1. Introduction

Things are changing at an accelerated rate in our world. Businesses today are operating in a volatile, uncertain, and complex environment. After the COVID-19 pandemic, several countries, companies, and stakeholders around the world have been forced to rethink their strategies and interventions . Not too long ago, several natural disasters occurred around the world that may be considered once-in-a-lifetime events.

Sustainability has been equated with "going green" and, when people think of sustainability, they think about things like reducing emissions, reducing energy consumption, or tracking water usage. The point is that, while these actions are essential, they represent only a tiny fraction of what needs to be done. Global change is driven by efforts to mitigate the accelerating effects of the aforementioned factors. As a result of these movements, organizations have become more aware of their impacts on society, their influence on the environment, and their interaction with the environment. It is at this point that sustainable development evaluation comes into play.

Corporate responsibility (CR), sustainable and responsible investment (SRI), and the impact of environmental, social, and governance (ESG) performance on the market value of companies and investors are becoming increasingly important in this dynamic and rapidly growing business environment. Managing ESG risks has become increasingly important for organizations, especially as investors and regulators focus on high-quality sustainability reporting. Furthermore, organizations are increasingly tying incentive compensation metrics to environmental, social, and governance goals in order to reflect that pressure in executive levels. It is vital to treat ESG as an element of business value creation as it becomes increasingly important.

The ESG function of an organization requires a strategically crafted internal control system that accurately reflects: 1) the relationship between an organization's ESG efforts, 2) business sustainability and resilience efforts, and 3) the organization's finances and its value creation efforts.

ESG is a criterion used in corporate evaluations based on companies' environmental, social, and governance (ESG) performance (Richardson, 2009). The United Nations Environment Program started incorporating environmental, social, and governance factors into financial decision-making in 1992. ESG as a concept was introduced and integrated into investment decisions in 2006 with the release of the UN Principles for Responsible Investment. In light of the rapid development of the economy and society, the ESG concept has become increasingly important. Investors are increasingly willing to invest in companies with outstanding ESG performance and other stakeholders are increasing their demand for corporate ESG information. Yu et al. (2020) cite ESG factors as the three most important dimensions to measure the sustainability of businesses.

According to the ESG concept, business and stakeholder relationships can be categorized as environmental, social, and governance (Semenova, 2013).

In addition to extending what has traditionally been considered corporate performance, it is an effective approach to attracting external investors and achieving sustainable growth for companies. The real test of a company's willingness and approach to ESG responsibility lies in its ability to generate value through ESG practices. Thus, clarifying the mechanisms by which ESG practices generate value for companies has great practical significance for both the academic community and companies seeking to engage actively in ESG practices. Business sustainability and resilience are enhanced through the effective implementation of ESG (Passas, 2024).

In order to create sustainability and ESG value, internal audit can and should play an important role. ESG controls can be established in a functional manner through its advisory role in identifying and establishing a functional ESG control environment. Additionally, it can provide critical assurance support by assessing how effectively ESG risk assessments, responses, and controls are working. Internal audit functions that follow the IIA's global recognized standards can also help organizations apply established, credible internal control frameworks to their ESG initiatives.

A qualified, independent, and properly resourced internal audit function should provide objective assurance on all ESG-related risk management processes. It is important to emphasize that, while this paper outlines how and why internal audit plays an important role in sustainability and resilience, the implementation of the ESG strategy must be effective. Assurance and advice should be provided by internal audit in all aspects of ESG risk management. Consequently, this paper examines how ESG creates value for companies and enhances corporate sustainability and resilience through its function. As a second point, this paper explains the role of internal audit in ESG's value creation process.

The following questions may be asked in this context: 1) "How Internal Audit contributes to the organization's sustainability and resilience efforts through the implementation of ESG?" and 2) "How can we measure the additional value created through implementation of ESG? Having been prompted by these research matters, the researchers investigated whether firms could benefit from having not only a well-established Internal Audit function, but also an integrated ESG framework.

The paper is structured as follows. Following the introduction, the second chapter presents the methodology, the third chapter presents the conceptual framework of the study, and the fourth chapter discusses the literature review. The fifth chapter presents the results of the study and the sixth chapter concludes the article.

2. Methodology

2.1. The Review Protocol

The systematic literature review is a valuable strategy to identify, evaluate, and synthesize comprehensive and significant research data on a specific topic, providing a holistic understanding of the studies and their findings (Petticrew, 2008 ) and (Vuori, 2009). Moreover, this approach minimizes the risk of bias due to human errors (Cook, 1997) and (Moher, 2009).

Figure 1 illustrates the general flow of a systematic literature review.

PRISMA, a reporting guideline introduced in 2009, addresses the issue of inadequate reporting in systematic literature reviews (Agustí, 2022). It emphasizes the importance of presenting a clear, comprehensive, and accurate narrative to outline the purpose, accomplishments, and findings of the review. The PRISMA-2009 statement has been updated to PRISMA-2020, aligning with advancements in methodologies for identifying, selecting, evaluating, and synthesizing articles (Page, 2021).

Our comprehensive review aims to gather relevant literature from diverse sources, guided by the following research objectives:

To provide a comprehensive understanding of how Internal Audit contributes to an organization's sustainability and resilience efforts through the implementation of Environmental, Social, and Governance (ESG) practices.

To explore methodologies for effectively measuring the additional corporate value generated through the implementation of ESG practices.

Aligned with these research questions, the review strives to achieve the following specific objectives:

To comprehensively examine how Internal Audit's involvement with ESG practices aligns with an organization's sustainability and resilience objectives.

To introduce and delve into the methodologies employed by Internal Audit for the seamless integration of ESG practices within the context of organizations along with their implications and potential avenues for further research.

To highlight the inherent advantages of Internal Audit's role in enhancing an organization's sustainability and resilience through the effective implementation of ESG practices.

To investigate and elucidate the methodologies and challenges associated with measuring and quantifying the additional corporate value stemming from the adoption of ESG practices within the field of auditing.

The systematic review adheres to the PRISMA approach, aiming to provide an in-depth understanding of how Internal Audit contributes to sustainability, resilience, and corporate value enhancement through the implementation of ESG practices. Additionally, the review endeavors to explore methodologies for effectively measuring the supplementary corporate value arising from the incorporation of ESG practices.

2.2. Formulation of Research Questions

The formulation of research questions was guided by the PICO framework (Lockwood, 2015). The PICO framework is a tool that authors employ to structure research questions, focusing on three essential elements: population, interest, and context. Utilizing these three elements, the research questions were designed to encompass auditors (population), ESG (interest), and corporations (context), thus shaping the primary research questions (

Table 1).

In this systematic literature review, the research questions were shaped to align with the focus on Internal Audit's role in enhancing sustainability and resilience through ESG practices, as well as methodologies for measuring the additional corporate value resulting from ESG implementation. The PICo framework informed the formulation of these questions, reflecting the targeted population (auditors), the core interest (ESG), and the contextual setting (corporations). The systematic review adheres to the PRISMA protocol, striving to offer a structured approach for understanding the multifaceted relationship between Internal Audit, ESG practices, sustainability, resilience, and corporate value enhancement.

2.3. Search Strategies

The search strategy was systematically designed to align with the research questions and consisted of three key phases: keyword identification, screening, and eligibility. The selection of keywords directly emerged from the research inquiries. The identified keywords for this review revolved around the themes of Internal Audit, sustainability, resilience, ESG implementation, and corporate value measurement. The objective was to identify studies that investigate how Internal Audit's involvement contributes to sustainability, resilience, and corporate value enhancement through ESG practices.

The exploration for relevant studies spanned across diverse databases, including Science Direct, Springer Link, Emerald Insight, Web of Science, and Scopus. These databases were chosen based on factors such as access privileges, relevance within the specified time frame, and reference lists in publications over the past decade focused on Internal Audit's role in ESG implementation and corporate value measurement. The selected databases have demonstrated a rich collection of peer-reviewed articles within this research domain.

The inclusion criteria (IC) were meticulously tailored to the research questions and objectives:

IC-1: Studies delving into the mechanisms through which Internal Audit contributes to an organization's sustainability and resilience via ESG practices.

IC-2: Studies that shed light on how ESG practices contribute to corporate value enhancement and ways that this added value can be measured.

IC-3: Studies published between 1995 and 2022.

IC-4: Studies published in the English language.

IC-5: Studies published in reputable and influential journals.

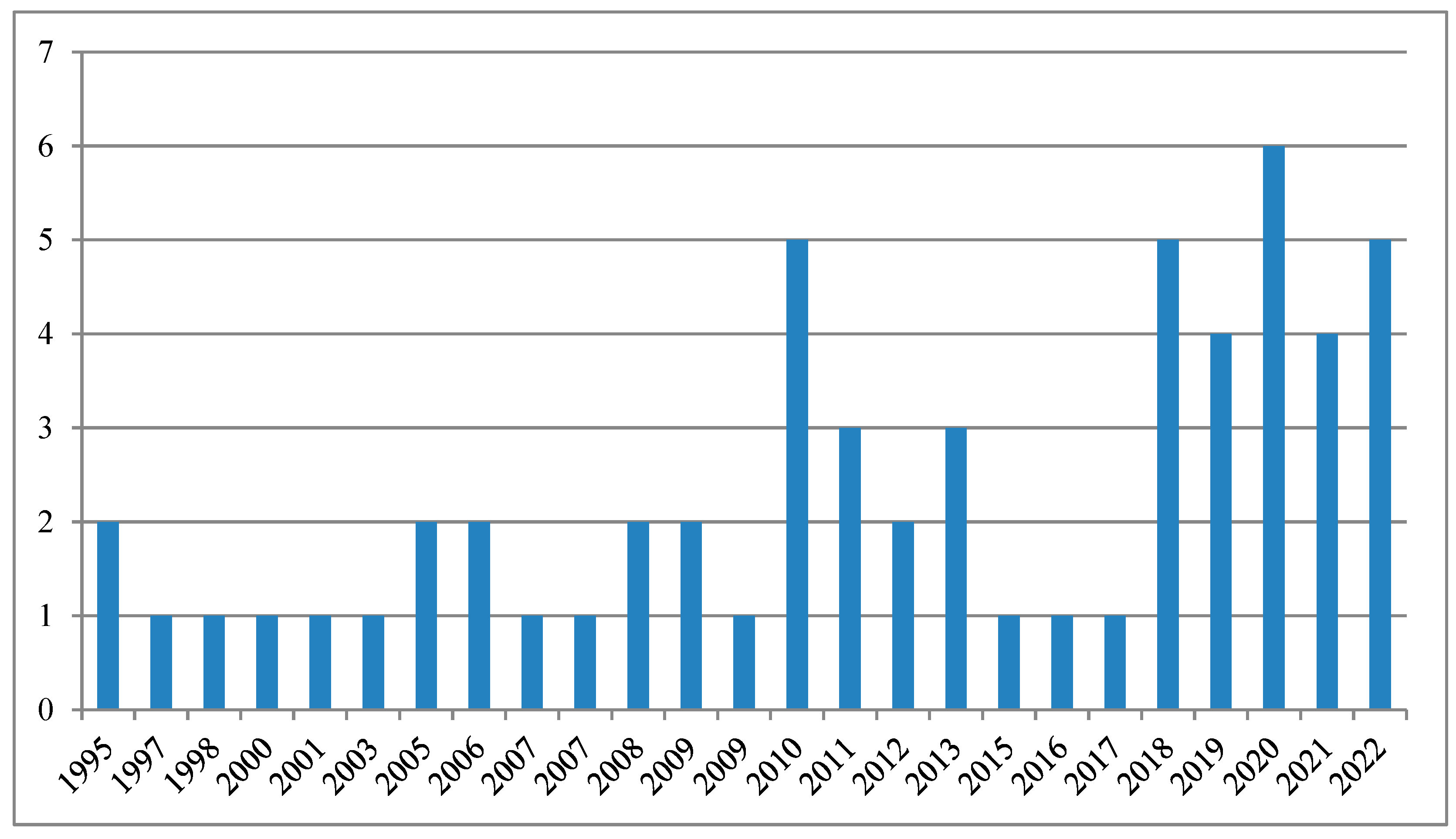

Papers not meeting these inclusion criteria were excluded from the review. The total number of papers reviewed from 1995 to 2022, is 58.

Figure 2, present the time distribution of the reviewed articles.

Notably, within the context of the research question on measuring the additional corporate value generated through ESG practices, the review aims to explore and detail methodologies employed for this purpose. This investigation will encompass a comprehensive understanding of how ESG value addition is measured, shedding light on the intricacies and methodologies.

3. Conceptual Framework

3.1. Definition, Roles of Sustainability and ESG

The term sustainability can be translated into a very familiar financial term: going concern. In finance, going concern refers to the ability of an organization or corporation to survive for the foreseeable future. In this concept, however, it refers to the ability to continue operating for years to come.

According to the UNESCO definition and the Risk in Focus 2022 report - published by the ECIIA - the Sustainability challenge can also be divided into three major concepts (ECIIA, 2022):

The sustainability of the environment:

An organization's ESG performance is determined by criteria such as sustainability, responsibility, or ethics. Environmental, Social, and Corporate Governance is the abbreviation for ESG. A company's ESG performance can be evaluated using ESG indicators through its investment philosophy and evaluation criteria. Decisions are made based on traditional financial information as well as nonfinancial indicators such as environmental, social, and corporate governance. Specifically:

E stands for Environment, which refers to indicators related to natural environments and ecological cycles.

S stands for Social Responsibility', which refers to indicators related to society's rights, benefits and interests reflected by external leaders, employees, customers, shareholders and communities.

G stands for Governance indicators, which pertain to corporate governance. A focus is placed on the structure of corporate governance, market transactions, intellectual property, and other aspects of corporate compliance management for project investment companies.

Sustainability and organizational life have evolved over time. Sustainability in organizations is typically defined by the impact they have on their environment. Organizations that are sustainable - especially businesses - focus on assessing and improving their operational impact, thereby addressing society's most pressing concerns: climate change and pollution, depletion of natural resources, inequality in the economy, societal injustices, etc. (Fedele S, 2021 ).

Despite some commentators cynicism that such efforts are more aimed at influencing an organization's image among stakeholders than the substantive impact of sustainability change measures, there has now been a shift in favor of substance over form (Instituut van Internal Auditors, 2022).

We live in an age when organizations have to consider not only their good intentions, but the true impact they have on the communities they operate in and the environment they live in. It is especially important for an organization's sustainability story to be truthful in order to be credible. It is likely that over time, so-called green washing, or exaggerating environmental achievements, will diminish.

The general belief is that organizations must not only rely on altruism or the feel-good factor of a brand in order to live up to sustainability promises. Commercially sensible decisions increasingly focus on improving society and the environment. ESG reporting can become regulated in some industries and ESG ratings influence a company's market value, thus affecting how investors and capital market advisors view the company. As a result, sustainability goals are now an integral part of the strategy for many corporate businesses. A key role of Internal Audit is to provide independent commentary regarding whether the organization is fulfilling its strategic objectives. A failure to do so may risk not only the company's intangible assets (such as its reputation), but also its ability to use its tangible assets to achieve best returns, especially in light of stakeholder expectations and competitors.

Achieving ESG requires the involvement of governments, organizations, communities, and individuals. It is crucial for many industries that businesses respond to the call for environmentally sustainable working practices. The future of the planet is in everyone's hands, and how businesses respond to the challenges of today and tomorrow is in everyone's hands as well.

Environmental sustainability is a challenge that organisations are adapting to at different stages, and the IA functions they require will reflect those differences. Deloitte 2022 shows that some businesses are already much ahead of their competitors. According to Deloitte's survey of CxO Sustainability leaders in 2022, 19 percent of the respondents are implementing at least four or five of the following 'needle-moving' actions (Deloitte , 2022 ):

Developing products or services that are climate-friendly;

Specifying sustainability criteria for suppliers and business partners;

Making facilities more climate resilient by updating or relocating them;

Including climate considerations in lobbying and political donations;

Incorporating sustainability performance into senior leader compensation.

While many businesses recognize their role in contributing positively to sustainability as a whole, they are not always able to articulate that role in terms that their shareholders will find persuasive and acceptable as reasons to continue investing. Using IA from many angles - strategic, operational, and investment - can help management find the business case for addressing ESG risks and opportunities.

3.2. Sustainability Opportunities for Internal Audit

Beyond ensuring compliance with regulations and fulfilling legal obligations, IA professionals can support their organizations meet the sustainability challenge. Obtaining the knowledge and becoming positioned as sustainability IA experts requires both time and effort. In addition to financial, operational, and compliance risks, internal auditors must be retrained and rebranded in order to focus on sustainability risks. As a result, IA individuals can engage in more in-depth conversations with stakeholders and get a better understanding of their sustainability and environmental agendas. There may be some practitioners who are less well equipped to steer a professional dialogue around such issues as they act in the best interest of their employer organizations, but there is still room for all to build meaningful relationships with stakeholders.

It is the role of IA to both catalyze and investigate how organizations are living up to their sustainability promises as a profession according to Fedele in 2021.

Having high-level connections and perspectives, yet the ability to perform very detailed work too, is precisely the expertise that can help to ensure the strategic aspects of sustainability planning are dealt with at an operational level.

IA is uniquely connected to both executive and non-executive directors. The independence and objectivity of internal auditors, as well as their assurance mindset, predisposes them to ensure that communications about sustainability conformance and performance are fair and true. As consultants, IA professionals are in a unique position to add value and improve an organization's operations. The IA philosophy of being systematic, methodical and disciplined is also vital to having comprehensive and multidisciplinary approaches to assessing the management and control of the strategic goals on sustainability.

Environmental sustainability will be a challenging journey for many organizations. In the next three to five years, it is anticipated that certain classes of businesses may require up to 25 percent of IA time to address matters of ESG reporting and related compliance matters (Audit, 2021). The importance of data, risk, and control will become more apparent for all organisations as they pursue environmental sustainability - and ESG reporting more generally (Audit, 2021). Internal Audit can - and must - play a role in the organization's ESG development process as a result of this increasing importance and the need for a substantiated and controlled approach.

The Internal Audit activity must evaluate and contribute to the improvement of the organization’s governance, risk management and controls processes using a systematic, disciplined, and risk-based approach. In order for internal audit to be credible and valuable, auditors should be proactive, provide new insights, and take into account how their evaluations will impact future outcomes (IIA, 2017 ).

The importance of acquiring the knowledge to position IA professionals as experts in the field - particularly related to governance, risk management, and internal control - but also covering emerging regulations and sector-specific policies - cannot be overstated. As a Sustainability Business Partner, IA uses that knowledge to help the business transition and address risks (Draaijer, 2012). It is the goal of the business and IA to align their sustainability strategy with near-market demands as well as more distant stakeholder demands, like those of financiers and regulators. Investing in sustainability will not always return a profit in the short- and even medium-term, but they will lay the foundation for continued operations and add value as investors view intangible assets (Draaijer, 2012). Besides challenging the organization's strategic position, IA must also assess if the organization has the right KPIs and risk measures in place, as well as challenge how business processes actually work in reality. Measurement and reward mechanisms should reflect the incentives for adhering to recommended ways of working effectively. ESG data accuracy is at the core of these critical measurements (Draaijer, 2012). Involving IA early in the planning and design phases enables the evolution of data, information and technology landscapes to be fit for sustainability change to be achieved much more accurately than when IA is not involved. After the strategy, business model, technology, output data, and information challenges are addressed, IA continues to play a role in making sure sustainability is integrated into its charter, audit universe, risk assessment, and audit plans, to spot subtle exceptions and nuances that may undermine the good work of sustainability efforts (Draaijer, 2012).

Many organizations will find themselves on a path to sustainability maturity, moving from conformance to performance to greater value creation – perhaps starting by satisfying the basics, then moving on to being a more mature, innovative or leading organization. Interventions and reporting requirements from IA will evolve along that journey, which means a different team make-up along the way. Organizations need IA to perform a variety of functions, from identifying gaps between strategy and execution to living up to sustainability expectations on a daily basis. The Internal Audit will be able to enhance its standing and credibility within the organization even further by leading thought leadership on a new topic, emphasizing the connection between strategy, risk management, and controlled processes, and riding the momentum of sustainability. A drive toward sustainability provides an opportunity for the organization and society to gain more value.

3.3. The Three Pillars of Sustainability

On a practical level, we see that IA’s role can develop through three integrated pillars, from knowledge to business partnering to full sustainability integration within IA activity.

Pillar One: Build up Knowledge and Capacity

To improve IA's capability, knowledge, and expertise, the team must, as part of its continuing professional development, seek to understand the data, technology, and culture surrounding sustainability, and assess where improvements are needed (Draaijer, 2012).

Staying up-to-date on sustainability-related regulations and requirements is essential. By researching and reviewing regulations, training periodically, incentivizing the team to attend courses, and reaching out to the broader internal audit community, first and second line internal auditors, and external experts, this can be accomplished.

Often, IA needs to challenge the business on aligning its sustainability strategy and process-level activities, including risk management. It is clear that this requires a deep understanding of the company's sustainability mission, strategy, performance, and policies on risk management. Managing organisational risks requires the Internal Audit team to work closely with first-line staff (those responsible for risk management) and second-line staff (those responsible for risk management and compliance). The IA team will be able to assess how they are integrating sustainability into their operations, and make the best use of all functions' skills and expertise by engaging with the first and second lines. Sustainability risk management can even be used as a flagship opportunity for IA to align the three lines of control.

Pillar Two: Partner the Business on Sustainability

The Sustainability Business Partner role requires comprehensive engagement at all levels of the organization. As a result of such business partnering, the control environment will be more robust, the reporting will be more relevant, and the outputs will be more reliable, since it will be matched to market expectations and regulatory requirements (Fedele S, 2021 ), including those required for external audits.

Due to the nature of its activities, the IA function is uniquely linked to both executive and non-executive directors, and can provide substantiated insights into governance, risk management, and control processes within the organization. As part of identifying and mitigating risks and helping to define improvements, the team should be involved early in the strategy development process to make the biggest impact. In addition, sustainability must be embedded into the organization's strategic objectives and day-to-day operations (De Blok T, 2021 ).

Pillar Three: Integrate Sustainability Throughout IA

After marshalling the knowledge and positioning the IA unit as the Sustainability Business Partner, the next step is to ensure that all internal audit activities consider sustainability.

Organisational sustainability needs and ambitions should be reflected in the audit charter and audit universe, and sustainability risks should be incorporated into the audit plan's risk assessment, which must address sustainability within the governance, risk management, and operational risk domains (Fedele S, 2021 ).

In other words, to find the right balance between incorporating the topic in regular operational audits, perform thematic activities and consulting engagements (e.g. on the field of setting up the sustainability risk management framework of an external audit readiness assessment). The internal audit plan itself should be dynamic, to ensure a continuous process of adaption as the sustainability agenda evolves and the company’s response changes accordingly.

These three pillars work alongside each other. Continually investing in sustainability and ESG knowledge-building qualifies IA to live up to its partnering role by delivering IA activity in an integrated way, staying ahead of changes to legislation, and anticipating on how such changes will impact the company’s strategy and culture. Likewise, as an organization matures, so its IA function will adapt to reflect that maturity.

As the Sustainability Partner requires both knowledge being built up in pillar one, and the insights gained through execution of the internal audit programme that is set up in the third pillar, linking the information gained from different angles and connecting this to the company’s forward looking sustainability strategy and objectives will help the Internal Audit department fulfill its mission to provide meaningful advice and insight, in order to show its organisational value and becoming a catalyst for change.

4. Literature Review

A review of academic papers is presented in the following chapter to demonstrate whether environmentally, socially, and politically responsible practices add value for investors and companies alike. Over a long period of time, ESG factors are directly correlated both with a company's financial performance and risk profile.

4.1. Corporate Social Responsibility

In order to determine ESG performance, two concepts need to be intersected and interacted with: Corporate responsibility (CR) and sustainable and responsible investment (SRI). According to Freeman in 2010, corporate social responsibility is defined as voluntary actions by businesses to improve their social and environmental performance. Intangible assets created by CR are linked to a company's long-term performance, which are boosted by operational and reputational benefits.

By investing in the CR process, a company creates a form of an intangible asset, which relates to the long-term performance of operations and reputation. The operational benefits as a result of the company’s internal business activities (i.e. cost reduction, operating efficiency, and productivity) are likely to be relatively uncertain about their future success and slowly to materialize. At the same time, all CR is a potential source of positive attitudes (e.g. reputational benefits) towards a company, which indirectly affect future earnings through a positive image related to an increase in sales, a lower cost of capital, acquisition and retention of skilful employees, and willingness to pay higher prices or to buy/hold the stock of a company. Reputational effects may include positive investor and customer attitudes to both good CR performance and a company’s management competence (Dowell, 2000) and (Ramiah, 2013).

The concept of corporate responsibility (CR) has been implemented through the lens of stakeholder theory, which outlines the various parties with interests in a company and aligns their concerns with the company's profit-oriented objective. In broad terms, these corporate stakeholders encompass customers, suppliers, shareholders, employees, communities, special interest groups, non-governmental organizations, and regulators. The contemporary understanding of CR has evolved into three main dimensions of stakeholder engagement: environmental, social, and governance (ESG). For instance, enhancing employee contentment can positively impact employee retention, motivation, and foster innovation in terms of new products, patents, and agreements. This, in turn, can yield lasting performance improvements that benefit shareholders (Edmans, 2011).

Embedded within the scope of corporate social responsibility is the concept of corporate governance. Academic research often gauges its effectiveness as a gauge for the extent of shareholders' rights, ensuring that board members and executives prioritize the long-term interests of shareholders (Gompers et al., 2003). An illustration of this is seen through the promotion of independent decision-making processes carried out by a capable, diversified, and autonomous board. Additionally, it involves aligning board of directors' compensation with both individual and company financial targets and key performance indicators, while also establishing vital board committees.

In sum, the CR framework implies that ESG elements, treated as distinct intangible factors, can potentially influence anticipated future earnings and the risk landscape of a company. This perspective underscores the significance of extra-financial performance in contributing to stock price ramifications, aligning with the core principles of valuation theory.

4.2. Sustainable and Responsible Investment

The concept of Socially Responsible Investment (SRI) has been defined as an investment approach that integrates Environmental, Social, and Governance (ESG) considerations with financial objectives in the decision-making process (Renneboog, 2008). Within the SRI stock market, a common classification distinguishes between a values-driven segment and a profit-seeking segment, characterized by specific investment screens employed in portfolio construction (Derwall J. G., 2005). The values-driven segment typically involves investors adhering to ethical criteria unrelated to a company's future earnings.

Hong in 2009, observed that values-driven SRI strategies tend to render controversial stocks (those associated with industries such as alcohol, tobacco, gambling, military, firearms, etc.) cheaper while offering higher expected returns. This phenomenon introduces market inefficiencies when these 'sin stocks' are traded at prices below their fundamental values. Notably, they identified superior abnormal risk-adjusted returns as compensation for the additional market risk associated with high litigation risk.

Recent research has shed light on the profit-seeking segment of the SRI stock market, where investors incorporate ESG considerations into fundamental valuations to pursue traditional financial objectives. This approach involves positive screens favoring stocks with high ESG scores for portfolio construction. Derwall in 2005, found that portfolios comprised of high-ranked, eco-efficient stocks deliver higher abnormal risk-adjusted returns due to short-term market mispricing, specifically an underestimation of ESG factors (market inefficiency). Consistent with this, Greenwald (2010) and Borgers (2012) demonstrated that ESG stocks more frequently surpass earnings estimates and analyst forecasts.

Furthermore, Derwall et al. (2011) argued that this market inefficiency diminishes as the market becomes aware of the impact of ESG factors on expected future cash flows. Tests of errors in the expectations hypothesis revealed that abnormal risk-adjusted returns associated with strong employee relations decrease as the evaluation horizon lengthens, reflecting investors' improved understanding of future earnings expectations. Bebchuk et al. (2013) introduced the concept of the learning and disappearing effects of governance on abnormal returns, showing that good governance ceases to be associated with abnormal returns once it becomes fully priced into stock values. Both the learning hypothesis and errors in the expectations hypothesis align with the traditional efficient market view, which posits that stock prices fully incorporate all publicly available information, including ESG data.

In 2012, the Principles for Responsible Investment (PRI) reported nearly 1100 global signatories overseeing over $32 trillion in assets under management, all of whom have policies addressing ESG considerations in their investments. Notably, mainstream investors constitute a substantial majority of PRI signatories, accounting for 73 percent. With the growing prominence of the UN PRI and its focus on ESG integration, there is a heightened need for a profound understanding of the material impact of ESG factors on corporate financial performance, which is becoming increasingly important for both investors and companies.

In summary, the SRI concept suggests that the preference for stocks with high ESG ratings among investors is driven by a wealth-maximizing effect arising from the positive influence of ESG actions on future earnings, as well as the optimistic market expectations shaped by both institutional and individual investors, transcending mere financial returns. Abnormal trading profits related to ESG are expected to persist until market participants fully comprehend the disparities in financial returns between ESG leaders and laggards and incorporate this knowledge into fundamental valuations.

4.3. The Value Relevance of ESG

By implementing ESG principles, companies can use resources more efficiently and innovate their businesses more effectively, resulting in higher profits and market value. According to the resource-based perspective and Porter hypothesis, environmental management contributes to a company's competitiveness by improving its products and processes, which in turn also result in a dynamic increase in profits (Porter, 1995) and (Lundgren T. a., 2009). As a result of ESG investments, there are fewer explicit costs associated with them (such as penalties and taxes), according to stakeholder theory. Furthermore, ESG practices improve relationships with stakeholders, which lead to higher operating efficiency, higher employee productivity, a larger customer base, and a greater reputation among stakeholders. There is also a theory that stock prices, employee commitment, and consumer demand are influenced by ESG performance rather than the actual efforts (Margolis, 2007). Value-creating schemes and CR contribute differently to operating performance, but positively to market value. Furthermore, companies with better corporate governance are highly rewarded by the markets based on their shareholder wealth.

Since many studies compare return differentials between companies with high and low ESG scores or conventional companies, the relations have also been investigated based on the specific characteristics of leading ESG companies. As Artiach in 2010 found, ESG leaders are large, visible companies. The most profitable ESG companies have higher returns on equity (ROE) and greater growth potential (Artiach, 2010). Companies with a substantial number of environmental and social policies that are highly sustainable are more likely to assign sustainability responsibility to their board of directors. In addition, executive compensation should be determined by ESG metrics, a formal stakeholder engagement process should be established, long-term orientation should be shown, and non-financial information should be measured and disclosed more frequently.

In terms of direct environmental impacts, environmental standards, levels of environmental performance, risk profiles, and stakeholder pressure, environmental differences are primarily determined by industry context. A high-risk or pollution-intensive industry, such as pulp and paper, utilities, energy, and mining, faces greater environmental demands and public pressure than a sector with low direct environmental risks, such as banking, software, or insurance (King, 2001; Heal, 2005; Telle, 2006; Cho, 2007).

Semenova and Hassel in their research papers in 2008 found that low-risk industries have lower market values, but higher environmental management scores and better operating performance than companies in high-risk industries. KLD, GES, and ASSET4 ratings indicate strong environmental performance in high-risk industries (Semenova N. , 2010). Ramiah et al in 2013 found that environmental regulations lead to market uncertainty and changes in long-term systemic risk.

4.4. An Empirical Analysis of ESG and Market Value

The impact of ESG on firm value and profitability has been documented in a number of studies. During the 1970s, researchers began searching for a link between corporate financial success and ESG standards. According to the researchers, about 90% of studies indicate that ESG impacts firm financial performance positively after reviewing 2200 papers. Based on a meta-analysis of 132 publications in reputable journals, 78% of papers showed a positive correlation between sustainability and financial performance (Alshehhi, 2018).

4.4.1. Findings of Positive Relationship Between ESG Performance and Firm Value – Profitability

There are a variety of variables that influence a company's financial performance, including its performance on ESG issues performance (e.g., company size, market risk, and R & D investments). In addition to capturing the intangible value of the stock market beyond its book value, market-based measures, such as Tobin's Q, also reflect the market's perception of both potential and current profitability. Return on assets (ROA) and return on equity (ROE) are accounting-based measures that reflect a historical perspective and estimate the company's financial performance. It is often considered beneficial to combine market- and accounting-based measures in these studies. In their article in 2008, Semenova and Hassel examined the relationship between environmental performance and financial performance. Further, environmental preparedness and performance are decomposed into two dimensions of company environmental opportunities. Market value (Tobin’s Q) and operating performance (ROA) are positively related to environmental preparedness and performance. According to the authors, adding an industry focus reveals that environmental preparedness brings benefits that go beyond incremental improvements in company performance. Operating and reputational benefits result from environmental performance of management. Based on the results of this study, environmental preparedness and performance may have different incremental effects on operating performance and market value.

Using two different indicators of environmental performance, policy and management, and financial performance, Semenova and Hassel (2008) investigate the moderating effects of environmental risk within the industry. In this article, the authors argue that the industry factor is highly relevant for investors due to the differences in material risks associated with climate change, energy consumption, waste management, and environmental laws. The implementation of proactive environmental performance management in a high impact industry is costly and company-specific, whereas it is easy to emulate and less resource-demanding than implementing environmental performance policies, such as environmental reporting. According to the results, the form of the relationship between environmental policy and management and operating performance is influenced by environmental risk for the industry, but the degree of the relationship between environmental variables and market value is influenced by the risk factor. Due to a negative relationship between environmental management and return on assets, environmental management is particularly costly in high-risk industries like oil and gas and utilities. There is a positive correlation between environmental policy and ROA in low-risk industries and a weaker correlation in high-risk industries. Tobin's Q is a measure of the relationship between environmental policy and management and the market's discount factor, leading to a lower market value in high risk industries and a stronger effect in low-risk industries. According to the results, the impact of environmental policy and management on profitability and market value is related to the level of environmental industry risk, which masks the universal perspective.

Both aggregated and sub-aggregated value relevance of environmental performance is supported by the Ohlson valuation model applied by Semenova et al in 2010. According to the results, social performance indicators are positively related to market value for communities and suppliers. It is concluded from this study that third party environmental and social performance ratings contain valuable information for investors. Intangibles such as environmental and social performance have a relatively weak impact on company value. In conclusion, this paper argues that integrating extra-financial value into traditional investment analysis improves long-term performance.

In terms of corporate governance indices, Gompers et al. (2003) and Bebchuk et al. (2013) find that good governance correlates with firm value (Tobin’s Q) as well as operating performance (ROA, sales growth, and net profit margin). The parameters on the governance indices have remained stable over the period 1990-2008, both in magnitude and statistical significance.

The impact of ESG performance on firm risk is also expected to be considered as part of the valuation framework. Generally, lower risk factors lead to lower capital costs or shareholder returns. Due to this, investors can apply a lower rate of return or discount rate to expected future earnings, thus increasing market value. A high ESG performance company is likely to be perceived by investors as having a low level of risk associated with future litigation and/or abatement expenditures. Over the period 1992-2007, Ghoul et al. (2011) examine the effect of CR performance ratings on the cost of capital. Evidence from implied cost of capital models indicates that lower equity capital costs are related to better CR performance. A significant correlation has been found between CR and capital costs in recent years (2000-2007) compared to 1991-1999, and CR categories such as employee relations, environmental performance, and product strategies are more significant in influencing a company's capital costs.

Researchers have been looking at ESG standards and corporate financial success since the 1970s (Friede, 2015). Having reviewed more than 2200 papers, the authors conclude that the research validates the rationale for investing in ESG and that about 90% of studies indicate a positive relationship between ESG and financial performance (Friede, 2015).

A meta-analysis of 132 papers published in reputable journals reveals that 78% of them showed a positive correlation between sustainability and financial performance (Alshehhi, 2018).

ESG increases firm value (Tobin's Q) and profitability (Return on Assets -ROA) as shown by Velte (2017). The author also finds that governance affects financial performance in a significant way.

A study by Yoon et al. (2018) examined the correlation between ESG ratings and Korean market value. It has been shown that CSR initiatives have a positive and considerable effect on a firm's market value, though its impact may vary based on its characteristics. In order to examine the relationship between ESG performance and energy market financial indicators, Zhao et al. (2018) review Chinese energy listed companies. They find that higher ESG performance increases financial performance. The ESG score affects financial success positively (Dalal, 2019), who examined 65 Indian enterprises from 2015 to 2017. According to Fatemi et al. (2018), strong ESG activities and reporting contribute to firm value in US companies from 2006 to 2011. Based on their findings, reporting moderates valuation by reducing the impact of deficiencies and amplification of strengths.ESG scores are also positively correlated with firm financial performance in some multi-country studies. A large sample of world-wide firms is examined by Xie et al. (2019). They find a positive correlation between ESG initiatives and financial performance.

From 2014 to 2018, Bhaskaranet al. (2020) assessed the impact of ESG on financial performance of 4887 firms using firm value (Tobin's Q) and operational performance (ROE and ROA). Market value is increased by firms with high environmental, governance, and social performance. Similarly, De Lucia et al. (2020) investigate a sample of 1038 public companies from 22 European countries from 2018 to 2019 and find a positive correlation between the ESG variables and the financial performance (ROE and ROA). According to Naeem (2022), financial performance is influenced by ESG performance in 1042 emerging companies from 2010 to 2019. Combined ESG scores and individual ESG scores positively and significantly affect firm value and profitability (Tobin's Q). The study by Chairani and Siregar (2021) examines listed companies in Asia (Indonesia, Malaysia, Philippines, Singapore, and Thailand) between 2014 and 2018. A positive relationship exists between enterprise risk management (ERM) and firm value and profitability based on the findings that ESG increases the impact of ERM on firm value.

Li et al. (2018) study 367 FTSE-listed companies between 2004 and 2013 to determine whether ESG reporting enhances firm value. The researchers find a strong correlation between stakeholder trust and accountability and firm value, indicating that the level of ESG reporting affects firm value positively. Moreover, Ahmad et al. (2021) examine the effects of ESG on financial performance of 350 FTSE companies for the period 2002–2018 and find that overall ESG scores significantly and positively impact financial performance of companies, whereas individual ESG performances have mixed results. Sector-specific studies are also available. Abdiet al. (2022) examined the effect of environmental, social, and governance (ESG) information on firm value and profitability using 38 airlines between 2009 and 2019. As a result of investing in governance, companies increase their market-to-book ratio, and they become more efficient financially when they are involved in social and environmental matters.

In a study published in 2020, Woei Chyuan Wong analyzed the impact of environmental, social, and governance (ESG) certification on Malaysian companies. As a result of ESG certification, a firm's cost of capital is reduced, while Tobin's Q increases significantly. It is clear from these findings that corporate social responsibility disclosure by emerging and developing nations enhances value, while these findings are consistent with those in developed economies. Upon receiving an ESG rating, a company's cost of capital reduces by 1.2%, and Tobin's Q increases by 31.9%. These findings demonstrate how SRI and ESG agendas benefit stakeholders.

A recent meta-analysis by Whelan et al. (2021) from Rockefeller Asset Management and NYU Stern Center for Sustainable Business examined more than 1000 articles focusing on the link between ESG and financial performance published between 2015 and 2020. There was a positive correlation between ESG and financial performance in the majority (58%) of the papers analyzed.

Based on a large dataset of 1720 companies, M.Aydogmus et al. (2022), examined the impact of Environmental, Social, and Governance (ESG) performance on firm value and profitability. A total of 14043 firm-year observations are included in the final panel data. A coefficient of 0.008 and 0.049, respectively, showed a positive and highly significant association between ESG performance and firm value and profitability. As a result of this study, corporate managers will be able to justify mobilizing additional resources towards ESG initiatives.

4.4.2. Findings of Negative Relationship Between ESG Performance and Firm Value – Profitability

Companies that invest in ESG incur additional costs, thereby reducing their profitability and market value. A classical profit-maximizing theory is violated by a reallocation of recourses from a company’s investors to its stakeholders, which does not generate a positive future return to shareholders (Artiach, 2010). This argument is generally credited to the ‘doing-good but-not-well’ hypothesis, cost-concern scholars, and neoclassical economists (Statman, 2009) and (Waddock, 1997).

Some scholars argue that ESG investment has a negative impact on profitability or firm value. According to Barnett in 2007, it is reasonable to predict investing in CSR will have negative impact on firm financial performance due to reallocation of funds to other stakeholders from shareholders.

We observe a number of country-based studies supporting negative relationship between ESG performance and firm value. Brammer et al. (2006) analyze impact of corporate social performance of firms in UK using market returns and find that low social score firms perform better than the market.

Lundgren and Olsson (2009) focus on bad news in the form of environmental incidents. In an international sample, the authors find that environmental incidents are generally associated with the loss of company value. For European companies, the loss is statistically significant and the magnitude of the abnormal returns is of economic significance to both companies and investors. Earlier environmental event studies find a significant negative effect of pollution news released by the US EPA on stock prices (Hamilton, 1995) and (Khanna, 1998). The drop in stock price may indicate the direct future costs in order to improve environmental performance.

Semenova and Hassel (2012) examine the asymmetry in the value relevance of environmental performance information, which is driven by company size and the environmental risk of the industry. The authors state that when large companies in regulated, high-risk industries push their environmental performance beyond average compliance, environmental management becomes costly and the capital markets interpret such investments as overinvestment with a potential to destroy short-term shareholder value. In low-risk industries, there is more room for voluntary environmental improvements at a lower cost. Market premium is positive and stronger for large companies in industries with low environmental risk than for large companies in medium-risk industries. A strong, negative relation between market value and environmental performance is shown for large companies in high-risk industries with tight environmental policies. The environmental performance of small companies is not value relevant for investors. The results of the study are supported by the fact that financial analysts follow more closely large than small companies and also companies in high-risk industries.

Landi and Sciarelli in 2019 focused on 54 listed Italian companies from 2007 to 2015 and report a negative relationship between their ESG scores and financial performance. Folger-Larondeet al. (2020) analyzes the link between ESG ratings and financial returns of ETFs (Exchange Traded Funds) during Covid-19in Canada. They conclude that high ESG performance in ETFs does not ensure protection during severe downturn of the market.

Nollet in 2006, used accounting and market metrics to investigate the connection between social and financial performance of S&P 500 companies from 2007 to 2011.They found evidence of negative relationship on linear models and positive relationship on non-linear models. Marsat and Williams (2011) report negative relationship between CSR rating and firm value using worldwide MSCI ESG ratings.

There a few multi-country studies reporting negative relationship as well. Duque-Grisales (2021) examine 104 multinational firms in Latin America from 2011to 2015. Their findings indicate negative relationship between ESG scores and financial performance of these firms. Garcia (2020) compares emerging and developed countries through 2165 firms from 2007 to 2014. They reveal that in emerging markets the relationship between ESG scores and financial performance is negative.

4.4.3. Findings of Mixed Relationship Between ESG Performance and Firm Value – Profitability

According to a third group of researchers, ESG performance and financial return were mixed. Hanet al. (2016) found no relationship between social and governance scores for Korean stock companies from 2008 to 2014, while there was a positive relationship between environmental and governance scores.

Using ESG scores, Atan et al. (2019) examined how company profitability, firm value, and cost of capital are affected by ESG scores. In terms of firm value or profitability, they find no evidence of a relationship. Using data from 2007 to 2017 from Turkish listed companies, Saygili et al.(2021) examine the effect of ESG performance on financial performance. According to their findings, environmental reporting negatively affects firm financial performance, stakeholder participation positively affects social dimension, and governance positively affects financial performance. ESG scores were examined by Giannopoulos et al. (2022) for Norwegian listed companies from 2010 to 2019. According to the results, ESG scores are positively correlated with firm value (Tobin's Q) but negatively correlated with profitability (ROA). According to Behl et al. (2022), there is a mixed relationship between ESG reporting and the value of Indian energy sector firms. Using a multi-country study, Lopez-de-Silanes et al. (2020) find that ESG scores do not influence firm financial performance.

5. Results

The analysis of the literature reveals a multifaceted relationship between environmental, social, and governance (ESG) practices and their impact on companies' financial performance and market value. This section presents a summary of the key findings from the reviewed studies, highlighting both the consensus and areas of disagreement within the existing body of research.

The intersection of corporate responsibility (CR) and sustainable and responsible investment (SRI) serves as the foundation for understanding the value of ESG performance. CR involves voluntary corporate actions that extend beyond legal requirements, leading to operational and reputational benefits. The operational benefits encompass cost reduction, operating efficiency, and productivity improvements, though these gains may materialize gradually and with uncertain outcomes. Reputational benefits emerge through positive attitudes towards the company, contributing to increased sales, reduced capital costs, employee retention, and higher stock prices. Stakeholder theory operationalizes the CR concept, aligning the profit-maximizing goals of companies with the interests of various stakeholders. The evolving CR concept is embodied in the environmental, social, and governance (ESG) categories, with stakeholder relations playing a pivotal role in shaping companies' long-term performance.

Sustainable and responsible investment (SRI) emerges as a driving force in the ESG discourse, integrating ESG considerations with financial goals in investment decision-making processes. The SRI market is bifurcated into values-driven and profit-seeking segments that construct portfolios. Values-driven SRI involves ethical criteria, impacting companies unrelated to future earnings. Notably, the contentious "sin stocks" in controversial industries exhibit unique pricing dynamics (Passas, 2022). In contrast, the profit-seeking SRI strategy focuses on positive screens, favoring stocks with high ESG scores. Research demonstrates that high ESG scores are linked to abnormal risk-adjusted returns, hinting at market inefficiencies, which may diminish as market participants internalize the ESG-effect on expected future cash flows.

The connection between ESG practices and financial performance is nuanced and multifaceted. ESG performance contributes to efficient resource utilization and innovation, leading to improved profitability and market value. ESG investments are associated with lower explicit costs and enhanced relations with stakeholders, leading to increased operating efficiency, employee productivity, consumer bases, and corporate reputation. The underlying mechanisms include the positive impact of ESG actions on stock prices, employee commitment, and consumer demand. Corporate governance, an integral part of ESG, also plays a pivotal role in shaping financial performance, with studies highlighting the significance of independent and diverse boards.

The empirical evidence collected from various studies presents a diverse range of perspectives on the relationship between ESG practices and firms' financial performance. A majority of studies indicate a positive relationship between ESG and financial success, emphasizing the potential value created by ESG initiatives. Meta-analyses, encompassing a wide range of publications, substantiate this trend, with findings consistently pointing towards favorable outcomes. However, there exists a notable minority of studies reporting negative or mixed relationships. The variance in results may stem from factors such as industry-specific characteristics, regional variations, and methodological differences. Nevertheless, the prevailing trend toward positive relationships suggests that the incorporation of ESG practices can potentially enhance long-term financial performance and market valuation.

The impact of ESG practices on firm financial performance is not uniform across industries and regions. Industry-specific characteristics, risk profiles, and stakeholder pressures contribute to variations in the relationship between ESG practices and market value. High-risk industries face unique challenges, where environmental management investments may be viewed as costly and potentially detrimental to short-term shareholder value. Regional differences also influence the relationship between ESG practices and financial outcomes, with studies highlighting divergent results across countries and regions.

6. Conclusions

The role of Internal Audit (IA) is undergoing a transformative evolution, encompassing sustainability and Environmental, Social, and Governance (ESG) considerations that extend beyond compliance to cultivate broader organizational resilience. IA's contribution to driving sustainability initiatives within organizations is pivotal, as professionals in this field build expertise in sustainability and ESG, offering insights beyond traditional financial and operational audits. By integrating sustainability factors into IA activities, such as risk assessments and audit plans, organizations adeptly navigate the intricate landscape of ESG requirements and expectations.

This evolving role of IA within the sustainability paradigm mirrors a larger shift in organizational mindset – from viewing sustainability as a moral duty to recognizing it as a strategic imperative. The dynamic ability of Internal Audit to assess, advice, and validate sustainability efforts not only fortifies organizational resilience but also enhances stakeholder trust and market reputation. By proactively addressing the challenges posed by sustainability and ESG considerations, organizations position themselves as responsible stewards of both the environment and society, fostering a more sustainable and resilient future.

The comprehensive exploration of the literature in this study unveils the nuanced relationship between ESG practices and their profound implications for companies financial performance and market valuation. By synthesizing insights from a diverse array of academic papers, this research elucidates the intricate interplay between corporate responsibility (CR) and sustainable and responsible investment (SRI), accentuating their pivotal role in shaping the value proposition of ESG practices.

The fusion of CR and SRI concepts forms the bedrock of understanding the inherent value in ESG practices. CR encompasses voluntary corporate actions that surpass legal mandates, leading to operational and reputational gains. These benefits encompass cost reduction, streamlined operating efficiency, and gradual productivity enhancements. The subsequent reputational advantages stem from cultivating a positive corporate image, resulting in amplified sales, decreased capital costs, enhanced workforce retention, and elevated stock prices. Operationalizing CR, stakeholder theory aligns corporate objectives with the diverse interests of stakeholders. This evolving concept takes tangible form in the ESG framework, encompassing environmental, social, and governance dimensions that wield substantial influence over companies' long-term performance.

The ascendancy of sustainable and responsible investment (SRI) emerges as a transformative force within the ESG discourse. Integrating ESG considerations into investment decisions, SRI operates within the realms of values-driven and profit-seeking strategies. The former integrates ethical criteria detached from future earnings, illuminating unique pricing dynamics in industries characterized by contentious practices. Conversely, the profit-seeking approach employs positive screens to identify stocks with high ESG scores, unearthing abnormal risk-adjusted returns that hint at potential market inefficiencies. Over time, these inefficiencies may diminish as market participants internalize the impact of ESG considerations on future cash flows.

The intricate relationship between ESG practices and financial performance manifests through efficient resource utilization and innovation, culminating in enhanced profitability and market value. ESG investments yield reduced explicit costs and heightened stakeholder relationships, bolstering operating efficiency, employee productivity, consumer bases, and corporate reputations. The resulting positive ripple effect on stock prices, employee commitment, and consumer demand substantiates ESG's tangible contribution to sustainable long-term financial gains. Corporate governance, a central facet of ESG, amplifies these effects, with studies underscoring the importance of diverse and independent boards in shaping financial performance.

Empirical evidence gathered across a wide spectrum of studies unveils a panorama of perspectives on the relationship between ESG practices and financial performance. The prevailing trend indicates a favorable correlation between ESG and financial success, substantiating the potential value generated by ESG initiatives. Meta-analyses consistently underscore this trend, yielding positive outcomes. However, a minority of studies document negative or mixed relationships, possibly attributed to industry-specific traits, geographic variations, or methodological disparities. Acknowledging these nuances, the broader trend toward positive associations underscores the potential for ESG practices to bolster long-term financial performance and market valuation.

This study's uniqueness lies in its comprehensive global perspective, encompassing a compilation of academic papers that foster a holistic understanding of diverse viewpoints surrounding ESG practices and their influence on financial outcomes. By amalgamating insights from various disciplines, industries, and regions, this study adds both depth and breadth to the ESG discourse, offering a panoramic perspective on the value proposition of ESG practices.

Contribution to the existing research landscape, this study consolidates a comprehensive overview of the ESG-finance relationship, presenting a synthesis of findings and disparities from diverse studies. By delineating the mechanisms through which ESG practices influence financial performance this research lays a robust foundation for informed decision-making by companies and investors alike.

However, the study is not without limitations. The inherent heterogeneity of methodologies, contexts, and timeframes in the reviewed studies may hinder direct comparisons. Future research endeavors should consider refining methodologies for greater comparability, delving into industry-specific nuances, and investigating the evolving impact of regulatory changes on the ESG-finance relationship.

In brief, this comprehensive literature review unveils the intricate web of relationships connecting ESG practices, financial performance, and market value. Its contribution to the global discourse lies in synthesizing diverse perspectives, allowing stakeholders to glean insights for well-informed decision-making. As ESG practices continue to shape the corporate landscape, their implications for long-term financial success remain a dynamic field of inquiry, ripe for further exploration and enlightenment.

Author Contributions

Conceptualization, S.L.. and G.T.; methodology, S.L.; software, A.G.; validation, S.L., G.T. and I.P.; formal analysis, S.L.; investigation, S.L.; resources, X.X.; data curation, S.L. and A.G.; writing—original draft preparation, S.L and I.P.; writing—review and editing, S.L and I.P.; visualization, G.T.; supervision, I.P.; project administration, I.P.; funding acquisition, I.P. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding

Institutional Review Board Statement

Not applicable

Informed Consent Statement

Ethics Approval Exemption Statement – issued by Law 4957/2022, Chapter L, Articles 277–282, in Greece. This confirms that the present study is non-interventional, fully anonymous, involves no personally identifiable or sensitive data, is not funded, and therefore does not require prior IRB approval.

Data Availability Statement

The data presented in this study are available on request from the corresponding author due to (specify the reason for the restriction).

Acknowledgments

The authors have reviewed and edited the output and take full responsibility for the content of this publication.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Abdi, Y. , Li, X. & Càmara-Turull, X. Exploring the impact of sustainability (ESG) disclosure on firm value and financial performance (FP) in airline industry: the moderating role of size and age. Environ Dev Sustain, 2022. [Google Scholar] [CrossRef]

- Agustí María and ORTA-PÉREZ, MANUEL, Big Data and Artificial Intelligence in the Fields of Accounting and Auditing: A Bibliometric Analysis. REFC – Spanish Journal of Finance and Accounting. Forthcoming. Available at SSRN: https://ssrn.com/abstract=4155537.

- Ahmad, N. , Mobarek, A., Roni, N. N., & Tan, A. W. K. (2021). Revisiting the impact of ESG on financial performance of FTSE350 UK firms: Static and dynamic panel data analysis. Cogent Business & Management, 8(1). [CrossRef]

- Alshehhi A, Nobanee H, Khare N. The Impact of Sustainability Practices on Corporate Financial Performance: Literature Trends and Future Research Potential. Sustainability 2018, 10, 494. [CrossRef]

- Artiach Tracy & Lee, Darren & Nelson, David & Walker, Julie. (2010). The determinants of corporate sustainability performance. Accounting and Finance. 50. 31-51. 10.1111/j.1467-629X.2009.00315.x.

- Atan, R. , Alam, M.M., Said, J. and Zamri, M. (2018), "The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies", Management of Environmental Quality, Vol. 29 No. 2, pp. 182-194. [CrossRef]

- Audit, A. (2021). ESG Reporting and Attestation: A Roadmap for Audit Practioners. Center for Audit Quality.

- Barnett, M. L. (2007). Stakeholder influence capacity and the variability of financial returns to corporate social responsibility. Academy of Management Review, pp. 794-816.

- Bebchuk, Lucian A. and Cohen, Alma and Wang, Charles C. Y., Learning and the Disappearing Association Between Governance and Returns. Journal of Financial Economics, Vol. 108, No. 2, pp. 323-348, May 2013, Harvard Law School John M. Olin Center Discussion Paper No. 667, Available at SSRN: https://ssrn.com/abstract=1589731.

- Abhishek Behl & P., S. Raghu Kumari & Harnesh Makhija & Dipasha Sharma, 2022. "Exploring the relationship of ESG score and firm value using cross-lagged panel analyses: case of the Indian energy sector," Annals of Operations Research, Springer, vol. 313(1), pp 231-256.

- Bhaskaran Rajesh Kumar & Irene Wei Kiong Ting & Sujit K. Sukumaran & Saraswathy Divakaran Sumod, 2020. "Environmental, social and governance initiatives and wealth creation for firms: An empirical examination," Managerial and Decision Economics, John Wiley & Sons, Ltd., vol. 41(5), pp 710-729.

- Borgers, Arian, Derwall, Jeroen, Koedijk, Kees and ter Horst, Jenke, (2013), Stakeholder relations and stock returns: On errors in investors' expectations and learning, Journal of Empirical Finance, 22, issue C, pp 159-175.

- Brammer, Stephen & Brooks, Chris & Pavelin, Stephen. (2006). Corporate Social Performance and Stock Returns: UK Evidence from Disaggregate Measures. Financial Management. 35. 10.2139/ssrn.739587.

- Chairani, C. and Siregar, S.V. (2021), "The effect of enterprise risk management on financial performance and firm value: the role of environmental, social and governance performance", Meditari Accountancy Research, Vol. 29 No. 3, pp. 647-670. [CrossRef]

- Chung-Jen Chen, Ruey-Shan Guo, Yung-Chang Hsiao, Kuo-Liang Chen (2018), How business strategy in non-financial firms moderates the curvilinear effects of corporate social responsibility and irresponsibility on corporate financial performance, Journal of Business Research, Volume 92, pp 154-167. [CrossRef]

- Charles H. Cho, Dennis M. Patten (2007),The role of environmental disclosures as tools of legitimacy: A research note,Accounting, Organizations and Society,Volume 32, Issues 7–8, pp639-647,ISSN 0361-3682. [CrossRef]

- Cook, D. J. , Mulrow, C. D., & Haynes, R. B. (1997). Systematic reviews: synthesis of best evidence for clinical decisions. Annals of internal medicine. [CrossRef]

- Anklesaria-Dalal, Karishma & Thaker, Nimit. (2019). ESG and Corporate Financial Performance: A Panel Study of Indian Companies. 18. 44-59.

- De Blok T, H. P. (2021). Climate Change and Environmental Risk. IIA Netherlands.

- De Lucia, Caterina & Pazienza, Pasquale & Bartlett, Mark. (2020). Does Good ESG Lead to Better Financial Performances by Firms? Machine Learning and Logistic Regression Models of Public Enterprises in Europe. Sustainability. 12. 5317. 10.3390/su12135317. Deloitte. (2022 ). CxO Sustainability Report. pp. 1-23.

- Derwall Jeroen & Ganster, N.K. & Bauer, Rob & Koedijk, C.G.. (2004). The Eco-Efficiency Premium Puzzle. Financial Analysts Journal. 61. 10.2469/faj.v61.n2.2716.

- Jeroen Derwall, Kees Koedijk, Jenke Ter Horst (2011). A tale of values-driven and profit-seeking social investors, Journal of Banking & Finance,Volume 35 8, pp 2137-2147, 0378-4266. [CrossRef]

- Dowell, Glen & Hart, Stuart & Yeung, Bernard. (1999). Do Corporate Global Environmental Standards in Emerging Markets Create Or Destroy Market Value. Management Science. 46. 10.1287/mnsc.46.8.1059.12030.

- Draaijer, D. (2012). Een Sleutelrol voor Internal Audit in Sustainability. Compact.

- Duque-Grisales, E. , Aguilera-Caracuel (2021), J. Environmental, Social and Governance (ESG) Scores and Financial Performance of Multilatinas: Moderating Effects of Geographic International Diversification and Financial Slack. J Bus Ethics. [CrossRef]

- ECIIA. (2022). Risk in Focus . IAA , pp. 1-42.

- Edmans, Alex (2011), Does the Stock Market Fully Value Intangibles? Employee Satisfaction and Equity Prices (January 20, 2010). Journal of Financial Economics 101(3), 621-640, Available at SSRN: https://ssrn.com/abstract=985735.

- Ali Fatemi, Martin Glaum, Stefanie Kaiser (2018) ,ESG performance and firm value: The moderating role of disclosure, Global Finance Journal, Volume 38, pp 45-64,ISSN 1044-0283. [CrossRef]

- Fedele S (2021). ESG and the Role of Internal Audit. Deloitte, The CFO Program.

- Folger-Laronde, Z. , Pashang, S., Feor, L., & ElAlfy, A. (2020). ESG ratings and financial performance of exchange-traded funds during the COVID-19 pandemic. Journal of Sustainable Finance & Investment, 12(2), 490–496. [CrossRef]

- Freeman, R. E. , & Dmytriyev, S. (2017). Corporate Social Responsibility and Stakeholder Theory: Learning From Each Other. Symphonya. Emerging Issues in Management, (1), 7–15. [CrossRef]

- Friede, Gunnar and Busch, Timo and Bassen, Alexander (2015), ESG and Financial Performance: Aggregated Evidence from More than 2000 Empirical Studies. Journal of Sustainable Finance & Investment, Volume 5, Issue 4, p. 210-233. [CrossRef]

- Alexandre Sanches Garcia & Renato, J. Orsato (2020), Testing the institutional difference hypothesis: A study about environmental, social, governance, and financial performance, Business Strategy and the Environment, Wiley Blackwell, vol. 29(8), pp 3261-3272.

- El Ghoul, Sadok, Guedhami, Omrane, Kwok, Chuck C.Y. and Mishra, Dev (2011), Does corporate social responsibility affect the cost of capital?, Journal of Banking & Finance, 35, issue 9, p. 2388-2406, https://EconPapers.repec.org/RePEc:eee:jbfina:v:35:y:2011:i:9:p:2388-2406.

- Giannopoulos G, Kihle Fagernes RV, Elmarzouky M, Afzal Hossain KABM. The ESG Disclosure and the Financial Performance of Norwegian Listed Firms. Journal of Risk and Financial Management. [CrossRef]

- Paul Gompers, Joy Ishii, Andrew Metrick (2003), Corporate Governance and Equity Prices, The Quarterly Journal of Economics, Volume 118, Issue 1, Pages 107–156. [CrossRef]

- Greenwald, C. (2010). ESG and earnings performance. ASSET4: Thomson Reuters Study.

- Hamilton, J. (1995). Pollution as news: media and stock market reactions to the toxics release inventory data. Journal of Environmental Economics and Management , pp. 98-113.

- Han, Jae-Joon, Kim, Hyun Jeong and Yu, Jeongmin, (2016), Empirical study on relationship between corporate social responsibility and financial performance in Korea, Asian Journal of Sustainability and SocialResponsibility,1,1:61-76, https://EconPapers.repec.org/RePEc:spr:ajossr:v:1:y:2016:i:1:d:10.1186_s41180-016-0002-3.

- Heal, G (2005). Corporate Social Responsibility: An Economic and Financial Framework. Geneva Pap Risk Insur Issues Pract. [CrossRef]

- Harrison Hong, Marcin Kacperczyk (2009) ,The price of sin: The effects of social norms on markets,Journal of Financial Economics,93, 1, 15-36,ISSN 0304-405X. [CrossRef]

- IIA. (2017). Implementation Guide 2100. International Standards for the Professional Practice of Internal Auditing.

- Instituut van Internal Auditors. (2022). Risk in Focus. European Confederation of Institutes of Internal Auditing ,pp 1-42.

- Khanna Madhu and Quimio Anton, Wilma Rose H. and Bojilova Dora (1998), Toxics Release Information: A Policy Tool for Environmental Protection. PERE Working Paper #7, Available at SSRN: https://ssrn.com/abstract=45557.

- King, Andrew & Lenox, Michael. (2001). Does It Really Pay to Be Green? An Empirical Study of Firm Environmental and Financial Performance. Journal of Industrial Ecology. 5. 105 - 116. 10.1162/108819801753358526.

- Landi, Giovanni & Sciarelli, Mauro. (2018). Towards a more ethical market: the impact of ESG rating on corporate financial performance. Social Responsibility Journal. 15. 11-27. 10.1108/SRJ-11-2017-0254.

- Yiwei Li, Mengfeng Gong, Xiu-Ye Zhang, Lenny Koh (2018),The impact of environmental, social, and governance disclosure on firm value: The role of CEO power, The British Accounting Review,Volume 50, Issue 1,60-75.

- Lockwood, C. , Munn, Z., & Porritt, K. (2015). Qualitative research synthesis: methodological guidance for systematic reviewers utilizing meta-aggregation. International journal of evidence-based healthcare. [CrossRef]

- Lopez-de-Silanes, Florencio and McCahery, Joseph A. and Pudschedl, Paul C (2019)., ESG Performance and Disclosure: A Cross-Country Analysis. TILEC Discussion Paper No. DP2019-032, European Corporate Governance Institute - Law Working Paper No. 481/2019, Available at SSRN: https://ssrn.com/abstract=3506084. [CrossRef]

- Brännlund, Runar & Lundgren, Tommy. (2009). Environmental policy and profitability-Evidence from Swedish industry. Sustainable Investment Research Platform, Sustainable Investment and Corporate Governance Working Papers. 12. [CrossRef]

- Lundgren, Tommy & Olsson, Rickard. (2008). How Bad is Bad News? Assessing the Effects of Environmental Incidents on Firm Value. American J of Finance and Accounting. [CrossRef]