]

- Buckley, J.J., & Qu, Y. (1990). On using α-cuts to evaluate fuzzy equations. Fuzzy Sets and Systems, 38 ,3, 309–312. [CrossRef]

- Buckley, J.J., & Feuring, T. (2000). Fuzzy differential equations. Fuzzy Sets and Systems, 110,1, 43-54. [CrossRef]

- Dubois, D., Folloy, L., Mauris, G., & Prade, H. (2004). Probability–possibility transformations, triangular fuzzy sets, and probabilistic inequalities, Reliability Computing, 10, 273–297. [CrossRef]

- Bo, L., You, C. (2020). Fuzzy Interest Rate Term Structure Equation. Int. J. Fuzzy Syst. 22, 999–1006 . [CrossRef]

- Shapiro, A. F. (2004, November). Fuzzy regression and the term structure of interest rates revisited. In Proceedings of the 14th international AFIR colloquium (Vol. 1, pp. 29-45).

- Andres-Sanchez, J., & Gómez, A.T. (2003). Estimating a term structure of interest rates for fuzzy financial pricing by using fuzzy regression methods. Fuzzy Sets and Systems, 139(2), 313-331. [CrossRef]

| Log-normal (BSM) | Log-normal (more than one asset) | Other Brownian processes | Jump-diffusion | Heston | Fractional | Levy | |

| All revised papers | [24,25,28,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,54,55,56,57,58,59,62,63,64,65,66,67,68,69,70,71,72,73,74] | [26,27,29,53,60,61] | [67,80] | [81,92,96] | [77,79] | [75,78,89,90,95,97,98] | [76,82,83,84,85,86,87,88,91,93,94] |

| Fuzzy numbers of higher degree | [59,66] | [67] | [90] | ||||

| Non-European options | [47,49,55,71,72,73] | [26,27,29,53,60,61] | [89,90] | [91,94,98] | |||

| Hedging | [35,36,41,43,46,69] | [80] | |||||

| Application to financial markets | [31,32,50,51,52] | [77] | [93,94] | ||||

| Real Options | [33,34,37,39,45,58,59] | [26,27,29,53,60,61] | [80] | ||||

| Other financial applications | [65,66,74] | [67] | [88,94] |

| Journal | Number of items |

|---|---|

| Fuzzy Sets and Systems | 10 |

| Journal of Computational and Applied Mathematics | 4 |

| International Journal of Fuzzy Systems | 4 |

| European Journal of Operational Research | 4 |

| Soft Computing | 3 |

| IEEE Transactions on Fuzzy Systems | 2 |

| Fuzzy Optimization and Decision Making | 2 |

| Journal of Intelligent & Fuzzy Systems | 2 |

| Computers & Mathematics with Applications | 2 |

| Discrete Dynamics in Nature and Society | 2 |

| International Journal of Information Technology & Decision Making | 2 |

| International Journal of Intelligent Systems | 2 |

| International Journal of Applied Mathematics and Statistics | 2 |

| Journal of Applied Mathematics | 2 |

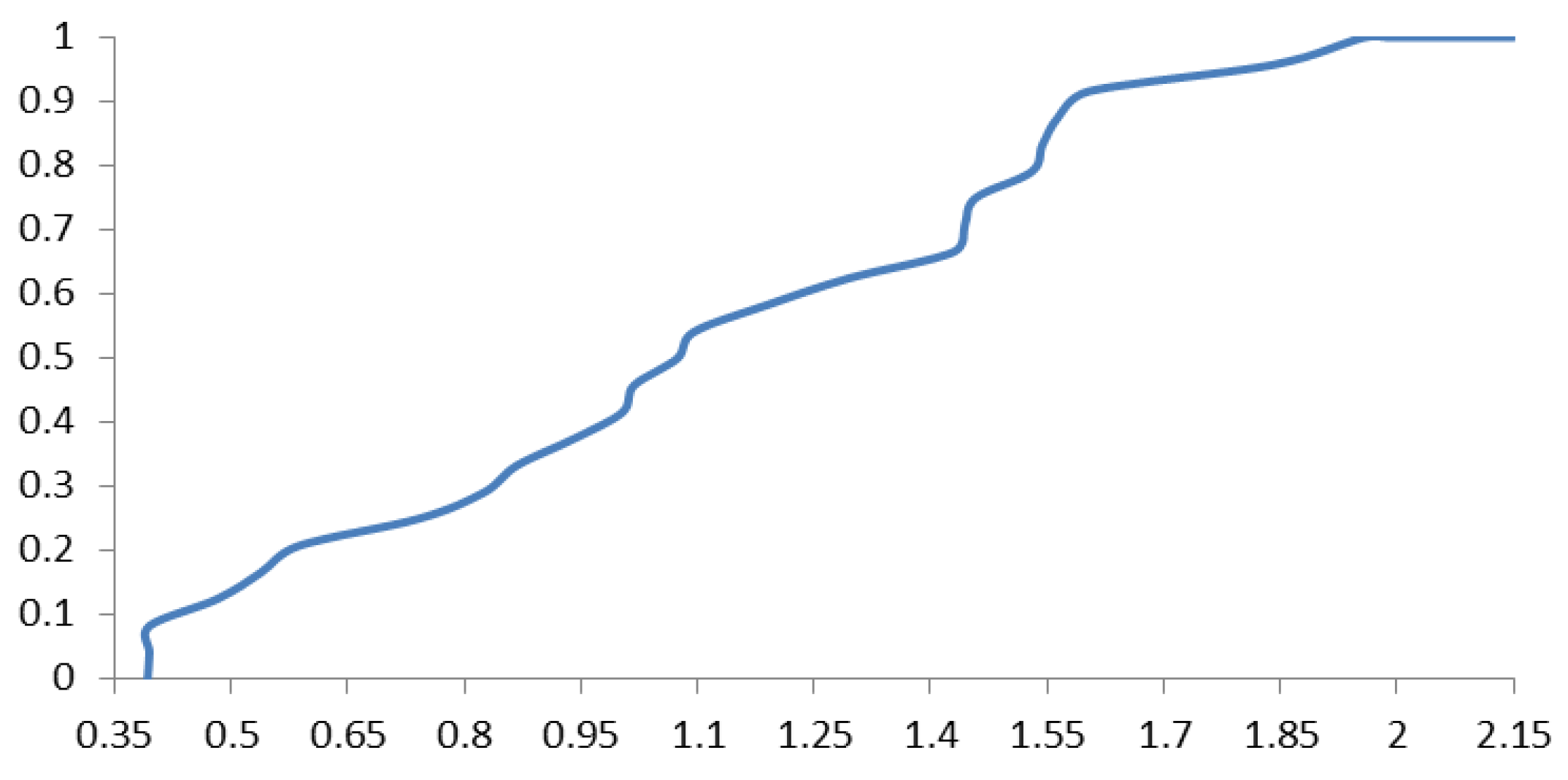

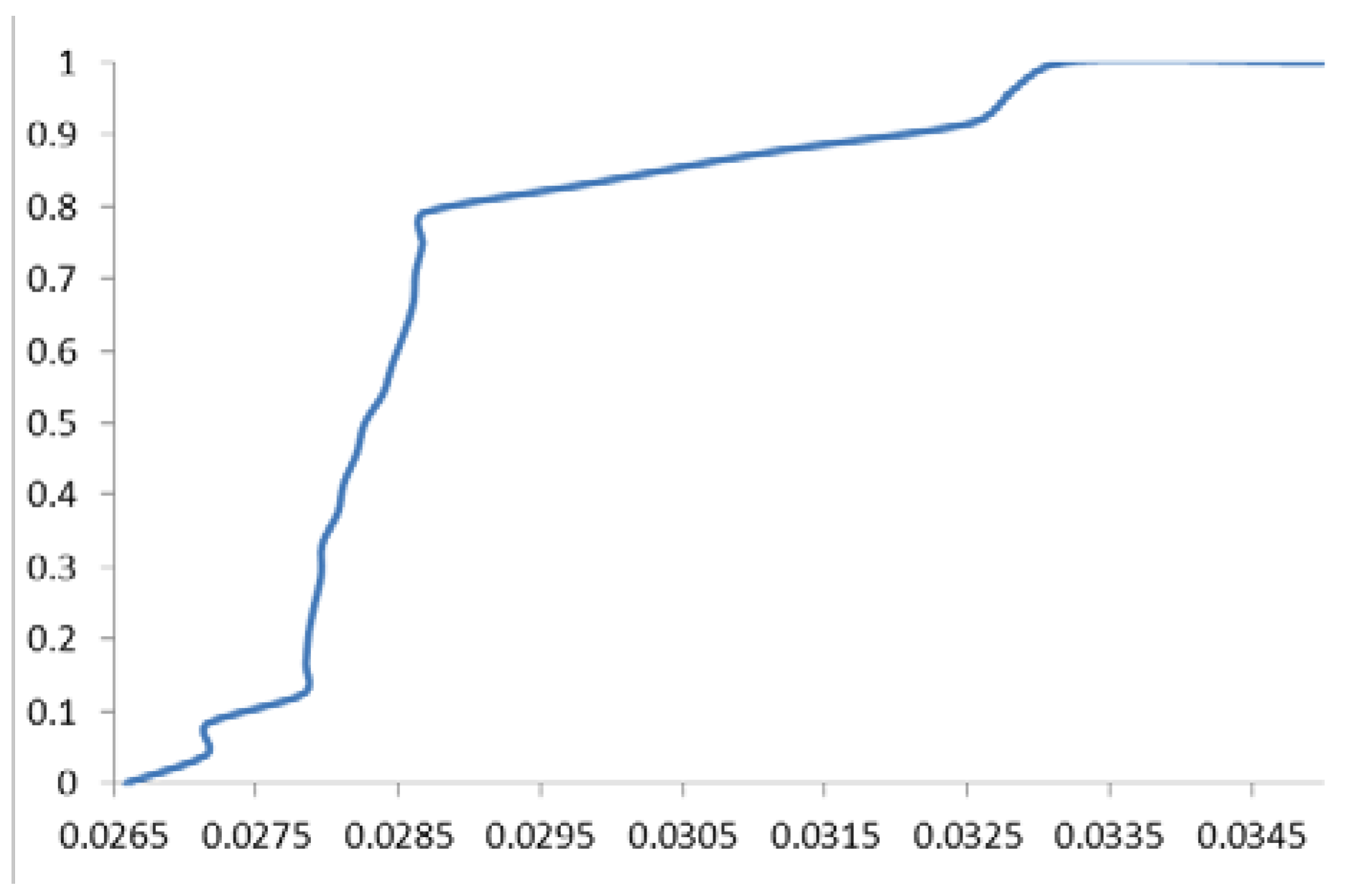

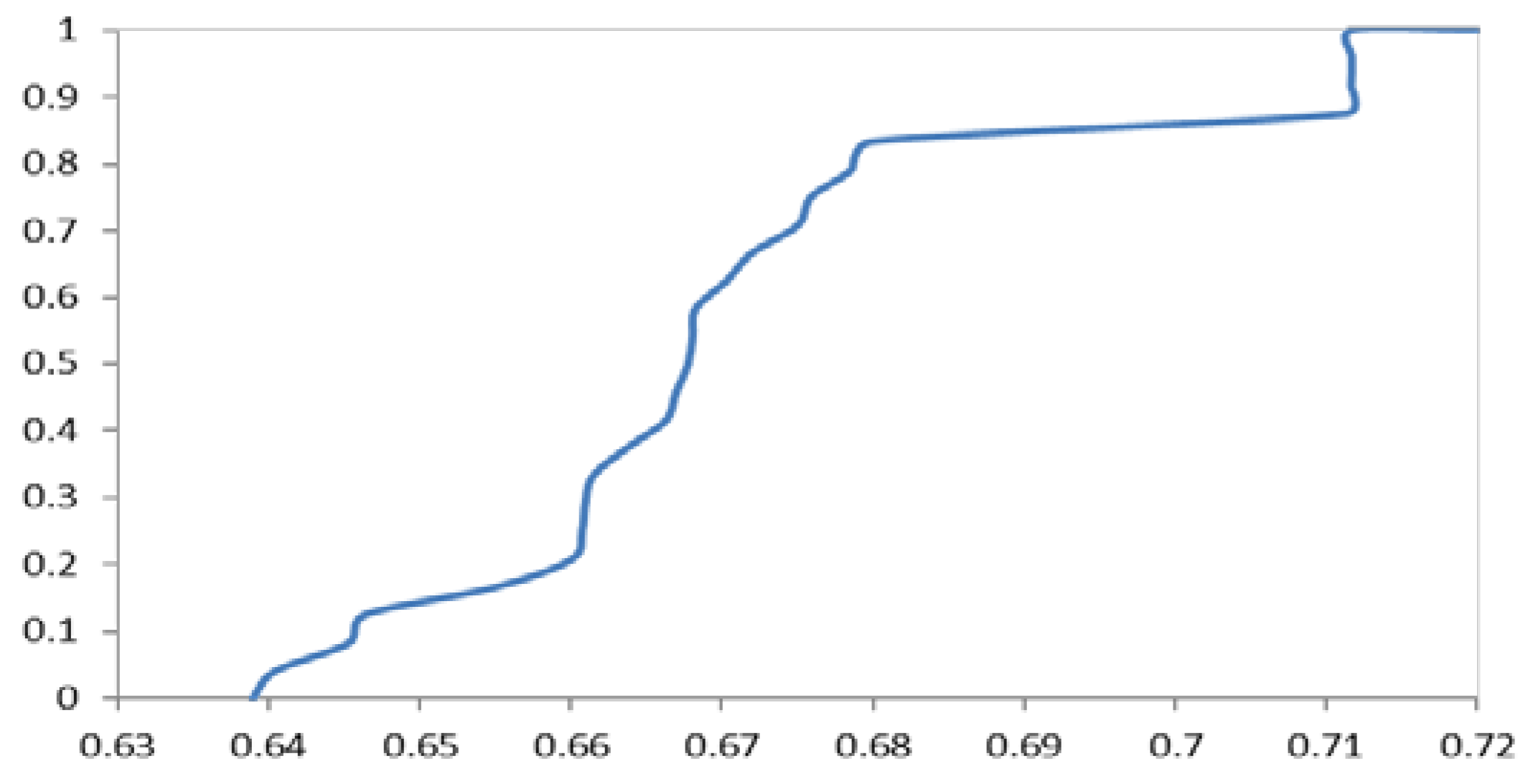

| k | ||||

| mean | 1.117 | 0.02882 | 0.0067075 | |

| std. dev. | 0.245 | 0.00174 | 0.0002121 | |

| centre | 1.117 | 0.02882 | 0.0067075 | |

| 2 | spread | 0.491 | 0.00349 | 0.0004242 |

| 3 | spread | 0.736 | 0.00523 | 0.0006363 |

| 4 | spread | 0.982 | 0.00697 | 0.0008484 |

| Estimated by Vasicek’s model | ||||||

| Observed | 1-cut | 0.5-cut | 0-cut | |||

| T | ||||||

| 3 months | 99.29 | 99.28 | 99.27 | 99.29 | 99.25 | 99.29 |

| 1 year | 97.04 | 97.16 | 97.00 | 97.26 | 96.79 | 97.28 |

| 2 years | 94.62 | 94.40 | 93.96 | 94.72 | 93.44 | 94.81 |

| 3 years | 92.57 | 91.72 | 90.98 | 92.31 | 90.16 | 92.52 |

| 4 years | 90.56 | 89.12 | 88.09 | 89.98 | 86.99 | 90.37 |

| 5 years | 88.49 | 86.59 | 85.29 | 87.72 | 83.93 | 88.32 |

| 6 years | 86.36 | 84.13 | 82.58 | 85.53 | 80.98 | 86.35 |

| 7 years | 84.20 | 81.74 | 79.96 | 83.39 | 78.14 | 84.45 |

| 8 years | 82.02 | 79.42 | 77.42 | 81.31 | 75.39 | 82.61 |

| 9 years | 79.86 | 77.17 | 74.96 | 79.28 | 72.74 | 80.82 |

| 10 years | 77.73 | 74.98 | 72.57 | 77.30 | 70.18 | 79.07 |

| 11 years | 75.64 | 72.85 | 70.27 | 75.37 | 67.72 | 77.37 |

| 12 years | 73.61 | 70.78 | 68.03 | 73.48 | 65.34 | 75.70 |

| 13 years | 71.64 | 68.77 | 65.87 | 71.65 | 63.04 | 74.08 |

| 14 years | 69.73 | 66.82 | 63.78 | 69.86 | 60.82 | 72.49 |

| 15 years | 67.90 | 64.92 | 61.75 | 68.12 | 58.69 | 70.93 |

| 16 years | 66.13 | 63.08 | 59.79 | 66.41 | 56.62 | 69.41 |

| 17 years | 64.44 | 61.29 | 57.89 | 64.76 | 54.63 | 67.93 |

| 18 years | 62.82 | 59.55 | 56.05 | 63.14 | 52.71 | 66.47 |

| 19 years | 61.27 | 57.86 | 54.27 | 61.56 | 50.86 | 65.05 |

| 20 years | 59.79 | 56.22 | 52.54 | 60.03 | 49.07 | 63.65 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).